Event Driven Strategies – Muted due to Mayhem

November 29, 2022

When Elon Musk signed an agreement with the Twitter board to acquire the microblogging social media giant, Pentwater Capital, a hedge fund with close to $ 5 Billion in assets, acquired 18.1 Million shares in Tesla in the same quarter, spending upwards of $ 700 million at $ 40 per share. Finally, when Musk completed his purchase of Twitter in early November paying $ 54.20 a share, Pentwater stood to make around $ 14.20 a share, translating to a gain of $ 257 Million, a 35% profit1 in a matter of around 8 months!

However, in the event of the deal falling through, Pentwater may have lost a bundle.

Event Driven Strategies – A Primer

Event driven strategies are deployed by a hedge fund to take advantage of an event that may or may not happen or has already happened. Typical events that predicate event driven investments range from M&As, divestiture, carve-outs, distressed assets such as corporate debt etc. Consequently, these are the fund manager’s perception of the risk/reward balance within the event. Many a time, the fund manager also hedges her bets by placing a put in case the price goes below a certain level. Within the broad definition of event-driven strategies, there are four sub-strategies which are commonly deployed:

- Activist, which accumulates sizeable stock in a company with a view to exert their influence on the management to undertake actions which, in their view are likely to increase shareholder value.

- Merger Arbitrage funds exploit the opportunities presented during an M&A or a carve out with respect to a company

- Multi Strategy event driven is deployed when multiple strategies involving shorts, puts, options are used during an event that offers an upside opportunity while mitigating the risk

- Opportunistic event driven utilizing the pricing inefficiencies that may occur during an event presenting the manager with an upside potential.

An Underwhelming Year

Due to the very nature of the opportunity that is more company driven, the proportion of event-driven funds as compared to the other strategies is rather low. It is estimated 2 that at the end of H1, 2022, there were around 219 funds focused on event driven strategies aggregating around $ 281 b of Assets Under Management. In sharp contrast, there were over 1,000 hedge funds with equity long/short strategy with over $ 550 b AUM.

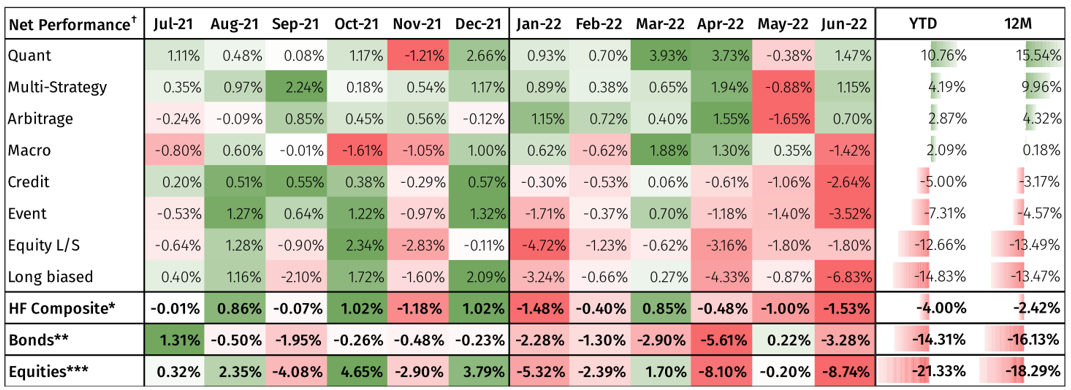

The event-driven strategy was an underperformer in 20222 .The net returns from event-driven strategies were – 7.31 % till the end of H1 2022. The 12 month return stood at -4.57, essentially due to a good 2021. Historically, event-driven funds with activist sub-strategies have displayed a high beta to equities due to the intrinsic relationship between the company event and its impact on the shares. Therefore, it is no surprise that while event driven funds – activist sub-strategy had one of the best returns in 2021, the same has not been true in H1 2022, with returns down 17%, broadly again in line with the equities. The best among the sub-strategies was event -multistrategy, which ended flat.

From an overall Master Strategy perspective, 2022 saw the event driven strategies sitting at the bottom half the Net Returns table

NET RETURN OF MASTER STRATEGIES

Way Forward

Going forward, with the Fed already indicating a timeline for ending the rate hikes by the spring of 2023, the overall scenario, while continuing to be modest, will perhaps lose the Uncertainty that was all-pervading the world in 2022. In such a scenario, most funds would factor in the inflation and the resultant impact. Secondly, this would have an impact on the equities presenting them a more stable economic and market environment and also would allow the equities and bonds to taper down their losses. It is expected that the M&A activity which had become rather subdued in 2022 could pick up pace in 2023, albeit an overall recessionary trend across the US and the eurozone. A long tail recession in the US and the ECB member states stabilizing the energy market will also provide an impetus for the funds to look at corporate earnings and events that could create arbitrage opportunities or give rise to special situations for the event driven strategy. This in turn, will impact the equity and debt markets in the medium term. Given the extent of correlation that event driven strategies have with the equity and bond markets, one can expect to see an upward tick, the latter concomitant with the stability in the global equities market.