Carbon Markets 2.0: The Financialization of Climate Risk

January 12, 2026

For decades, buying ‘offsets’ has been a corporate chest-thumping gesture toward greening the annual report, more a symbolic act than any significant commitment to decarbonization, a somewhat bright spot in the messy backyard of Corporate Social Responsibility (CSR).

Welcome to Carbon Markets 2.0. For the last few years, the landscape has fundamentally shifted. Carbon is no longer just a checkbox- it is a sophisticated, liquid, and volatile financial asset class. Carbon markets have evolved from niche compliance mechanisms into trillion-dollar arenas that blend policy enforcement with corporate sustainability. The maturation of both voluntary and compliance markets is attracting a new class of participants: hedge funds. For these investors, carbon represents the ultimate “alpha” opportunity—a market defined by massive pricing inefficiencies, regulatory shifts, and a direct link to the global energy transition.

The Maturation of the Market

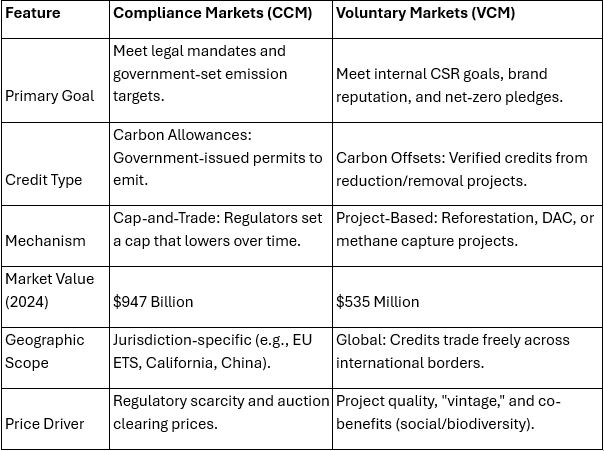

Carbon credits serve as a financial umbrella for allowances and offsets, with each representing one tonne of carbon dioxide equivalent. Compliance markets operate through regulated cap-and-trade systems in which governments mandate emission limits for specific industries. In these massive markets, entities must purchase or trade allowances to meet legal obligations. Conversely, voluntary markets are project-based, allowing corporations to purchase offsets from initiatives such as reforestation to meet internal sustainability goals. While the compliance market dominates in financial scale, reaching $947 billion in 2024, the voluntary sector offers a global, unregulated platform for cross-border trading, private commercial relationships, and corporate environmental leadership.

Compliance carbon markets utilize cap-and-trade frameworks to create financial incentives for emission reductions. Regulators set strict caps and distribute allowances through auctions or free allocations, thereby forcing high emitters to purchase surplus permits or face penalties. In contrast, the voluntary carbon market (VCM) is significantly smaller but truly international, operating outside jurisdiction-specific laws. VCMs facilitate the trading of credits generated from verified sequestration or reduction projects. Despite their smaller 2024 valuation of $535 million, these markets enable essential price discovery and transparency, helping organizations prepare for future regulations while enhancing their reputations through verifiable, proactive climate action.

Source: ICMA1

In the Compliance Markets — specifically the EU Emissions Trading System (EU ETS) — the “2.0” phase is driven by scarcity. As the EU aggressively tightens its emissions cap and phases out free allocations for heavy industry, a structural supply deficit is looming for 2026–2027. This “programmatic scarcity” is what makes carbon a predictable, albeit volatile, bet for macro funds.

Why Hedge Funds are Keen

Hedge funds are drawn to carbon for three primary reasons: liquidity, volatility, and information asymmetry.

● Exploiting Pricing Inefficiencies

Unlike the traditional S&P 500, carbon markets are highly fragmented. Research published by the World Federation of Exchanges2 suggests that VCMs are up to 10 times less efficient than mainstream financial markets. Issuance lags, lack of standardization, and the fact that nearly two-thirds of transactions still occur in private over-the-counter (OTC) deals create massive price gaps. Sophisticated funds use proprietary satellite data and AI-driven monitoring to spot “high-integrity” projects before they are officially rerated by the market. An example would be the pricing difference between the EU ETS at €80-100/tCO2e versus California’s $30-40, allowing for arbitrage opportunities across jurisdictions.

