Business Development Company (BDC) Structures in the US

November 22, 2023

Business Development Companies (BDCs) are publicly traded investment companies that invest in small and medium-sized businesses (SMBs). They provide a way for retail investors to gain exposure to the potential growth of small and medium-sized enterprises while providing these companies with the capital needed to grow and thrive.

BDCs are structured in a variety of ways, but they all share some common features. First, BDCs are registered with the Securities and Exchange Commission (SEC) as investment companies under the Investment Company Act of 1940. Second, BDCs are required to invest at least 70% of their assets in private or thinly traded public companies. Third, BDCs must distribute at least 90% of their net investment income to shareholders as dividends each year.

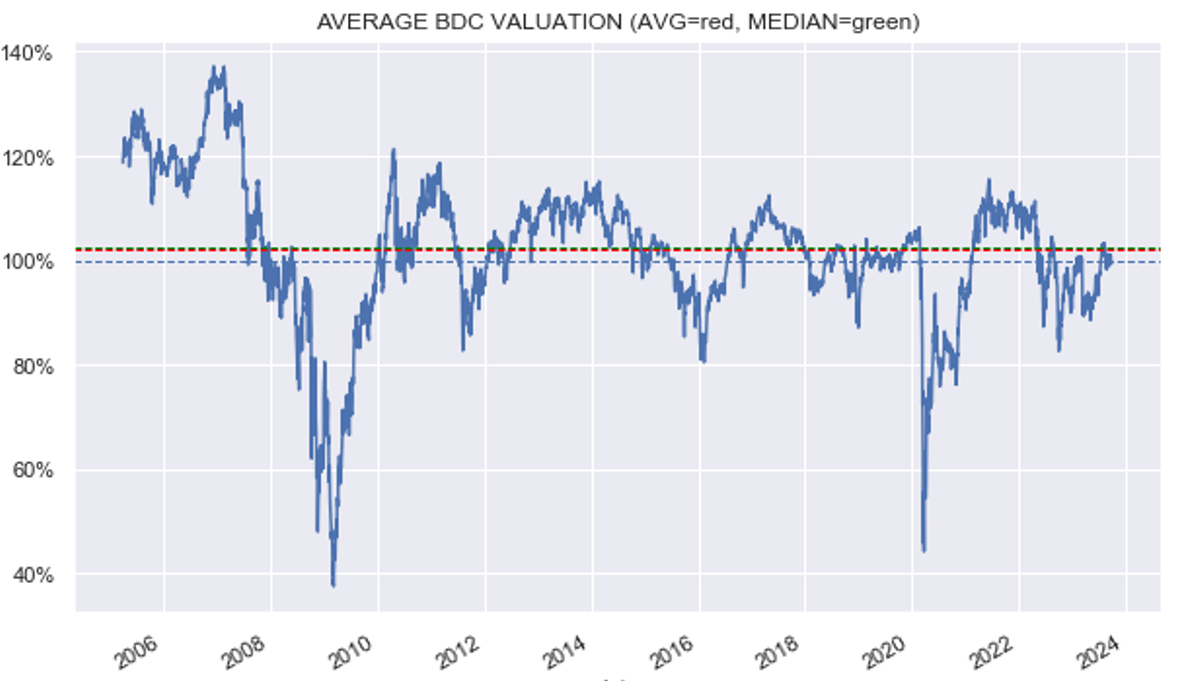

As per data from Systematic Investment, the BDC sector valuation is trading at around 100%, or a little below the historical average.

BDC Valuation as of Sept 30, 2023. Systematic Income data via SeekingAlpha1

Types of BDC Structures

There are two main types of BDC structures: externally managed and internally managed.

- Externally managed BDCs are managed by a separate investment advisor, which typically charges a management fee.

- Internally managed BDCs are managed by the company’s board of directors.

In addition to externally managed and internally managed BDCs, there are a few other types of BDC structures, including:

- Non-traded BDCs are not publicly traded and are typically only available to accredited investors.

- SBICs (Small Business Investment Companies) are BDCs that receive special tax treatment from the Small Business Administration (SBA).

- C-Corps and S-Corps can also elect to be taxed as BDCs.

Advantages and Disadvantages of Different BDC Structures

Each type of BDC has its own advantages and disadvantages. Given the costs of setup, training, technology, and operations, internally managed BDCs can be more expensive to operate. Additionally, there is a lack of time flexibility and after-hours support, as well as the possibility of conflict between the BDC and the sales team. However, they offer more control over the relationship with the customer and the dealership culture, and familiarity with the customer will also result in better customer experiences. Internal BDC agents can be more familiar with the dealership’s specific products and services, and having direct access to the CRM means that all calls and metrics can be easily tracked, making ROI easily determinable.

Externally managed BDCs are typically less expensive than internally managed BDCs, and they can provide 24/7 coverage. There are also several advantages in operational flexibility, cost saving, and quality of data collected. However, they may not be as familiar with the dealership’s specific products and services, or their working culture and customer relationships. In the case of offshore BDCs, there could be language barriers or cultural differences that make it difficult to connect with customers and fulfil their needs. The dealership also will not have control over the process as the BDC will have its own internal processes that may result in cross-communication and inefficiencies. Lack of access to the CRM also makes tracking and reporting difficult, as the dealership will have to rely on the data provided by the BDC. The lack of CRM integration makes it difficult to estimate ROI.

