Real Estate Funds: Cautious Optimism after the 2023 Meltdown

May 26, 2024

Over the years, private real estate funds have consistently been a good option in a diversified investment portfolio, often making sense during periods of macroeconomic uncertainty and allowing investors to access institutional funds at lower investment minimums. However, any conversation around their outlook in 2024-25 gets tempered by its performance across 2023, which some consider as a year to forget for real estate investors and dealmakers. McKinsey says global closed-end fundraising declined by 34% in 2023 to $125 billion1. Capital shifted away from core and core-plus strategies amidst growing demand for liquidity through redemptions, resulting in gross contributions hitting their lowest levels since 2009. Given this scenario, analysts believe that the only path left is the one going north, though a clearer picture would require clarity around the Fed Rates and its impact on valuations and future financial performances. But all agree that the green shoots are visible.

What Exactly Went Wrong? Almost Everything

We mentioned that capital shifted away as investors demanded more liquidity, something that real estate funds hardly ever promise. In the United States, the open-ended funds recorded a massive outflow of $13 billion in 2023, reversing the positive net inflows that continued for almost a decade between 2010 and 2020.

Source: McKinsey Global Private Markets Review 20242

This caused the NAV in US open-end funds to fall 16% year-on-year. All this while, the global AUM of these funds was on its way up, touching a peak of $1.7 trillion in June 2023 and registering a 14% growth in the previous 12 months. Almost right on cue, the sector began underperforming historical averages as high-performing multi-family and industrial sectors joined office space to produce negative returns in the wake of slow demand growth and capacity expansion.

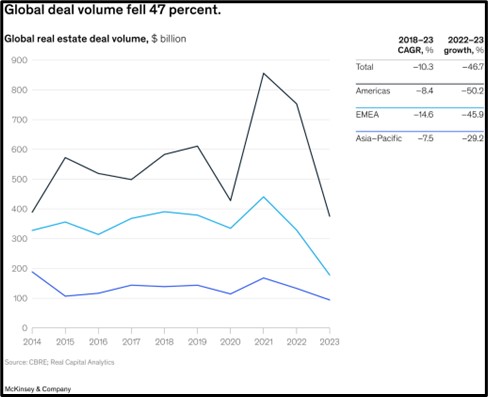

Close-ended funds collectively posted a negative net IRR of 3.5% over January-September, the first time it had incurred such losses since the global financial crisis. Only hospitality kept its head above water, largely on the back of post-pandemic vengeance travel. The lack of demand meant that global deal volumes went south too, falling 47% during 2023 to touch a ten-year low of $650 billion. The office sector remained depressed due to continued global economic uncertainty where customers kept hedging their investments due to the prevalent hybrid working models. The limited deals also saw a widening of bid-ask spreads amidst uncertainty in valuations and higher cost of financing due to the Fed rates driving north.

What Has Changed Now, and How Does It Matter?

For starters, we know that interest rates have peaked. After their monthly meeting on May 11, Fed chairman Jerome Powell asserted that there would be no upward revision on the benchmark lending rates amidst inflationary pressures on the US economy. Valuations should get clearer as would future financial performance in the coming weeks. Of course, things could get better if the Fed cuts its benchmark rates. This possibility, which was expected in the second quarter, now appears to have crawled on to the third as the Fed officials seek more data-led inputs around inflation moving below the 2% mark.

(Source: White & Case3)

Along with the prevalent high lending rates, analysts were also concerned over geopolitical risks, though there is a consensus that they are considerably reduced now compared to 12 months ago. This is why most analysts predict that while 2024 may not see any records break, both in deal-making and fundraising, there could be enough action to warrant a sigh of relief. Some good tidings have also started filtering in with data suggesting that US commercial real estate prices posted their first quarterly gain over two years. After shedding a third of their value between Q1 of 2008 and 2010, the average US commercial property prices rose by 2.2% in the April-June period, Reuters reports4, quoting the Investment Property Databank US Quarterly Property Index. Elsewhere in Germany, foreign investors skirted property deals, accounting for just 35% of commercial real estate purchases in the first quarter, its lowest level since 2013. However, they are hopeful of change5 once the US real estate majors return – which they expect as valuations assume more clarity in the coming months.

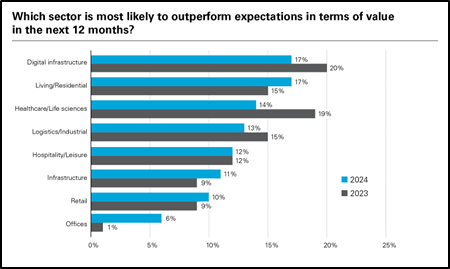

Analysts also note that the long-term fundamentals supporting real estate appear to be strong. For example, the heightened focus on interest rates and inflation has caused the demand to be overlooked. Sectors like logistics are bound to see activity due to structural tailwinds of e-commerce, nearshoring, and supply chain resilience. Then there are the looming debt maturities that could keep pipelines of real estate non-performing loans at elevated levels that could come into the markets during the next few months. Analysts also believe some opportunistic fund strategies would emerge out of growth in digital infrastructure, healthcare, and residential properties. Real estate debt funds and real estate secondaries could be the ones at the forefront of the revival. Per estimates, over $1.5 trillion of US real estate debt is likely to mature by 2025, which could inject liquidity into companies with limited headroom in their capital structures. A quick analysis of the cross-section of real estate opportunities reveals that while office space could continue to underperform due to multiple factors such as reduced demand and a hybrid workplace, digital infrastructure could more than make up for this slump. A demand spurt from businesses for digital infrastructure to house large data volumes while the retail and entertainment space too are witnessing similar trends due to the requirement of storage space in spite of the rising cost of funds.

A Modicum of Caution

However, most funds are looking at the developing scenario with cautious optimism. Analysts note that the focus on financing and liquidity stays on top of the priority and even if rates flatten out in the latter part of 2024, actual financing costs could remain above the ultra-low levels that borrowers saw in 2021. With an estimated $2 trillion of commercial real estate debt maturing by 2027, the refinancing would be at higher costs. One would also have to factor in the effects of inflation on the overall construction costs and resource availability, though fears around this are considerably lower compared to what prevailed in 2023. Some of these factors are keeping real estate professionals on the ground even as a sense of optimism is creeping in from a spike in both M&A and fundraising activities.

Optimism on the Upswing

Despite these challenges, real estate fundamentals have remained healthy across most property sectors, despite headlines around office vacancies and foreclosures. Though property values may have softened across several sectors, the leverage levels remain in the balance with a few signs of oversupply. Looking ahead, it is quite likely that some pockets could experience distress, driven by near-term debt maturities, but overall, the tailwinds of opportunity appear strong enough. Moreover, lower prices could also facilitate better entry points in high-conviction property sectors across select geographies.