Outlook on Equity Long/Short Strategies: Spotlight on Beta Neutral and Low Net Equity Approaches A Market at Crossroads

August 22, 2025

Equity markets today are defined by a paradox. On the one hand, the long-term growth narrative, driven by innovation, demographics, and productivity, is structurally attractive, as massive disruptions in technology, supply chains, and consumption shape it. On the other hand, short-term volatility has become the norm, driven by policy flux, elevated interest rates, geopolitical shocks, and the aforementioned technological disruptions.

For investors, this duality poses a dilemma. While traditional long-only equity portfolios remain vulnerable to macro-driven swings, the pursuit of stable, risk-adjusted returns continues to intensify. In this scenario, Equity Long/Short (ELS) strategies are re-emerging as valuable tools. By taking long positions in expected winners and shorting likely underperformers, ELS funds generate alpha from stock selection while controlling exposure to broader market moves.

Within this universe, Beta Neutral and Low Net Equity strategies offer potential investors the opportunity to participate in equity alpha while mitigating portfolio exposure to market volatility.

Fundamentally, ELS strategies are:

- Going long on companies expected to outperform.

- Taking short positions on underperformers.

The Rise of Beta-Neutral and Low-Net Strategies

A range of strategies fall under the general category of long-short equity. In today’s market environment, the most compelling strategy is a low-net or zero-net strategy, also known as a market-neutral approach. Compared to other long-short equity strategies, market-neutral tactics tend to exhibit low or zero beta, suggesting little to no correlation with the broader market movements. These strategies seek to generate returns primarily through skillful stock selection (alpha). They are not meant to deliver spectacular returns but provide steady, positive returns even during market downturns.

- Low-Net Strategies: This is a more moderate approach. A low-net fund maintains a small, positive exposure to the market (10-20% long) allowing capture of some of the market’s upside, while its significant short positions provide a strong hedge against downside risk. This approach is particularly suited for investors who seek modest market participation but show a preference to capital preservation and risk management.

- Beta-Neutral Strategies: As the purest form of alpha generation, a beta-neutral fund aims to totally eliminate market risk (beta). This is achieved by carefully balancing long and short positions so that the total market exposure is zero. For example, if a manager has a $100 million portfolio, they might take $100 million in long positions and an equal value in short positions. The core of this strategy is the the manager’s ability to pick winners and losers, independent of the market’s overall direction. This is ideal strategy for investors who believe their fund manager has a distinct edge in stock selection, either through process, information management and data analyses and has the ability to pick stocks without depending upon the market noise. These investors desire to protect their capital from broad market downturns.

Both beta-neutral and low-net strategies provide a stark contrast to traditional long-only funds, which are fully exposed to market risk. Beta neutral strategies balance long and short exposures, so overall portfolio beta is near zero. Market direction becomes irrelevant; stock selection is the sole driver of returns.

Relevance of Beta Neutral and Low-Net Today

* Volatile Macro Backdrop

Global equities continue to navigate interest rate uncertainty, inflationary pressures, and shifting supply chains. The US Fed has remained stubborn and continues to be watchful in a market that is swinging from a high of 60 on Vix Index to around 17 currently. The impact of Tariffs, Russia-Ukraine, and the Middle East continues to be unclear and each trading block – EU, BRICS etc are still trying to figure out the way forward. In such a situation, long-only investors continue to remain hostage to these dynamics, while beta-neutral and low-net approaches provide relative stability.