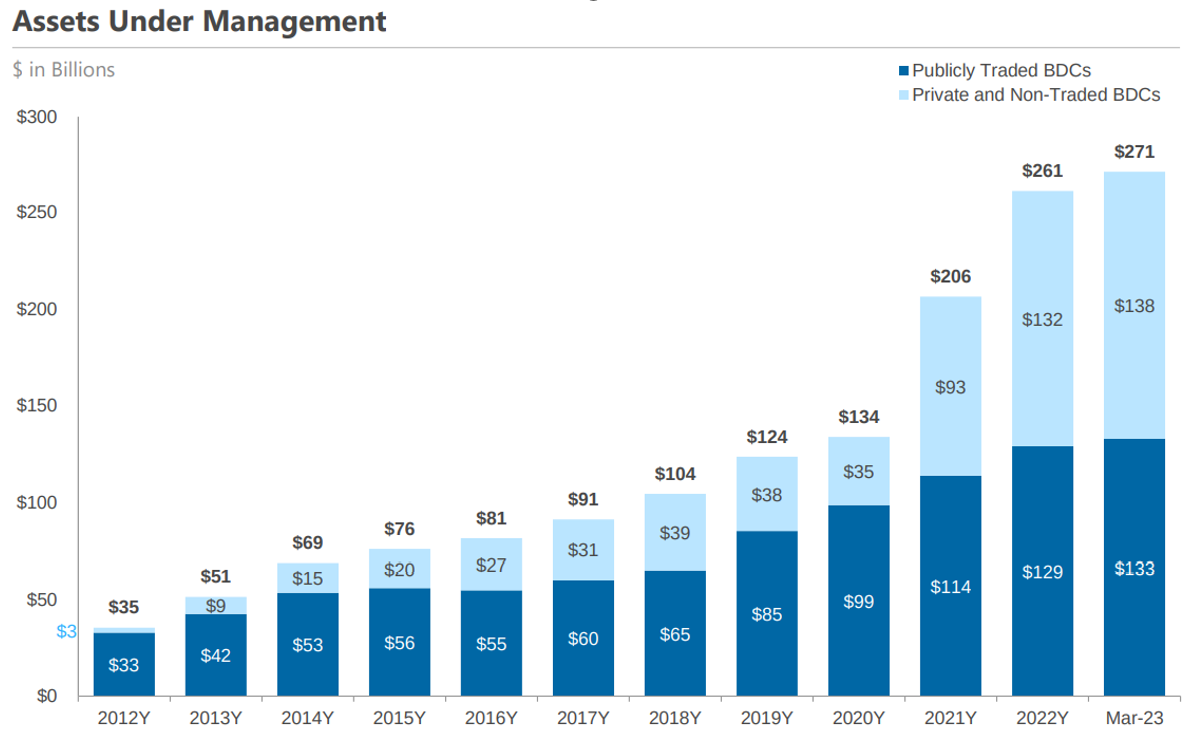

Image via Houlihan Lokey2

In recent years, there has been a trend towards more externally managed BDCs. They typically have a team of experienced investment professionals who are responsible for managing the portfolio. However, externally managed BDCs also have higher management fees than internally managed BDCs.

Another trend in BDC structures is the rise of non-traded BDCs. Non-traded BDCs offer investors the opportunity to invest in BDCs without having to buy shares on the public market.

Internally managed BDCs have lower management fees than externally managed BDCs, partially because they do not have a large management organization and only have to pay their employees. By the same token, however, they may not have the same level of investment expertise. Internally managed BDCs are also more likely to be controlled by the company’s founders or management team, but conversely, there also exists the view that internally managed BDCs have better alignment between their management and shareholders, thus driving better performance.

High Yields, High Risks

Many BDCs offer high dividend yields, often around 10% or more, despite low interest rates. These high yields come with significant risks because BDCs provide loans to riskier, sometimes struggling businesses that other banks avoid. The cash flow supporting these dividends comes from these high-risk loans.

BDC loans vary; some are riskier than others, with higher interest rates. BDCs with higher operating costs are forced to lend to even riskier companies to cover their dividends. Some of these loans are unsecured, meaning there’s no collateral if the company defaults, leading to potential losses for the BDC.

BDCs often rely on issuing more shares to raise investment capital, making them vulnerable to changing investor sentiment. If they make too many speculative loans that go bad, their share prices can plummet, leading to a downward spiral of declining value, dividend cuts, and investor losses. Additionally, the ease of starting a BDC in a world with cheap capital has led to increased competition and pressure to take on riskier loans when economic conditions deteriorate.

Conclusion

BDCs are a variety of investment vehicles that provide investors with exposure to small and medium-sized businesses. BDCs can be structured in a variety of ways, but they all share some common features, including being registered with the SEC as investment companies and being required to invest at least 70% of their assets in private or thinly traded public companies.

BDCs have grown in popularity in recent years, as investors have sought exposure to small and medium-sized businesses. They can be a good investment for investors with a high risk appetite who are looking for high yields and the potential for capital gains. However, BDCs are also a riskier investment than traditional stocks and bonds and are therefore not the best option for investors seeking steady returns. An understanding of the market and advice from a professional will help investors select the right BDCs to create a diversified portfolio that delivers high returns.