CAT Bonds: The Time is Now

February 29, 2024

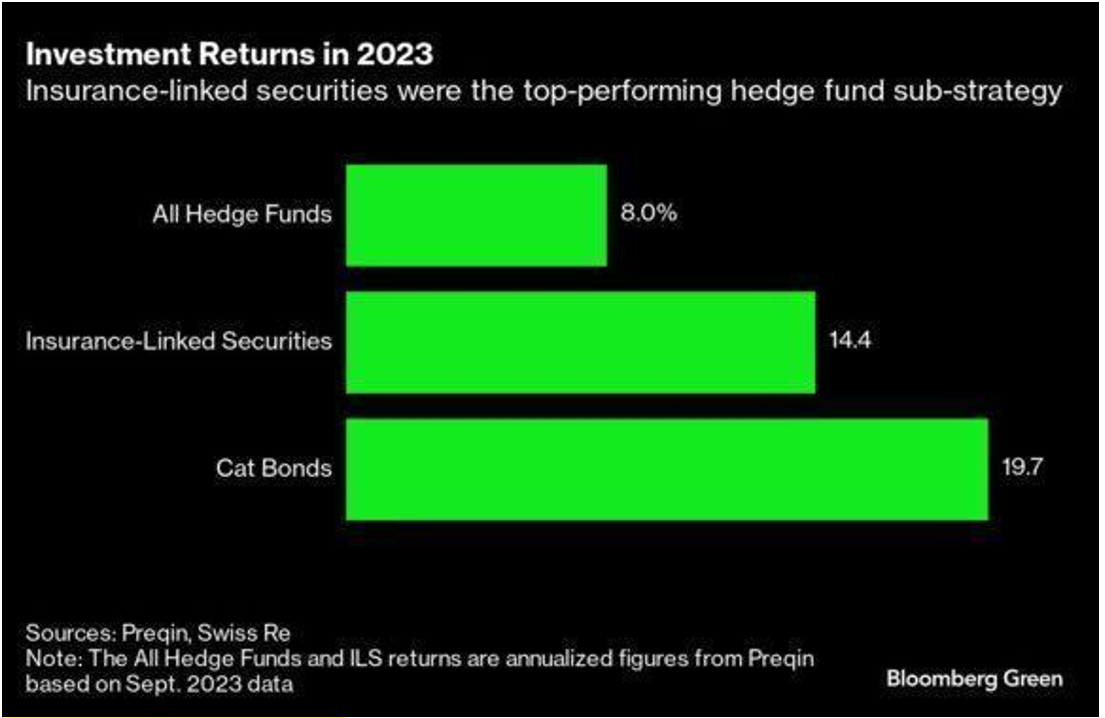

When a lesser-known asset class outperforms tech stocks and derivatives for the larger part of twelve months, you cannot help but sit up and take notice. And so, it was for catastrophe bonds, known more popularly as CAT bonds – a financial instrument that protects against losses from natural disasters. This niche segment outperformed hedge funds by almost 35% over 2023, according to a report published by Fortune1. And if one were to go by predictions2 made by broker-dealers, its issuance could range between $13.5 billion to $17.3 billion for 2024.

The history of CAT bonds

So, what exactly are CAT bonds, and how and why did they emerge as a market favorite?

CAT bonds are a specialized type of insurance-linked security (ILS) that are primarily issued by insurance and reinsurance companies. They are designed to manage the financial impact of natural disasters, such as earthquakes and hurricanes. When such catastrophic events occur, CAT Bonds provide the necessary funds to the issuer, mitigating the financial strain on their resources and helping them to maintain their regulatory capital requirements.

The ILS market has its origins in the 1990s3, following the first securitization that was offered to Institutional Investors by Reinsurance Firms after the occurrence of some catastrophic events. These events led rating agencies and regulators to require insurance companies to increase their capital levels based on new, forward-looking probabilistic models to provision for future infrequent but large catastrophes. Standard approaches to raising this additional solvency capital, such as frequently issuing equity to address tail-event exposures, proved costly – hence the need to issue CAT Bonds at yields that are attractive to the broader capital markets.

