Rare Earths and Strategic Metals: The Next Frontier in Critical Commodities Investing

December 10, 2025

As the global economy pivots from efficiency to security, there is a shift in the battleground – from oilrigs to the periodic table. With the continued focus on decarbonization, advanced technological and geopolitical alignment, the modern economy – from electric vehicles and renewable energy to advanced defense systems and quantum computing – is being envisaged upon a thin crust of highly specialized materials known as Rare Earth Elements (REEs) and Strategic Metals. As the global economy veers toward electrification and technological self-reliance, these critical commodities are becoming the newest, most volatile battleground for supply chain control. For investors, while understanding that geopolitical risk is inherent to the system, understanding the policy-driven demand shock is essential for positioning capital in what is rapidly becoming the most compelling, structural macro trade of the decade.

What are REEs and Strategic Metals

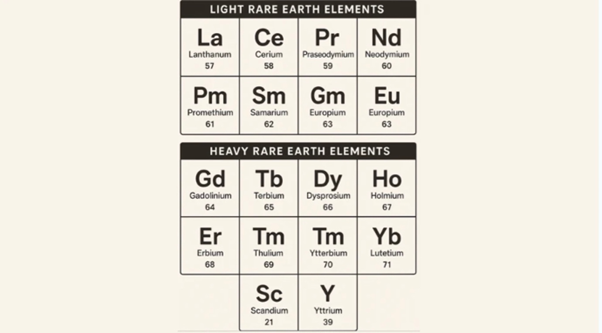

Rare Earth Elements (REEs) find their use in a wide range of high-tech applications, from smartphones, wind turbines, and lasers to missile guidance systems and electric motors. These materials possess unique magnetic, luminescent, and electrochemical properties that make them irreplaceable in miniaturized, high-performance technologies.

The Indispensable Elements of Modern Technology

Critical commodities like lithium, gallium, and the 17 rare earth elements (including Neodymium, Praseodymium, and Dysprosium) are not merely components; they are the invisible foundations of modern technological superiority.

- Lithium (Li): The undisputed king of the energy transition, lithium is essential for the cathodes of almost all high-capacity batteries (Li-ion, LiFePO4) that power Electric Vehicles (EVs) and grid-scale storage solutions. Without a secure lithium supply, the global shift away from fossil fuels stalls.

- Gallium (Ga): Although used in small volumes, Gallium is critical for compound semiconductors used in 5G infrastructure, advanced radar systems, and high-performance computing (HPC). Its function in next-generation microelectronics makes it a non-negotiable input for military and technological supremacy.

- Rare Earth Elements (REEs): Elements like Neodymium and Dysprosium are vital for permanent magnets, which are necessary for virtually every high-efficiency motor—from wind turbines and robotics to stealth fighters and precision-guided missiles. Their unique magnetic properties are irreplaceable in these applications.

Source: Crispedia1

The global economy’s pivot toward electrification and digitization is creating an exponential rise in the demand for REE. For instance:

- Neodymium, praseodymium, dysprosium, and terbium are key to making permanent magnets used in EV drivetrains and wind turbines2.

- Lanthanum and cerium are essential in battery alloys and fuel cracking catalysts.

- Yttrium and gadolinium power LED displays and MRI machines.

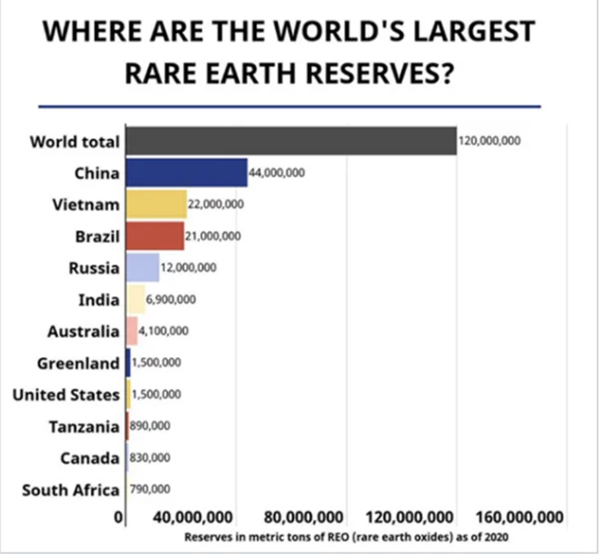

Currently, the global REE supply looks like this:

Crispedia3

While the applications of the REEs are clearly strategic in nature, it is the lopsided supply-demand situation that is creating the scenario for the weaponization of the REEs and increasingly volatile supply chain. For instance, China’s dominance in REES is truly massive. 92%4 of rare earths refinement and 98% of global magnet production happens in China. Additionally, while other countries may have REE reserves in significant sizes, it takes years to build a rare earth refinery and establish independent supply chains: a process where China took the lead many years ago.

