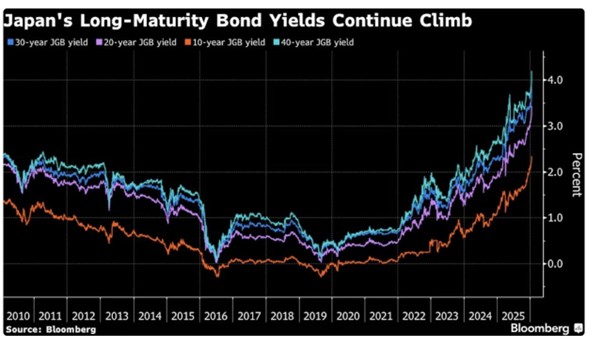

News Digest: Record JGB Rout: 40-Year Yields Hit 4% Amid Takaichi Tax-Cut Fears

January 22, 2026

The Japanese bond market experienced a historic rout on Tuesday, with yields skyrocketing to levels not seen in over three decades. The 40-year sovereign rate surged past 4%, marking a record high since its 2007 debut. This “canary in the coal mine” selloff was triggered by intense market skepticism over Prime Minister Sanae Takaichi’s election pledge to eliminate consumption taxes on food.

Investors are dumping bonds due to the absence of a clear funding source for Takaichi’s populist tax-cut plan. Analysts warn that the market anticipates these cuts will be financed through increased government bond issuance, further straining Japan’s massive public debt burden. Since Takaichi took office in October 2025, long-term yields have climbed approximately 80 basis points. With a snap election scheduled for February 8, 2026, the political gamble has already fueled record net sales of long-term bonds by local insurers, who dumped over ¥822 billion in December alone.

The volatility in Tokyo is reverberating across global markets, putting downward pressure on U.S. Treasuries and weakening the yen toward 158.60. Notably, Japan’s 30-year yield has now surpassed Germany’s equivalent, a significant shift for a nation that maintained ultra-low rates for years.

While higher yields are attracting some foreign investors, who now account for 65% of monthly JGB transactions, the rapid pace of the selloff is causing alarm. Experts suggest the Bank of Japan (BOJ) may be forced to intervene with its “unlimited bond-buying” tool as early as this week to stabilize the rout. As the newly merged opposition, the Centrist Reform Alliance, gains traction, the BOJ’s potential intervention remains the last line of defense against a downward spiral in the world’s third-largest debt market

End Notes