AI and Data Centers – Powering Generative Alpha

July 22, 2025

Velocity, not mere acceleration, has always been central to hedge fund success: micro and milliseconds matter in arbitrage. As models become more and more complex and the variables increase, latency is no longer a trading issue. As generative AI moves beyond chatbots and image generators into financial modeling, hedge funds are exploring proprietary ‘generative’ research platforms that automate fundamental analysis, earnings call interpretation, and even portfolio optimization.

At a public access level, this calls for clean financial data, significant GPU power for model training and robust secure private cloud infrastructure. However, in order to gain a latency edge, many funds are now exploring training their own Large Language Models (LLMs) on financial data, earnings transcripts, proprietary datasets combining them with fund manager’s insights to create ‘generative alpha’.

Gen AI as the Driver

Generative AI is emerging as a game-changer. It automates research, portfolio administration, and even trade execution, freeing human analysts for more strategic tasks. AI-driven strategies can not only detect short-lived market inefficiencies but also adapt in real time to market movements by processing terabytes of streaming data, a task impossible for conventional workflows

This doesn’t come cheap. A typical LLM development and training can cost millions of dollars. Additionally, data security concerns dictate that most hedge funds would be predisposed to a bias on having on-prem resources as compared to a public cloud. In fact, AIMA research1indicates that around 68% of the respondents rated security as the #1 concern with respect to using Gen AI.

The convergence of AI and advanced data centers provides hedge funds with a formidable competitive edge:

- Proprietary Insights: By building unique data ecosystems and applying bespoke AI models, funds can generate insights that are not readily available to the broader market, leading to sustainable alpha.

- Speed and Responsiveness: Faster processing and analysis enable quicker reactions to market shifts and the ability to capitalize on fleeting opportunities.

- Deep Market Understanding: AI allows for a more granular and comprehensive understanding of market dynamics, consumer behavior, and geopolitical factors impacting investments.

- Operational Efficiency: Automation of data processing, analysis, and even parts of the trading workflow free up human talent to focus on higher-level strategic thinking.

ESG Imperatives in AI Infrastructure

Another emerging trend is the predilection of the funds to back sustainable AI infrastructure to maintain reputational optics. For instance, Balyasny Asset Management co-invested in a solar-powered AI training facility in Texas, while in the EU, Two Sigma increased its stake in a Nordic data center startup that uses geothermal cooling and hydropower to run its GPU clusters.

Beyond the apparent, most funds believe that energy-efficient AI infrastructure will offer better long-term cost profiles and less regulatory scrutiny, essential in a future where climate compliance is tied to capital allocation.

Data Centers as an Investable Theme

Beyond operational utility, hedge funds are also allocating capital into the data center sector itself. In 2025, the industry is seeing:

- Renewed interest in data center REITs like Equinix and Digital Realty.

- Growth-stage investments in modular, portable data centers for edge computing.

- Structured financing for AI-specific colocation hubs.

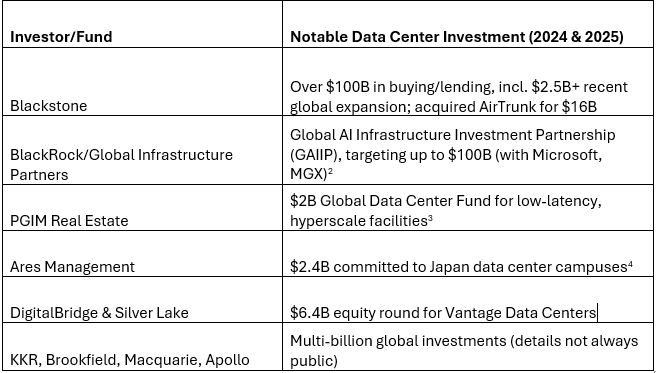

This has led to a rush of hedge funds towards investing in data centers. Examples include:

According to Mckinsey5, by 2030, data centers are projected to require $6.7 trillion worldwide to keep pace with the demand for compute power.

Challenges on the Road Ahead

Despite the promise, this transformation comes with hurdles:

- Data Quality and Bias: AI is only as strong as its data. Hedge funds must vigilantly monitor for flawed sources and inherent biases.

- Power and ESG Concerns: The energy demands of AI-centric data centers are massive, prompting investments in renewables and smarter grid integration.

- Cost Pressures: Rising infrastructure costs threaten margins, motivating funds to balance in-house builds with cloud solutions and strategic partnerships.

- Skills Gap: The war for AI talent is fierce, as financial engineering increasingly blends with data science and computational physics

What This Means for the Future of Hedge Funds

Hedge funds are no longer just consumers of AI: they are architects of the ecosystems that power it. From investing in liquid-cooled GPU data centers to building proprietary LLMs, they’re putting capital, talent, and infrastructure behind a singular mission: sustainable, defensible, AI-driven alpha. The convergence of hedge funds, AI, and data centers signals more than just a technological leap: it’s reshaping how markets operate, how capital is allocated, and how the next chapter of global competition unfolds.

As hedge funds double down on AI and demand ever more advanced data centers, they are not only transforming their own fortunes; they are setting the pace for digital capitalism itself, laying the groundwork for the next generation of innovation