From Oil to Lithium: How Commodities Investing is Evolving in the Energy Transition

August 26, 2025

For more than a hundred years, oil has been the pied piper in the march of the global commodities. Oil, along with coal and natural gas, has dictated global economics, geopolitics, and investment cycles: massive volumes of capital have flown into this sector, from hedge funds to sovereign wealth funds. Driven by the need to combat climate change and promote the growth of clean technologies, the fossil-fuel-driven energy market is ceding ground to a new class of minerals and metals. This is not just another investment strategy shift for the investors; it is a fundamental rewiring of the global commodities landscape, where the new movers are not black gold but rather the building blocks of batteries and renewable energy: lithium, cobalt, and copper.

For decades, commodities investing essentially meant a view on oil and, to a lesser extent, coal and gas. Today, the map has redrawn itself. The energy transition is not merely changing power sources; it’s rearranging the entire raw-materials stack underpinning modern economies. As electrification, grid upgrades, and industrial decarbonization scale, investor attention is shifting toward critical minerals – lithium, cobalt, nickel, copper, graphite, and rare earths – while still valuing the stubborn resilience of hydrocarbons. Hedge funds and private equity are now building theses that straddle both worlds: monetizing volatility in oil while owning the picks-and-shovels of clean tech.

Why Fossil Fuels Still Matter

Oil’s obituary has been written too many times. In reality, global demand remains anchored by aviation, petrochemicals, and heavy transport, even as EVs chip away at road-fuel growth. Geopolitical risk keeps a volatility premium in crude, and that liquidity, transparency, and deep derivatives market continue to attract macro and CTA strategies. Meanwhile, coal, though in structural decline in OECD markets, still plays a grid-balancing role in parts of Asia. For multi-asset commodity funds, hydrocarbons serve as both a hedge and a cash generator, funding more patient capital in upstream minerals.

The New Center of Gravity: Battery Minerals & Copper

Electrification is metal-intensive. EVs, utility-scale storage, and transmission lines require multiples more metals per unit of energy delivered than fossil systems. Two categories dominate investor screens:

- Battery metals (lithium, nickel, cobalt, graphite): Supply is fragmented, projects are geologically and chemically complex, and refining is geographically concentrated. This is a scenario typical of cyclical booms, sharp drawdowns, and rich dispersion, a perfect recipe for long/short traders and disciplined PE roll-ups.

- Copper: This is the quiet workhorse. Every EV, solar farm, wind turbine, and kilometer of new transmission line needs copper. Yet grade decline, permitting bottlenecks, and long lead times constrain supply. For investors, copper offers structural demand with embedded scarcity.

- The mineral demand for use in EVs and battery storage is a significant force, growing 30X to 2040. Lithium has the fastest growth, with demand rising by over 40X in the SDS by 2040, followed by graphite, cobalt, and nickel (around 20-25X).

Geography: From Chile to Indonesia (with a few stops in between)

- Chile & Argentina (Lithium): The Lithium Triangle remains the world’s swing producer. Policy has oscillated between resource nationalism and investment openness, creating entry windows for investors who can navigate state partnerships and brine chemistry. Direct lithium extraction (DLE) pilots are a leverage point: if the economics scale, brine projects could grow without massive evaporation ponds.

- Indonesia (Nickel): The government’s ore export bans accelerated a domestic refining ecosystem—from laterite ore to nickel pig iron (NPI) to matte and MHP suited for batteries. Investment here is about industrial policy alignment, power cost (often captive), and ESG disclosure to satisfy Western buyers.

- DRC & Zambia (Cobalt/Copper): High-grade assets, complex governance. Investors mitigate risk via joint ventures with experienced operators, revenue-sharing frameworks, and diversified logistics to ports. Increasing regional processing ambitions could shift more margin onshore.

- Australia & Canada (Hard-rock lithium, nickel, rare earths): Permitting clarity and high ESG standards make these jurisdictions magnets for Western capital. Rare earths (NdPr) projects also benefit from defense-linked demand, with midstream separation capacity as the investable bottleneck.

