A Fine Balance: Commercial Viability and ESG Responsibilities

May 28, 2023

In recent years, environmental, social, and governance (ESG) factors have been playing an increasingly crucial role in business decision-making. Companies are cognizant that integrating ESG considerations into their operations not only contributes to a more sustainable and equitable world but also brings significant commercial benefits. Even as a large number of organizations recognize the value of aligning financial success with responsible practices, there is also an acknowledgment of the fact that ESG-related projects must be commercially viable in order to be sustainable. While ESG managers have gained a substantial amount of AUM despite investing in commercially unviable projects, this trend is not sustainable and will only harm the business in the long run.

Source: Holding Redlich1

Start Small, Think Big – Innovation and Scalability

Ensuring commercial viability in ESG-related projects fosters innovation and technological advancements. Greenko Group’s ‘water battery’/pumped storage hydropower project in Kurnool, Andhra Pradesh2 perfectly illustrates this approach: using solar/wind power to convert water’s potential energy to kinetic energy to produce large amounts of hydroelectricity.

In his article ‘Energy Revolution: Want to Save the Planet? Re-Industrialize’3, Bloomberg’s Andy Mukherjee refutes the idea that developing countries should accept lower living standards in order to prevent global warming and climate change. Mukherjee highlights the Greenko project’s “potential to change the economics of the fuel of our future – green hydrogen”. The ability to store green hydrogen will bring down the price of green hydrogen to US3$ per kilo, allowing developing countries to industralize with 24×7 renewable energy. “We must re-industrialize to decarbonize,” says Mukherjee.

The Pinnapuram Integrated Renewable Energy with Storage Project4, which aims to turn 4,000MW of irregular solar and wind energy into dependable, continuous power supply, could be a game-changer in India’s push to produce sustainable energy on a mass scale. Making sustainability-related projects commercially viable through technological innovation will encourage greater investment in ESG funds, initiatives, and companies.

Demonstrating the commercial viability of innovative solutions encourages companies to implement ESG projects on a larger scale. When a company develops an ESG initiative that is both commercially viable and impactful, it can serve as a model for others and encourage industry-wide adoption of ESG principles. Scaling up successful projects and replicating them across different sectors and geographies can have a transformative effect on the global sustainability landscape. Therefore, companies in the sustainability space must focus on making their projects and innovations commercially viable in order to truly drive change and pave the way for a more sustainable future.

Investor Confidence and Behavior

One of the main reasons why commercial viability is crucial in ESG-related projects is that it ensures financial sustainability. While businesses have a responsibility to address societal and environmental issues, they also have an obligation to their shareholders and stakeholders to generate profits. When ESG initiatives generate positive financial returns, securing the necessary resources and funding for more ambitious future projects becomes far easier, as shareholders and stakeholders feel that they can repose confidence in the business. Thus, by integrating ESG factors into their operations in a commercially viable manner, companies can strike a balance between profitability and sustainability. On the other hand, if a company forges ahead with ambitious ESG goals without considering the financial viability and planning accordingly, the project will likely fail, leading shareholders to lose confidence and exit en masse, thereby ensuring that the company can no longer raise funding for its goals.

Moreover, commercial viability in ESG-related projects attracts investors. There has been a significant shift in investor behavior over the past decade, demonstrating a growing preference for companies with strong ESG performance. Investors now recognize that ESG factors can be indicators of a company’s long-term financial prospects and risk management capabilities. As a result, companies that prioritize commercial viability in their ESG initiatives are more likely to attract investment and enjoy a competitive advantage in the market. By aligning their projects with investor expectations, businesses can tap into a growing pool of capital that is dedicated to sustainable and responsible investment, particularly in initiatives aimed at addressing critical sustainability challenges, such as reducing carbon emissions, improving resource efficiency, promoting diversity and inclusion, ensuring fair labor practices, and enhancing corporate governance.

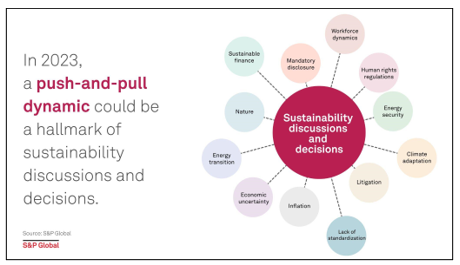

Source: S&P Global5

Conclusion

Commercial viability is a crucial aspect of ESG-related projects. By ensuring that initiatives are financially sustainable, companies can align their economic success with responsible practices. Commercially viable ESG projects attract investors, enable scalability, drive innovation, and contribute to a more sustainable future. As businesses increasingly recognize the importance of ESG factors, integrating commercial viability into their projects becomes paramount. By doing so, companies can thrive financially while making a positive impact on the environment, society, and governance practices