The Surge in Gold Prices: Causes, Trends, and Future Outlook

February 28, 2025

Gold has long been considered a safe-haven asset, a store of value, and a hedge against economic uncertainty. In recent years, gold prices have experienced a significant surge, reaching record highs in 2023 and continuing to climb in 2024. This blog explores the key drivers behind this rise, including central bank buying, global uncertainty, and tariffs, supported by hard data. We also examine whether these high prices are likely to persist and what global commodity firms and analysts are forecasting for the future.

Reasons Behind the Rise in Gold Prices

The Current Landscape of Uncertainty

- Central Bank Buying

Central banks around the world have been aggressively increasing their gold reserves, a trend that has significantly contributed to the rise in gold prices. According to the World Gold Council (WGC), in 2024, central banks around the world bought 1,045 tonnes of gold, the third year in a row that demand has exceeded 1,000 tonnes1. Emerging markets, in particular, have been at the forefront of this buying spree. For example China’s central bank increased its gold reserves by 102 tonnes in 2023, While in 2024, Poland, followed by India were the leading central banks. Turkey, and Russia have also been significant buyers, diversifying their reserves away from the US dollar amid geopolitical tensions and economic uncertainty.

This sustained demand from central banks has provided a strong floor for gold prices, as their purchases are often large-scale and strategic.

- Global Uncertainty

Gold thrives in times of uncertainty, and the current global landscape is rife with geopolitical and economic risks. The ongoing Russia-Ukraine war, US-China trade tensions, and conflicts in the Middle East have heightened global insecurity. Investors often turn to gold during such times as a safe-haven asset. Despite efforts by central banks to curb inflation, many economies continue to grapple with elevated price levels. Gold is traditionally seen as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines.

Concerns about a global economic slowdown have also driven gold demand. In 2023, the International Monetary Fund (IMF) projected global GDP growth of just 2.9% for 20242, prompting investors to seek safety in gold.

- Tariffs and Trade Policies

Trade policies and tariffs have also played a role in driving gold prices. The US-China trade war, which began in 2018, has led to increased tariffs on billions of dollars’ worth of goods. This has created uncertainty in global markets, pushing investors toward gold. In 2023, the US imposed new tariffs on critical minerals and semiconductors, further exacerbating trade tensions. Such policies disrupt global supply chains and increase the appeal of gold as a stable asset. In the wake of the Trump administration in the US imposing tariffs on allies and opponents worldwide, there has been a surge of demand for the yellow metal which has led to a continued run on gold prices.

