News Digest: Stablecoins get a Boost with GENIUS Act: JP Morgan

September 7, 2025

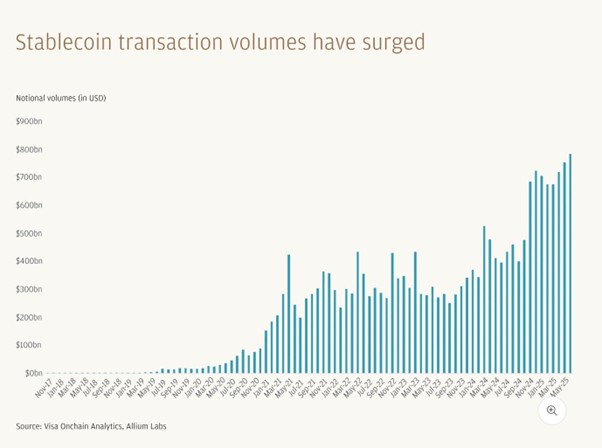

Stablecoins, first introduced in 2014 with BitUSD, have re-emerged in focus following the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), signed into law in July. The legislation provides a clear regulatory framework for stablecoin issuance and adoption, reflecting their growing importance in the financial system.

At their core, stablecoins are cryptocurrencies designed to maintain a steady value by pegging to assets such as fiat currencies. They fall broadly into two types: fully reserved stablecoins, backed one-to-one by cash or liquid securities, and algorithmic stablecoins, which use smart contracts to adjust supply and demand. Today, U.S. dollar-denominated stablecoins dominate the $225 billion global market, roughly 7% of the $3 trillion crypto ecosystem. Analysts at J.P. Morgan project the market could expand to $500–750 billion in the next few years, though estimates as high as $2 trillion by 2028 may be overly optimistic.

Stablecoins promise faster, cheaper cross-border transactions, programmability, and 24/7 settlement, making them attractive for trading, payments, and remittances. Yet risks persist. Events like the TerraUSD collapse in 2022 exposed the potential for sudden runs, while the Bank for International Settlements warns that stablecoins fall short on key monetary standards such as singleness and elasticity.

The GENIUS Act seeks to address some of these concerns by mandating one-to-one reserves in high-quality assets and setting strict issuance rules. While issuers cannot offer yield, reducing competitiveness with deposits and money funds, the law lends credibility to the sector. Whether adoption accelerates depends on infrastructure, investor confidence, and regulatory clarity.

End Notes