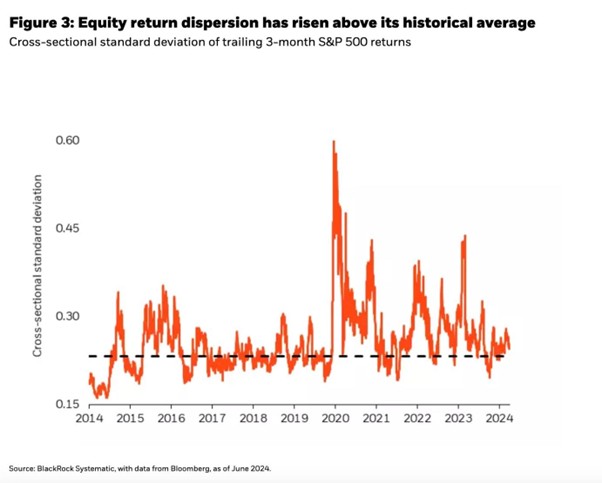

- Rising Stock DispersionDispersion represents a distinct source of returns that lies outside the traditional 60/40 equity-bond framework. Unlike stock and bond performance, which remain heavily tied to macroeconomic cycles and market direction, dispersion, the performance gap between winners and losers, can persist in any environment. In fact, it often peaks during periods of heightened volatility and uncertainty, precisely when conventional 60/40 portfolios struggle the most.As shown below, equity return dispersion has moved above its long-term average, signaling a shift from the “rising tide lifts all boats” era of broad market gains. In this new regime, the ability to capture relative performance differences between securities becomes critical. That’s why market-neutral strategies, which harness dispersion as a return driver while neutralizing broad market risk, are increasingly compelling for investors seeking resilience and alpha generation.

Source: BlackRock1

Post-2020, equity markets have been marked by high intra-sector dispersion. In every sector – Technology, FMCG, Retail, there are clear indications of a set of leaders and, by contrast, others who may be lagging. For instance, in technology, the MAAMI stocks have returned disproportionate returns which have been in sharp contrast to the rest of the tech sector. Such dispersion creates fertile ground for long/short managers to exploit relative winners and losers.

- Institutional Demand for Diversification

Pension funds, sovereign wealth funds, and family offices are increasingly seeking proper diversification rather than diluted exposure. As a consequence, they prefer strategies with low correlation to traditional equity and bond portfolios. Beta-neutral funds stand out in such a situation by delivering consistent alpha during drawdowns. - No More Zero Interest Rates

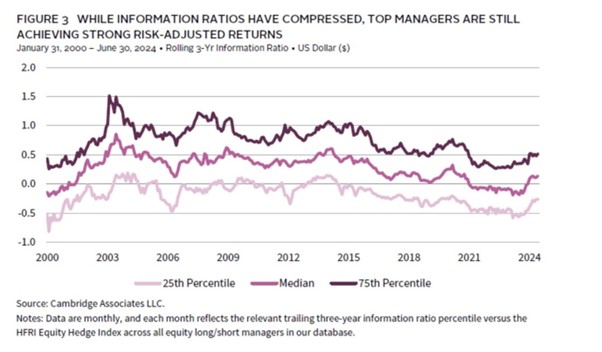

It is becoming increasingly clear that while most central banks, including the Fed, will cut rates in 2025, there is no going back to zero-interest rate policy (ZIRP) levels of the 2010s. The ZIRP environment had fewer carry trade opportunities while exceptional public equity returns challenged ELS managers. As the manager’s value-add reduced, IRs also reduced, since the manager’s ability to provide higher alphas waned.

Information Ratios, 2000–2024

Source: Cambridge Associates LLC2

Historical Evidence

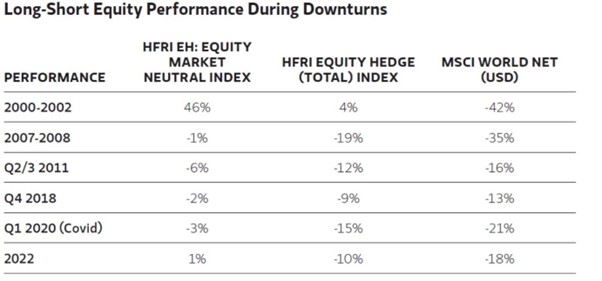

There are three known instances in the last 25 years, when, during times of turbulence, beta neutral strategies have provided a cover:

- During the dotcom bust (2000–02), beta-neutral strategies significantly cushioned capital erosion.

- In 2008, when global equities fell sharply, many beta-neutral funds posted flat to modestly positive returns.

- In 2022, amid inflation shocks, they again showed resilience compared to long-only portfolios.

Source: Morgan Stanley3

Institutions view these strategies as “defensive alpha”: an allocation that protects capital while still compounding returns through manager skill.

Low Net Exposure: Balanced Growth + Protection

Low-net-equity long/short portfolios typically carry 10-20% net long exposure. This provides modest participation in market upside while hedging downside with shorts.

