Hedge Funds: An M&A Prognosis for 2024

May 28, 2024

Hedge funds have gone through an extended period of market volatility, starting with the global pandemic four years ago and driven further by geopolitical tensions, and interest rate fluctuations. That these funds exist to generate alpha during market turbulence brought them into sharper focus, making their performance journeys over the past few years into a mixed bag. Some have consistently outperformed the market, while others have struggled to stay resilient amidst all this unpredictability. Despite macroeconomic headwinds and geopolitical concerns, 2023 still proved to be a good one for hedge funds. A recovering stock market last year brought additional returns to these funds, though the large ones managed to outdo the rest. Market data suggests that the world’s 20 most successful hedge funds reaped record profits in 2023, creating a combined $67 billion for investors.

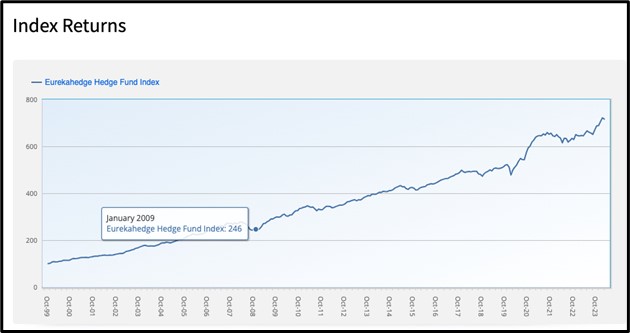

And this optimism seems all set to carry over into 2024. With growing competition further tightening the performance and management fees, hedge funds now seem poised to get back to their winning ways, consistently outperforming the markets. In addition to innovative investment strategies across sectors, these funds are also leveraging technology such as artificial intelligence to get better returns for investors who’ve stayed with them. The chart below indicates the growth bumps over the past few years.

(Source: Eurekahedge1)

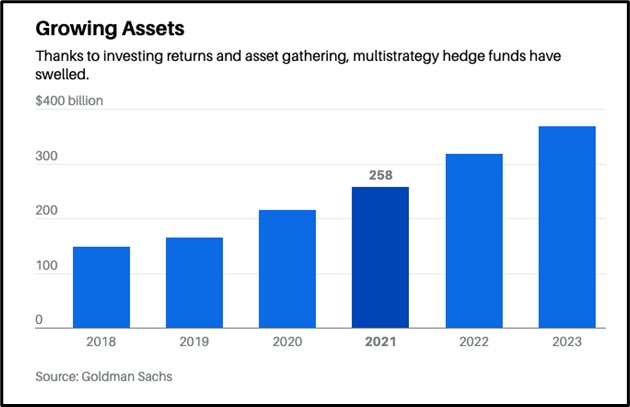

Over the past few years, multi-strategy hedge funds have come to the forefront, delivering standout returns in 2023 with annual returns ranging from 15% to nearly 40%. An analytical report by Morgan Stanley notes that investors plowed money into funds that did not rely on a single asset manager but offered an army of traders investing in multiple strategies2 . These behemoths secured pretty much all the new money in the hedge fund industry during 2023, cementing a tectonic shift that’s accelerated post the pandemic. (See chart below)

Elsewhere, M&A transactions performed poorly, losing 2% on average during the same period, further bolstering the demand for multi-strategy funds. However, this trend may witness a change soon as first-quarter M&A data across the US, Europe, and Asia saw an upswing. According to numbers shared by EY, globally $796 billion worth of deals were announced in the first quarter, a healthy spike of 36% over the same period of 2023. These gains were driven by the US economic numbers as well as signs of uplift from Europe and growth in Asia. Public M&A markets in the US topped $244 billion, their highest since 2022 when it reached $260 billion in the second quarter. Similarly, in Europe, the market touched $47 billion, driven largely by an uptick in the UK region that saw its highest quarter since Q2 of 2022. Asia posted the highest volumes since the last quarter of 2021 with as many as 644 deals in January-March. And, the technology sector saw the largest share of deals during Q1 of 2024, accounting for 19% of the total volumes while Energy & Utilities (15%), Banks (13%), Telecom & Media (12%), and healthcare (11%) were the other sectors, says a note shared by British law firm Linklaters3.