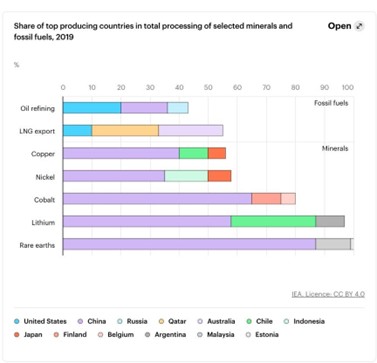

- China (Processing dominance): Regardless of where ore is mined, much of the chemical value-add still runs through China. PE and strategic investors outside China are racing to localize parts of conversion and component manufacturing to qualify for incentives and de-risk supply chains.

Source: IEA1

Hedge Funds: Trading Dislocations Across the Supply Chain

Hedge funds are increasingly trading not just front-month futures but the entire battery value chain:

-

- Arbitraging the “chemical premium”: Converting spodumene (hard-rock lithium concentrate) into hydroxide/carbonate introduces a variable spread. Funds use proxy exposures – miners, converters, cathode makers – to express a view on tightening/loosening conversion capacity.

- Term-structure and regional spreads: Nickel and cobalt exhibit pronounced basis differences between LME contracts and physical intermediates (MHP, MSP, matte). Skilled desks exploit time spreads and regional premia driven by logistics and ESG constraints.

- Volatility around policy catalysts: Subsidy changes, export quotas, or permitting decisions in Chile, Argentina, Indonesia, or the DRC can move equities and offtake-linked credits faster than majors can react. Event-driven strategies thrive here.

- Private Equity: Building and De-Risking Battery Supply ChainsThe PE playbook focuses on industrial midstream control rather than taking geology risk. We can thus see the following four factors in a PE play:Processing and conversion capacity: The bottleneck in lithium and nickel isn’t about the ore, rather, it is about chemical conversion and refining. PE-backed platforms are acquiring or developing conversion plants, standardizing process flowsheets, and locking in long-dated tolling agreements with OEMs and cell makers.Vertical integration through offtakes: Rather than buy the whole mine, PEs for structured offtakes with prepayment or equity milestones, securing inputs for their midstream assets while sharing price risk. This “capital-light mining exposure” model leads to a better IRR and bankability.

Recycling as the second leg: Black mass recycling (Recovering lithium, nickel, cobalt, manganese, and graphite from scrap and end-of-life cells) creates a lower-carbon, domestically moored supply. PE platforms are rolling up such black mass recyclers and monetizing ESG credits simultaneously.

Grid and copper adjacencies: The global energy transition will also depend on physically expanding the grid. Renewable resources such as offshore wind and solar farms are often located far from demand centres, requiring substantial new investments in transmission infrastructure. The IEA estimates that to achieve net-zero emissions by 2050, the total size of the global electricity network will need to double. Insufficient capacity already prevents renewable energy from being fully utilized. In the U.S., for example, renewable energy projects face interconnection delays due to grid constraints. In Europe, bottlenecks within and between countries limit trade in electricity, increasing costs and slowing decarbonization efforts.

Risk, ESG, and The New Diligence Toolkit

The energy transition isn’t a free pass on ESG; if anything, scrutiny is higher. OEMs now trace metals to the mine. Investors need auditable chain-of-custody systems and lifecycle assessments baked into contracts. Social license can make or break a project. Funds are underwriting stakeholder agreements, like onerous covenants, with milestone-based disbursements tied to ESG outcomes. Battery chemistries evolve (e.g., LFP vs. NMC), affecting metal demand mixes. A robust thesis hedges this via diversified exposure (copper + lithium + recycling) and flexible offtake terms.

What a resilient portfolio looks like

A modern commodities strategy is bar-belled:

- Liquid sleeve: Macro exposure to oil and copper futures for liquidity and hedging; options to monetize volatility around policy or OPEC+ headlines.

- Real-asset sleeve: Minority stakes in upstream projects with structured offtakes; controlling positions in midstream conversion and recycling; select bets on transmission components and rare earth separation.

- Contracting edge: Long-dated offtakes with price floors/caps, ESG-linked pricing premia, and inflation escalators to stabilize cash flows across cycles.

The Takeaway

The handoff from oil to lithium is going to be anything but neat. It is going to be messy and fractious, underscored by nationalistic overtones and a massive gap between supply and demand. There is no question that hydrocarbons still power the growth and liquidity, while critical minerals define the next two decades of capex and geopolitics. The winners will be those who don’t pick sides but will be masters of the interfaces: where geology meets chemistry, where policy meets project finance, and where molecules meet electrons.

References:

1. https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

Sources: