Balancing the long-short credit strategies in the overall allocation

December 26, 2022

Balancing between long and short-term credit strategies within an overall asset allocation is an important consideration for asset managers. Implementing a balance between these strategies can help the portfolio achieve its desired risk profile, while also helping to diversify the portfolio and increase its potential to generate alpha.

What is it all About?

Long-term credit strategies involve buying and holding large baskets of bonds over extended periods of time and are designed to capture long-term returns. The goal of long-term credit strategies is to generate stable income through coupon payments and to benefit from rising bond prices over time. This strategy is particularly attractive for investors looking for a low-cost, low-volatility approach to credit investing.

Short-term credit strategies involve actively managing short-term bond portfolios in order to take advantage of short-term market trends and volatility. Short-term bond portfolios typically contain a mix of liquid and illiquid securities, enabling investors to capitalize on opportunities in movements of specific bonds, sectors, or even the entire market. Short-term bond portfolios can also be a good vehicle to capture returns in rising rate environments.

When selecting the right balance between long and short-term credit strategies, asset managers should consider a variety of factors, including the type of bonds to hold, the duration and nature of the strategies being implemented, and the overall risk appetite of the portfolio. It is also important to ensure that the strategies complement each other, providing diversification and potentially higher returns. By carefully selecting a mix of long and short-term credit strategies, asset managers can create a balanced portfolio that is better able to achieve its goals, both in terms of generating returns and managing risk. In doing so, asset managers will be better positioned to maximize return potential and reduce the risk of losses due to unexpected market shocks.

The story so far

Long-short credit strategies have been gaining a lot of attention in the finance industry due to their ability to produce attractive returns with reduced risk. They have become increasingly popular in recent years, particularly among institutional investors, as they seek to navigate the uncertain market environment.

For the year 2022, long-short credit strategies are expected to remain in high demand as investors try to capitalize on favorable conditions while avoiding the downside risks that had plagued the markets in 2020 and 2021. In terms of 2022 investments, long-short credit strategies could be an attractive option for investors. The global economy is expected to improve steadily throughout the year, with most countries entering a period of recovery. This should make it easier for investors to identify potential opportunities in the credit space. At the same time, the tight regulations imposed on the banking sector should remain in place, providing additional protection to investors.

Forecast for 2023

Looking ahead to 2023, long-short credit strategies will continue to be profitable, although investors should prepare for the potential of rising interest rates and rising market volatility. Investors should also be aware of potential changes in fiscal and monetary policies, as governments and central banks seek to manage the recovery. To be successful in this environment, investors must carefully monitor the market and adjust their strategies accordingly. Overall, long-short credit strategies can be a viable solution to navigating the changing and uncertain market environment. Through traditional as well as alternative credit strategies, investors can potentially unlock attractive returns while protecting their portfolios against potential losses. As always, investors should be sure to diversify their portfolios appropriately and conduct due diligence on all investments before committing any capital. With a long-term investment strategy, investors can potentially capitalize on the opportunities that the credit markets present over the next few years.

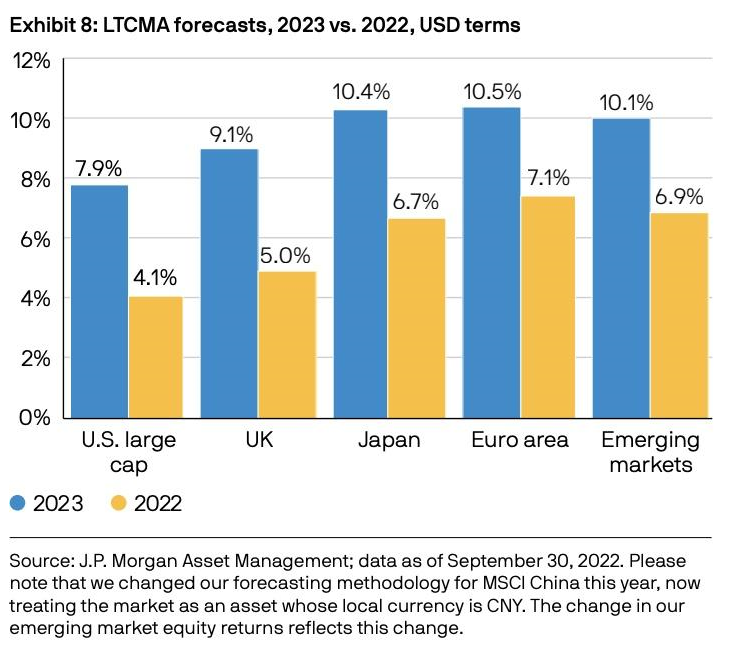

As markets begin to stabilize and shake off the Fear, Uncertainty and Doubt (FUD) factor, 2023 could see a resurgence of equity that was perhaps the biggest casualty. Many companies, forced by the events of 2022 and a palpable inflation, have resorted to increasing prices after several years. A JP Morgan report1 suggests that gains in equity will be across the board and global.

Calling it Back to Basics, JP Morgan predicts a rosy picture for the traditional 60:40 strategy in 2023, forecasting a return of 7.2% for the same, with equities pegged at 7.9%.

In conclusion

The primary driver for the equities tailwind is primarily due to the removal of the FUD factor, rather than any other factor. Higher inflation will persist, and while the Fed has promised to taper the interest rates by the spring of 2023 and the Russia-Ukraine is playing out in a long and drawn out manner, financial markets have accepted the fact that a return to a low-interest regime is not happening anytime soon and consequently, the corporate actions, design to thrive under the above circumstances will take center-stage as against a state of near-paralysis that permeated the market in early 2022. Consequently, the long-short funds will probably have an easier time going forward in terms of allocation in a much more predictable environment.