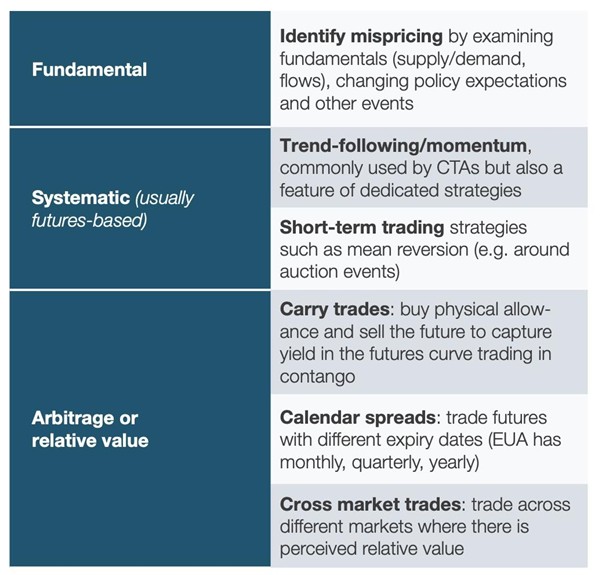

● Emerging Trading Strategies

o The Compliance-Voluntary Arbitrage: In markets like China, the restart of the CCER (China Certified Emission Reductions) program allows companies to offset a portion of their compliance obligations with voluntary credits.

o Relative Value Plays: Trading the price difference between different jurisdictions (e.g., EU ETS at €80-100/tCO2e versus California’s $30-40).

o The “Removals” Long: Taking long-term positions in carbon removal start-ups, essentially betting that future net-zero regulations will make these credits mandatory and exponentially more expensive.

Source: bfinance3

Early Entrants

The entry of high-profile funds has provided the liquidity needed for these markets to scale, though not without significant risk.

- Andurand Capital, led by Pierre Andurand, is among the most prominent players in the Andurand Climate and Energy Transition Fund. Despite a volatile 2025 in which the fund experienced deep mid-year drawdowns due to commodity price fluctuations, it recovered significantly4 toward the end of the year, driven by bullish bets on carbon permits and transition metals.

- Carbon Cap Management: Their World Carbon Fund5 focuses exclusively on compliance markets, using a “multi-strategy” approach to trade liquid carbon certificates across Europe, North America, and New Zealand.

- Salt Investment Funds: Based in New Zealand, their Carbon Fund6 allows institutional and retail investors exposure to both local and offshore emissions trading schemes.

- e360 Power7 trades global carbon credits, analyzing prices for electricity insights amid $850B+ compliance market value.

- Others, like Mercuria and Citadel, enter via options and spreads on ICE and EEX exchanges

The “Pen Risk”: Regulatory Uncertainty

The biggest threat to the “Carbon 2.0” thesis remains regulatory risk, often called “pen risk”: the danger that a politician’s signature can wipe out an entire asset class.

The most significant hurdle is Article 6 of the Paris Agreement. This is the legal framework governing how countries can trade carbon emission reductions to meet their national targets (NDCs). While the 2024–2025 UN summits provided much-needed clarity on Article 6.2 (bilateral trades) and Article 6.4 (a UN-supervised global market), the risk of “double counting”-where both the buying and selling country claim the same emission reduction-remains a sticking point.

Furthermore, as the EU Carbon Border Adjustment Mechanism (CBAM) takes full effect, the relationship between domestic carbon prices and international trade will become even more complex.

The Road to 2030

The financialization of climate risk is an uncomfortable but necessary evolution. While some critics argue that “Wall Street” shouldn’t profit from the climate crisis, the reality is that the $100 trillion required for the global transition won’t come from government grants alone. It requires the deep pockets and risk appetite of the private sector.

As we look toward the remainder of 2026, the “winners” in Carbon 2.0 won’t be the ones buying the cheapest credits. They will be the ones with the best data, the deepest understanding of UN policy, and the patience to hold through the inevitable volatility of a world trying to price its most invisible — and dangerous — waste product.

Sources:

1. https://www.icmagroup.org/assets/ICMA-Carbon-Markets-paper-October-2025.pdf

3. https://www.bfinance.com/insights/sector-in-brief-carbon-trading-strategies

4. https://www.hedgeweek.com/andurand-fund-cuts-2025-losses-to-40-on-metals-rally/

6. https://www.saltfunds.co.nz/