Alternative Investments in 2023: Present and Future Tense

December 27, 2023

Exploring the Landscape:

Alternative investments encompass a wide range of options, including:

- Private equity: Investments in unlisted companies.

- Hedge funds: Employ various strategies to generate returns, often uncorrelated with the market.

- Real estate: Investing in physical property or related securities.

- Infrastructure: Investments in transportation, energy, and other essential infrastructure projects.

- Commodities: Investments in physical commodities like oil, gold, and agricultural products.

Performance in 2023:

The performance of alternative investments in 2023 has been mixed, reflecting the diverse nature of the asset class. Here’s a snapshot:

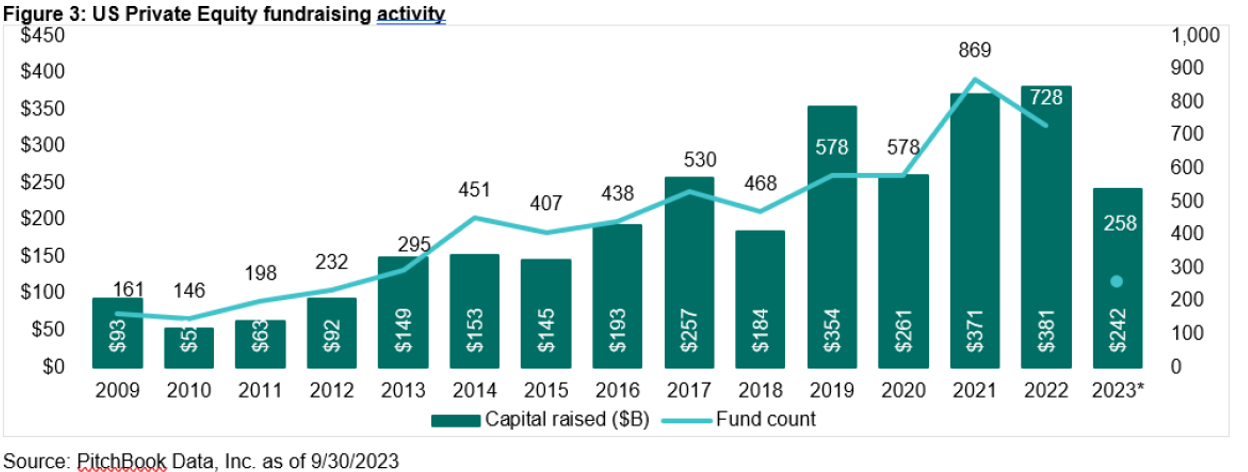

- Private equity: Despite market volatility, private equity funds generally delivered positive returns, benefiting from their longer investment horizons and focus on non-listed companies.

Image via CAIA1

- Hedge funds:The performance of hedge funds varied widely depending on their specific strategies. Some strategies, like macro and global macro, thrived on navigating market volatility, while others struggled.

- Real estate:While some sectors like industrial and multifamily performed well, others like office and retail faced headwinds.

- Infrastructure:Infrastructure investments offered stable returns due to their long-term, essential nature.

- Commodities:Commodity prices experienced significant volatility due to geopolitical tensions and supply chain disruptions, presenting both opportunities and risks for investors.

Looking Ahead:

The future of alternative investments remains promising, driven by several factors:

- Seeking diversification:As traditional asset classes face headwinds, investors increasingly seek diversification through alternative investments that offer potentially uncorrelated returns.

- Demand for yield:In a low-interest-rate environment, some alternative investments offer attractive potential returns that are difficult to achieve with traditional asset classes.

- Technological advancements:Technology is driving innovation in alternative investments, making them more accessible and transparent for investors.

However, key challenges remain.

- High fees:Some alternative investments carry higher fees than traditional assets, requiring careful due diligence and cost-benefit analysis.

- Liquidity constraints:Many alternative investments are illiquid, meaning they cannot be easily bought or sold, requiring a longer investment horizon.

- Regulatory complexity:The regulatory landscape for alternative investments can be complex, requiring specialized knowledge and expertise.

Investing in Alternatives: Key Considerations

- Investment objectives:Clearly define your investment goals and risk tolerance before exploring alternatives.

- Due diligence:Carefully research and assess the specific investment, manager, and fees involved.

- Diversification:Diversify your portfolio across different alternative asset classes and strategies to mitigate risk.

- Long-term commitment:Be prepared to hold alternative investments for a longer period due to their illiquidity nature.

- Seek professional advice:Consult with a qualified financial advisor specializing in alternative investments to guide your decision-making.

Conclusion:

While navigating the world of alternative investments requires careful consideration and due diligence, they present a compelling opportunity for investors seeking diversification, potentially higher returns, and protection against market volatility. As the traditional investment landscape becomes increasingly challenging, alternative investments are likely to play an even more prominent role in investor portfolios in the years to come.