Market analysts believe that the worst of the turbulence around geopolitical and economic challenges might be over, given the robust volumes and deal values of the first quarter. Similar levels of bumper deal-making were seen during the latter parts of 2021 and the first half of 2022. Access to debt and costlier financing options caused the deals to dry up as did the antitrust regulatory issues that became less predictable. However, with the growing likelihood of the US economy achieving a soft landing and inflation cooling off causing the Fed to cut their rates later this year, companies seem more confident of making strategic transactions.

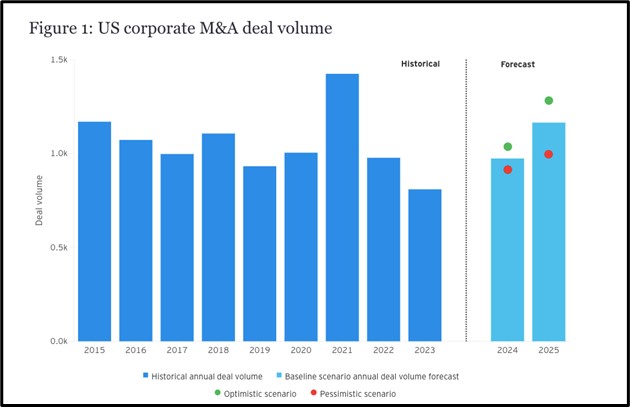

Some analysts note that the buoyancy visible in the first quarter of 2024 could extend through 2025. Per a note shared by EY, their Deal Barometer forecasts US corporate M&A volumes to grow 20% and private equity deals to rise 16% during 2024. “While Q1 2024 saw a 36% increase in global deal value, our M&A outlook shows CEOs are looking to make acquisitions, and there is a spike in those looking to divest assets.”

The report notes that per their survey, the optimistic scenario pointed to a 31% rise in deals with volumes (for deals over $100 million) gradually picking up to about 20% in 2024, as against a 17% contraction in 2023. Historically deal volumes in the US were stable at around 1,000 such deals but low inflation and cheaper funds in 2020-21 caused the volumes to surge, registering a jump of 40% in 2021. So, it would be safe to assume that the volumes could return to the pre-pandemic activity levels in 2024, the report says. On the PE deal front, the report expects volumes to rise faster in 2024 by 23% if the macroeconomic signals are aligned. Volumes could rebound by as much as 16% on a realistic level, which is a considerable spike from the 15% contraction in 2023, the report adds.

Amidst the market expectations of a robust 12 to 18 months of M&A dealmaking, hedge funds could be in just the right place at the right time. With assets under management valued at over $5 trillion and expectations of total market value to top $7.1 trillion by 2032, the resurgence in dealmaking could be just the strategy that hedge funds are seeking to break back into the market they’ve straddled for years. The rising population of high-net-worth individuals across the world seek to invest beyond the tradition and hedge funds could target more from this wealthy group by showcasing their expertise in M&A dealmaking and robust returns. Stability in interest rates could generate healthier mid-market deals over the next few months, leading to a further brightening of arbitrage hopes.

Furthermore, as companies re-evaluate their M&A themes and update strategy, invest in capabilities and assets, hedge funds too would be actively considering their portfolio evolution, considering new investments and divestitures in parallel. They could be well-served, at least in the second and third quarters, to shift their M&A themes to mitigate geopolitical risks by emphasizing localization instead of geographic expansion. Sector-specific strategies would get carried forward from the first quarter with more vertical integrations coming in over the next few months. As companies seek higher value creation to offset higher costs of capital, fund managers too would be broadening their strategies to not just cost or revenue-based deals, but also capex expansion and business transformational synergies.

Overall, the market signals are more positive than they’ve been at any time over the past 12 to 18 months and there is a willingness among dealmakers to find creative solutions to close out mergers and acquisitions with a clear view to accelerate transformation. Along with the pent-up demand from the post-pandemic highs to the lows of 2022 and 2023, a tipping point in the M&A narrative is around the corner in 2024.