Absolute Advantage: The Importance of Relative Value Strategies

June 26, 2023

Relative value strategies are a type of hedge fund strategy that seeks to profit from the mispricing of two or more securities. These strategies have been around for decades, but they have become increasingly popular in recent years due to their ability to generate consistent returns in both bull and bear markets.

In 2023, relative value strategies have performed well relative to other hedge fund strategies. According to data from Hedge Fund Research, the HFRI Relative Value Index is up 5.2% year-to-date, compared to a 2.5% decline for the HFRI Equity Hedge Index. This outperformance is due in part to the fact that relative value strategies are less sensitive to changes in market volatility than other hedge fund strategies.

(Updated up to June 2023)

The Eurekahedge Relative Value Hedge Fund Index (Bloomberg Ticker – EHFI255) is an equally weighted index of 63 constituent funds. The index is designed to provide a broad measure of the performance of underlying hedge fund managers The index is base weighted at 100 at Dec 1999, does not contain duplicate funds and is denominated in local currencies.

A consistent performer with a promising future

Relative value strategies have also performed well in recent years. Over the past five years, the HFRI Relative Value Index has returned an average of 8.2% per year, compared to 6.7% for the HFRI Equity Hedge Index. This outperformance is due to the fact that relative value strategies are able to take advantage of a variety of market conditions, including rising markets, falling markets, and sideways markets.

The outlook for relative value strategies in the future is positive. As the global economy continues to grow, there will be an increasing number of opportunities for relative value investors to profit from mispricing. Additionally, the rise of quantitative trading has made it easier for relative value investors to identify and exploit the mispricing.

If you are looking for a hedge fund strategy that can generate consistent returns in both bull and bear markets, then relative value strategies should be on your radar. These strategies have a long history of outperforming other hedge fund strategies, and they are likely to continue to do so in the future. However, this does not mean that there are no risks or challenges in this investment option.

Risks Associated with Relative Value Strategies

Relative value strategies are not without risk. One of the biggest risks is that these mispricing strategies that can be exploited can close quickly. This can lead to losses for investors if they are not able to exit their positions in time. Another risk associated with relative value strategies is that they can be complex and difficult to understand. This can make it difficult for investors to assess the risks of these strategies and to choose the right managers.

Comparison to Other Hedge Fund Strategies

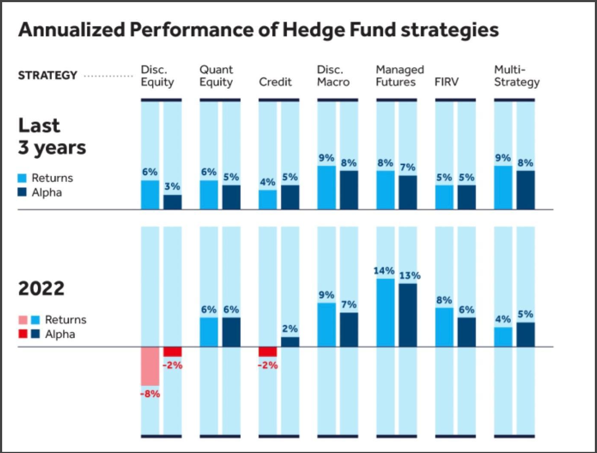

Relative value strategies are just one of the many approaches employed by hedge funds. When compared to other hedge fund strategies, such as long/short equity, global macro, or event-driven, relative value strategies offer distinct advantages. While they may not capture the same magnitude of returns as high-risk, high-reward strategies during periods of market euphoria, they exhibit lower volatility and offer more consistent returns over the long term.

(Source: Barclays Strategic Consulting analysis)

Major Players in Relative Value Strategies

Some of the managers that have done well in the relative value strategy space include AQR Capital Management1, Bluecrest Capital Management2, Citadel3, Millenium Management4, and Two Sigma Ventures5. These managers have all been able to generate consistent returns over the long term by employing a disciplined approach to relative value investing.

Conclusion

Relative value strategies have displayed varying performance in recent years, influenced by market conditions and geopolitical factors. While 2023 has presented mixed results, these strategies have historically performed well during stable market environments with reduced volatility. Hedge fund managers employing relative value strategies continue to seek opportunities in mispriced securities, aiming to generate consistent returns.

The outlook for these strategies remains positive, although ongoing market uncertainties and changing dynamics require adaptability and a deep understanding of the underlying asset classes. Successful managers in this space demonstrate expertise, discipline, and an ability to identify attractive relative value opportunities.