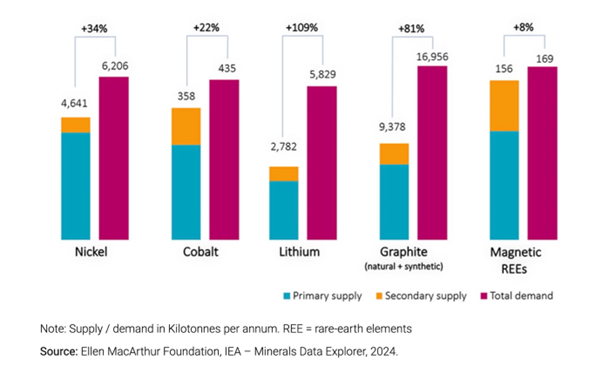

Demand for Many Critical Minerals is Expected to Exceed Supply by 2035

Robeco5

In a true illustration of the strategic importance of the REE market, the US government recently took majority ownership of MP Materials – the only US-based active Rare Earth mining company – reinforcing its commitment to focus on domestic supply chain resilience in this sector.

Given the above factors, The combination of rising demand, constrained supply, and political headwinds is creating a structural tightening, one likely to outlast current commodity cycles.

A Look at the Trends Shaping the Sector

With global supply chains under pressure and the energy transition accelerating, rare earths and critical materials are no longer niche but strategic. The major macro trends shaping how governments, investors, and companies compete include:

Global Trade Pacts and Strategic Alliances: From Japan to Australia to the US-Ukraine minerals cooperation deal, there is now a proliferation of cross-border partnerships aimed at securing critical materials; nations are building bilateral and multilateral agreements to attain supply chain resilience.

Private Capital Focus: Private equity, sovereign funds, and institutional investors are repositioning6 critical minerals as strategic, inflation-resilient assets. Deal volumes are focusing on mining tech, battery metals, and processing infrastructure as capital chases energy transition upside and long-term scarcity premiums.

Tech Innovation Enabling Circular Economy: Advanced recovery methods, AI-enabled exploration, and industrial waste reprocessing are gaining traction7. Western companies are reviving gallium, lithium, and rare earth recovery from electronics and industrial byproducts, turning waste streams into strategic supply. Without the uptake of recycling and reuse, mining capital requirements would need to be one-third higher

Policy-Driven Demand and the Scramble for Security

The demand for these critical commodities is not cyclical; it is structural and policy-driven. Government mandates and massive incentive programs ensure that demand growth for EVs, batteries, and renewable energy will continue for decades, creating a non-negotiable floor for prices.

In response to the weaponization risk, governments across the world have launched sweeping legislative efforts to catalyze new, secure supply chains such as the US Inflation Reduction Act (IRA) and the EU Critical Raw Materials Act (CRMA) etc. The key objective of these initiatives is to attain sovereignty in REE mining, processing and recycling.

These policies are, in effect, underwriting the investment risk for new mining and processing projects in politically secure (or “friend-shored”) jurisdictions. The market is transitioning from one driven purely by cost to one driven by security of supply, creating long-term structural tailwinds for diversified, Western-aligned producers.

Investment Positioning: It is a Long-Term Macro Play

Hedge funds and institutional investors are positioning ahead of these policy-driven supply shocks. This is not a short-term trade; it is a five-to-ten-year structural bet that aligns with the core themes of deglobalization and geopolitical alpha.

Key investment strategies include:

- Direct Investment in Mining and Processing: Allocating capital to junior and mid-tier mining companies operating in secure jurisdictions (e.g., Canada, Australia, U.S.) that have the political backing and capital access to begin production.

- Royalty and Streaming Agreements: Investing in companies that hold royalty rights over future production. This offers exposure to rising commodity prices without bearing the heavy capital expenditures or operational risks of running a mine.

- Thematic ETFs and Private Equity: Utilizing specialized ETFs or private equity funds that target the entire battery materials supply chain, from the mine pit to the refiner.

The fundamental investment thesis remains robust: the world is facing a structural supply deficit in these critical commodities. Despite massive spending, it takes five to ten years to bring a new mine online and establish a full refining supply chain. This long lead time ensures that, even if demand moderates slightly, the underlying scarcity and geopolitical imperative will keep prices buoyant and volatility high. For systematic investors, this high-dispersion, high-conviction macro trade is the new gold rush.

Sources:

5. https://www.robeco.com/en-int/insights/2025/11/eight-reasons-to-invest-in-critical-minerals