2024 Performance Review & 2025 Outlook

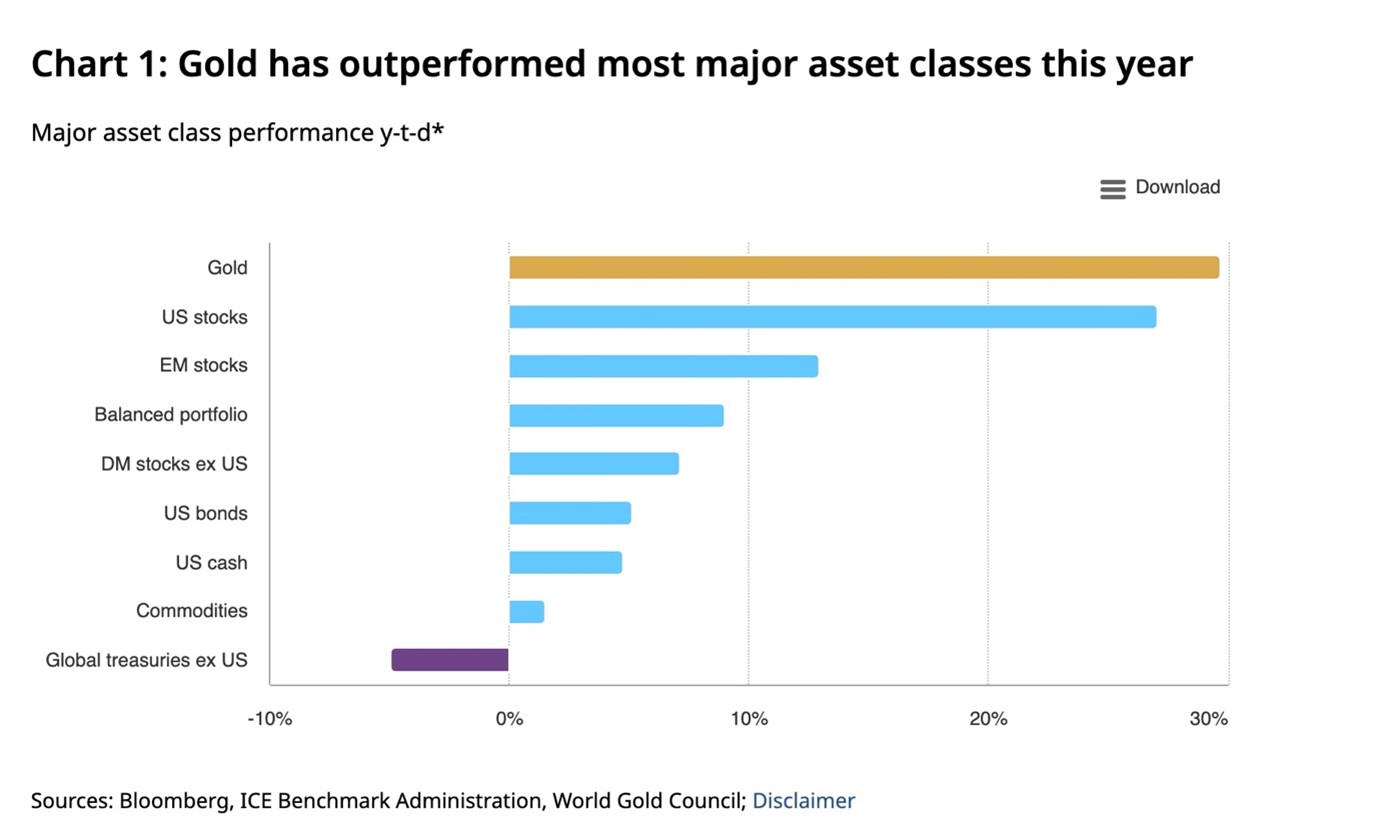

In terms of asset classes, Gold has performed admirably in 2024.

Source: World Gold Council3

Source: World Gold Council3

The outlook for gold prices remains bullish, driven by several factors:

- Sustained Central Bank Demand

Central banks are expected to continue buying gold as part of their diversification strategies. The WGC predicts that central bank demand will remain robust in 2024, particularly from emerging markets seeking to reduce their reliance on the US dollar [9].

- Persistent Global Uncertainty

Geopolitical tensions and economic risks are unlikely to abate in the near term. For instance:

-

- The US-China rivalry is expected to intensify, particularly in areas like technology and trade.

- Inflationary pressures may persist, especially if energy prices remain volatile due to conflicts in the Middle East.

