Energy and Infrastructure: The Next Frontier for Private Equity

August 24, 2025

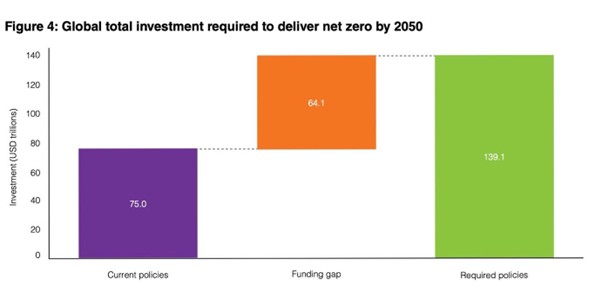

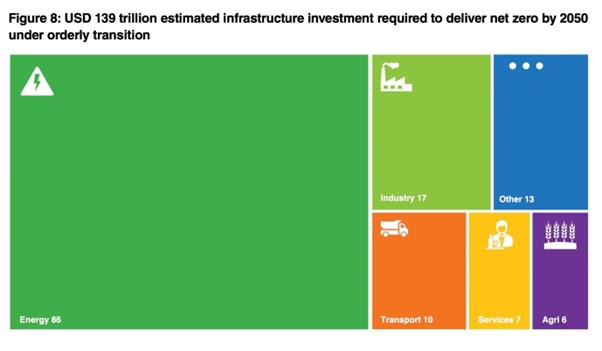

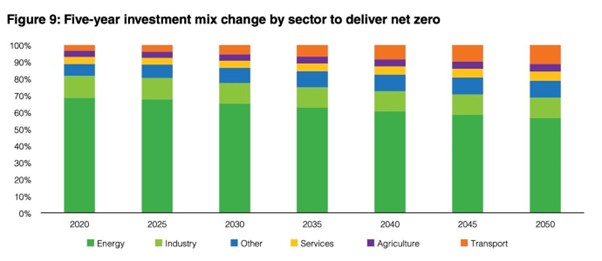

Let’s start with the numbers. According to research published by FIDIC and EY1, the total amount of investment required for Net Zero by 2050 is estimated to be around US$139 trillion, of which the current planned investment is in the range of US$75 trillion, and the investment gap will be US$64 trillion. Out of these, the infrastructure funding gap is estimated to be around US$15 trillion. Moreover, as governments ramp up infrastructure spending, exemplified by the U.S. Inflation Reduction Act, the EU Green Deal, and India’s National Infrastructure Pipeline, private capital is being invited to fill the funding gap.

Source: FIDIC & EY2

Global inflationary pressures, rising interest rates, and geopolitical instability—from Ukraine to the Red Sea—have underscored the need for more real asset exposure in portfolios. Infrastructure and energy investments, with their long-dated contracts, inflation linkage, and essential nature, provide a compelling hedge.

Source: FIDIC & EY3

It should therefore not come as any surprise that Private Equity (PE) is rapidly shifting its focus toward energy, climate, and infrastructure assets since limited partners (LPs) are looking out for attractive risk-adjusted returns and exposure to the primary structural shifts that are reshaping global economies.

Setting the Trendline

As the world gallops towards clean energy, a low-carbon ecosystem, and a sustainable economy, these investment pivots, often described as the ‘next frontier’ in PE, are driven by five key trends:

- Energy Transition and Decarbonization: economies and enterprises are running against the clock to meet energy transition and decarbonization goals. Private markets are now a pivotal force in scaling climate solutions. As traditional power sources are challenged and new demand emerges (such as data centers, Lithium batteries, EVs, hyperscalers), this in turn creates massive opportunities for investment in renewable generation, grid infrastructure, storage, and enabling technologies & adjacent businesses.

- Resilience and Security: The last few years and the first half of 2025 have been witness to major geopolitical and market shocks, highlighting the importance of reliable, secure energy supplies and robust infrastructure. LPs increasingly value investments that exhibit lower correlation to economic cycles, like regulated utilities, power assets, and transportation infrastructure.

- Attractive, Stable, and Long-Term: Infrastructure and tangible assets, especially those that are essential services or supported by government policy, offer inflation protection and resilience through market cycles. These have twin appeals of lower volatility and reliable sources of cash.

- Aging Infrastructure and Modernization: Across developed nations, existing infrastructure- from electricity grids to transportation networks to water systems – is aging and in dire need of modernization. Since governments often lack the immediate funds for these massive overhauls, there is a huge opportunity for private capital to invest in upgrading these essential assets, improving efficiency and resilience, and integrating smart technologies.

The Private Equity Advantage

PE firms are uniquely positioned to capitalize on these trends due to their:

- Large-Scale Capital Needs: Energy and infrastructure projects call for a scale of investments that often exceeds the capability of public markets. With their large pools of capital, PE funds can undertake these multi-billion-dollar investments.

- Operational Expertise: PE firms bring in smart capital. With deep operational expertise, they optimize project development and improve asset management, driving efficiencies that enhance returns.

- Long-Term Investment Horizons: Energy and infrastructure assets typically have long lifespans and generate stable, long-term cash flows, aligning well with the patient capital model of private equity.

- Flexibility and Agility: PE firms can often move more swiftly to identify and execute complex deals, adapting to evolving market conditions and regulatory landscapes. This is in contrast to governments, which are susceptible to multiple levels of bureaucratic red tape and adherence to set rules and regulations.

Driven by the size of the opportunity, dedicated climate and energy transition funds, such as TPG Rise Climate and specialized infrastructure managers, are raising large pools of capital to drive and benefit from the global shift toward clean energy, smart grids, electrification, and decarbonized industrial systems.

Key Investment Areas

| Area | Drivers & Opportunities |

| Renewable Energy | Solar, wind, and storage dominate new investments, driven by falling costs and policy support |

| Power Infrastructure | Transmission, distribution, and smart grids are critical bottlenecks for renewable expansion |

| Climate Tech | While new deal flow has slowed, there is ongoing backing for proven scale-up startups |

| Sustainable Infra | Water, urban resilience, efficient transport, and waste-to-energy are key emerging themes |

| Energy Security | Demand for reliable “firm power” and diversified sources including gas, nuclear, and hydrogen |

Key Challenges and Considerations

- Regulatory Uncertainty: Shifting policy landscapes can complicate long-term planning. While this is largely a risk in developing economies, the increasingly inward-focused policies worldwide, due to the US tariffs, are also reshaping supply chains and adding to the uncertainty.

- Execution Risk: Energy transition projects involve construction, permitting, and technology risks. The size of the projects can also heighten the execution risks and increase the project cost.

- Competition: Since infrastructure projects have become more attractive, valuations are rising, and differentiation via operational expertise will be key.

Conclusion

A McKinsey report4 suggests that the total annual cost of new physical assets for clean energy and enabling infrastructure could reach $6.5 trillion per year by 2050, the majority of which will likely be driven by net-zero pledges and sector-specific transitions. Private equity is reimagining its value creation playbook, and energy and infrastructure are at the heart of this transformation. Given the size of the opportunity, LPs are increasingly betting that energy, climate, and infrastructure assets will underpin the next phase of private equity outperformance—delivering not only financial returns but also a strategic response to the global megatrends of decarbonization, energy transition, and sustainable development. The smart money in 2025 is no longer just chasing alpha in tech or chasing leverage in mature buyouts. It’s building and owning the next-generation physical and digital infrastructure that underpins the climate economy.