CAT bonds are issued by the insurance industry to shield themselves from some of the risks from these events and hence typically (not always) the senior tranche (i.e., one with lower risk) of the insurance policies is transferred to willing investors at higher yields. Historically known Institutional Investors who have invested in ILS/CAT Bonds include some of the largest sovereign wealth funds, public & private pension funds, and also corporate investors globally.

Investing in CAT bonds does carry the risk of a loss (especially if the bond is focused on only one country or event i.e. not diversified) if a specified catastrophic event triggers the payout. However, this risk can be substantially minimized through strategic diversification. By spreading your investment across numerous countries, insurance firms, insurance policies, and a variety of natural disaster types (earthquakes, floods, hurricanes/typhoons), one can significantly reduce the probability of incurring losses.

Per a Bloomberg report4, hedge funds benefited substantially from the science of catastrophe management in 2023. Public filings show that companies with CAT bonds saw record gains that were more than double the industry benchmark. Industry experts are unanimous in their view that CAT bonds have not had such a good year since they were born in the 1990s.

Image via Bloomberg5

Market analysts feel that CAT bond issues are going into turbo mode amidst growing concerns around climate change. These were fuelled further by decades-high inflation that contributed to steeper rebuilding costs after calamities. However, they also argue that the 2023 highs were seeded several years ago.

CAT bonds versus CAT bond funds

Though CAT bonds came into their own in 2023, they have typically outperformed traditional bonds. However, while issuance remained above $10 billion for the sixth consecutive year, that hardly prepared us for a blockbuster 2023.

The choice between CAT bonds and CAT Bond Funds depends on individual investment goals and risk tolerance; however, a diversified portfolio of CAT bonds is often a better option than investing in a CAT Bond Fund. Before taking the plunge, it may be worthwhile to understand the differences between the two.

| Feature | CAT Bond | CAT Bond Fund |

| Diversification | High: Accesses hundreds of reinsurance policies across various catastrophes and geographies | Moderate: Invests in multiple CAT bonds, but inherently limited compared to a single well-structured CAT bond |

| Underlying Risk Universe | Large: Directly taps into traditional reinsurance capital ($605 billion+) | Small: Operates within the market of outstanding CAT bonds ($42 billion) |

| Alignment of Interests | Strong: Insurance company typically retains significant risk, ensuring shared interest in mitigation | Variable: Depends on the fund manager’s investment |

| Performance Volatility | Moderate: Primarily driven by premium income and specific event/s exposure | High: Fluctuates with market prices of individual CAT bonds, impacted by market sentiment and event predictions |

| Market Volatility | This can be mitigated through private structuring | Subject to market fluctuations |

CAT bonds typically provide uncorrelated returns compared to traditional assets such as stocks and bonds, thus helping in portfolio diversification and better overall risk-adjusted returns. For insurers, it helps transfer some of the risks associated with specific natural disasters to investors which frees up capital for the insurance companies.

The risks associated with CAT bonds, such as loss of principal in case a covered event materializes, relatively less liquidity, and complex structures, can also be mitigated through strategic diversification. Consider this: the odds of experiencing earthquakes, floods, and hurricanes in over fifteen different countries simultaneously are incredibly low. This diversification allows you to maximize potential returns while mitigating the risk of principal loss. It is also worth noting that CAT bonds are uncorrelated with the traditional financial markets, and as such, remain unaffected by the highs and lows of the business cycle.

Final thoughts

The CAT bond market has strong potential for growth in 2024. Pent-up demand for risk transfer, combined with rising replacement costs faced by primary insurers, is expected to keep demand high. Major reinsurers might also find CAT bonds favourable for their top tiers, given the success of fund managers in raising capital to absorb new investments.

It is important to note that like an Equity Long Short Fund which can diversify across sectors and geographies, CAT bonds can be structured to diversify across geographies/regions, insurance companies & policies and various catastrophic events. Thus, there are similarities (atleast in diversification terms) between a CAT Bond and a diversified equity market neutral or low-net strategy, with both typically also having strong downside protection.

Looking ahead, the CAT bond market is poised to become a more mainstream asset class. Last year’s strong performance, coupled with the growing awareness of climate risks, suggests that CAT bonds are gaining traction as a valuable tool for risk mitigation. As the market matures and offers more diversified products, it is likely to attract a wider range of investors seeking alternative risk management solutions in a changing world.