- Weakness in the US Dollar

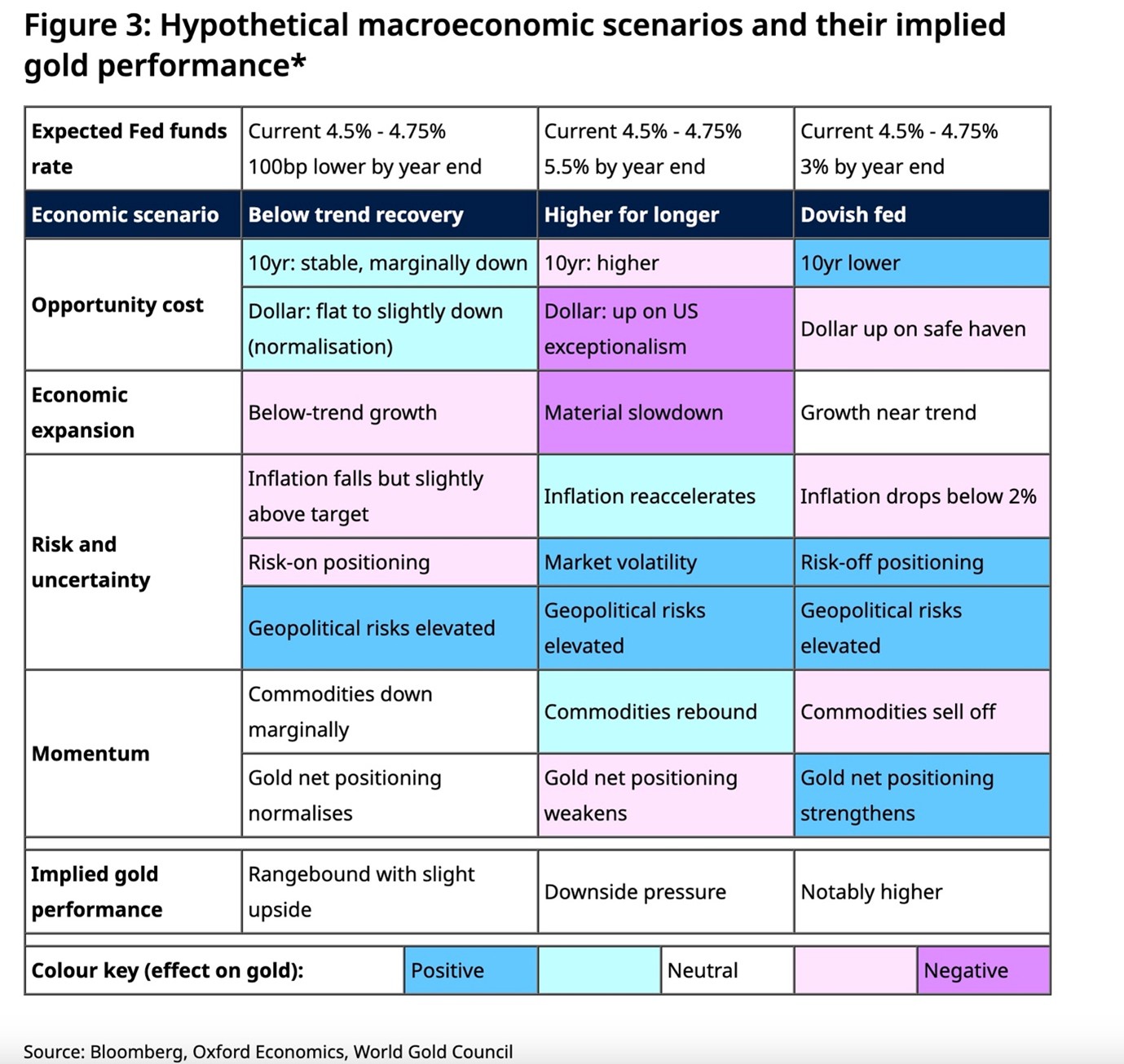

Gold prices are inversely correlated with the US dollar. The action of the US Fed will have a direct impact on the Gold prices in an inverse manner. The World Gold Council, using its proprietary tool Qaurum, has provided a scenario mapping of the gold prices based on certain hypothetical Fed actions.

Source: World Gold Council4

Source: World Gold Council4

Goldman Sachs has forecast gold prices to reach $2,300 per ounce by the end of 2024, citing strong demand from central banks and retail investors, while UBS analysts predict that gold will remain a key asset for diversification, particularly in a high-interest-rate environment. According to the World Gold Council, gold is likely to remain rangebound if existing market expectations are correct. However, a combination of higher rates and lower economic growth could negatively affect investors and consumers. This could be particularly evident in Asia. Conversely, significantly lower interest rates, or a deterioration in geopolitics or market conditions will improve gold’s performance.

Finally, a key checkpoint will be central bank demand as it will continue to provide a boost to gold if it remains at a healthy level. Gold’s final price performance will depend on the interaction of its four key drivers: economic expansion; risk; opportunity cost; and momentum.

While the outlook for gold is positive, there are two potential headwinds: Firstly, If central banks, particularly the Federal Reserve, resume aggressive rate hikes to combat inflation, gold prices could face downward pressure. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. Secondly, A stronger-than-expected global economic recovery could reduce demand for safe-haven assets, potentially weighing on gold prices.

The surge in gold prices is the result of a confluence of factors, including central bank buying, global uncertainty, and trade policies. With central banks continuing to diversify their reserves, geopolitical tensions persisting, and inflation remaining a concern, gold prices are likely to remain elevated in the near term. The surge in gold prices is a reflection of the complex interplay between economic, geopolitical, and market factors. While short-term volatility is inevitable, the long-term outlook for gold remains positive, driven by its role as a safe-haven asset, its use in technology, and sustained demand from central banks and retail investors. As the global economy navigates uncertainty, gold is likely to remain a cornerstone of investment portfolios worldwide.