Relevance:

- In range-bound markets, low net portfolios thrive, profiting from dispersion without being whipsawed by index-level swings.

- They allow family offices and HNIs to remain “in the equity game” without taking full directional risk.

- In environments of moderate growth, they deliver smoother return profiles than either pure long-only or fully neutral strategies.

Tailwinds Supporting ELS Strategies

- AI and Alternative Data

Machine learning, natural language processing, and big data are transforming stock selection. Hedge funds now harness a whole gamut of data ranging from satellite imagery for tracking retail footfall, supply-chain shipment movements, ESG disclosures, sentiment analysis from earnings call, related social media chatter, all of which sharpens the ability of the manager to enhance alpha capture. - Regulatory Maturity (Indian Case Study): A review of the rapidly evolving Indian market reveals how regulators are permitting sophisticated long/short strategies. An expanding stock universe is creating richer Alpha opportunities, while improved liquidity and transparency in securities lending are enabling shorting efficiency.

- Favorable Short Rebates and Interest Rates

The era of zero interest rates is over. Elevated cash yields now improve the economics of shorting: hedge funds are no longer penalized for carrying short positions, creating a tailwind for beta-neutral and low-net-book positions.

Historical Risk-Adjusted Returns

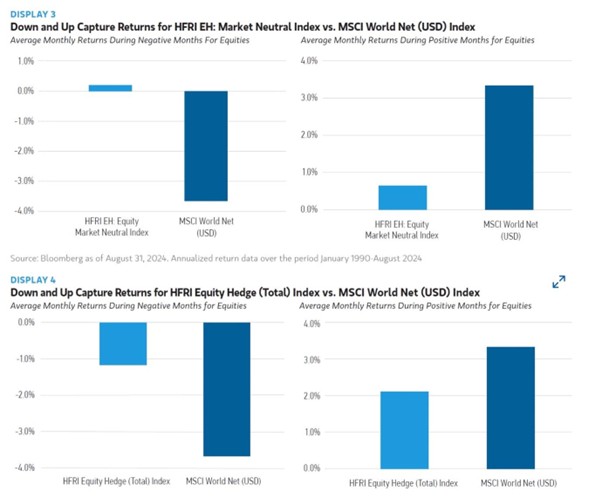

Studies show well-executed ELS strategies deliver mid-to-high single-digit annualized returns with lower volatility than equities. Beta-neutral funds gain significance during downturns, while low net strategies balance downside protection with upside capture. As shown in the charts below for the annualized returns from Jan 1990 to August 2024, Beta-Neutral funds have provided stable, but not spectacular return both during negative as well as positive months for equities as compared to both HFRI Equity Hedge total and also MSCI World Net.

Source4

FutureSpeak

Beta-neutral and Low-Net strategies will continue to be relevant for investors seeking stable returns and managed risk over the next few years.

- Dispersion will remain elevated: Global economies will continue to restructure, driven by decarbonization, digitalization, and a resultant information asymmetry is likely to increase. Consequently, sectoral dynamics will unfold, creating a gap between clear leaders and others.

- Volatility will persist: Since 2019, the world has been beset by one or the other factors that have kept volatility constant. This situation will continue. Geopolitical risks, trade bloc-driven policies, and technological disruptions will lead to increased risks, fiscal divergence, and inflation uncertainty, which in turn will keep equity markets volatile.

- Investor Priorities: With institutions prioritizing Sharpe ratios over raw returns, smoother performance profiles will be at a premium.

In such a future, Beta-Neutral serves as a ballast, delivering Alpha that is uncorrelated to the market and providing downside protection, while Low Net can offer balanced equity participation with controlled volatility. Traditional Long/Short will continue to provide tactical exposure in cyclical bull markets.

A significant portion of the future of equity investing will be defined by adaptability, dispersion, and risk control. Far from being plays for temporary volatility, Equity Long/Short strategies—particularly Beta Neutral and Low Net can emerge as strategic allocations that future-proof portfolios against an uncertain global macro environment. Over time, these strategies will move from niche allocations to core portfolio pillars—offering investors the much-sought-after combination of resilience, diversification, and consistent alpha.