Cryptocurrency Hedge Funds: Navigating Regulatory Challenges in a High-Stakes Arena

April 30, 2025

In recent years, the rise of digital assets has captivated institutional and retail investors alike, promising a new frontier in finance driven by decentralization, innovation, and disruption. At the forefront of this financial revolution are cryptocurrency hedge funds—entities that apply traditional hedge fund strategies to the volatile world of crypto. These funds invest in digital assets ranging from blue-chip tokens like Bitcoin (BTC) and Ethereum (ETH) to a wide variety of altcoins, DeFi protocols, and even NFTs. However, despite their growing influence, these funds are navigating a regulatory minefield that threatens to limit their full potential.

The Allure of Digital Asset Hedge Funds

Cryptocurrency hedge funds offer several key attractions. First, they provide exposure to a high-growth asset class that has outperformed many traditional investments over the past decade. Second, they offer diversification benefits, particularly for institutional portfolios that seek uncorrelated returns. And third, the evolving nature of blockchain and decentralized finance (DeFi) means hedge funds can employ a range of strategies—long/short, arbitrage, yield farming, and venture-style investing—all under the crypto umbrella.

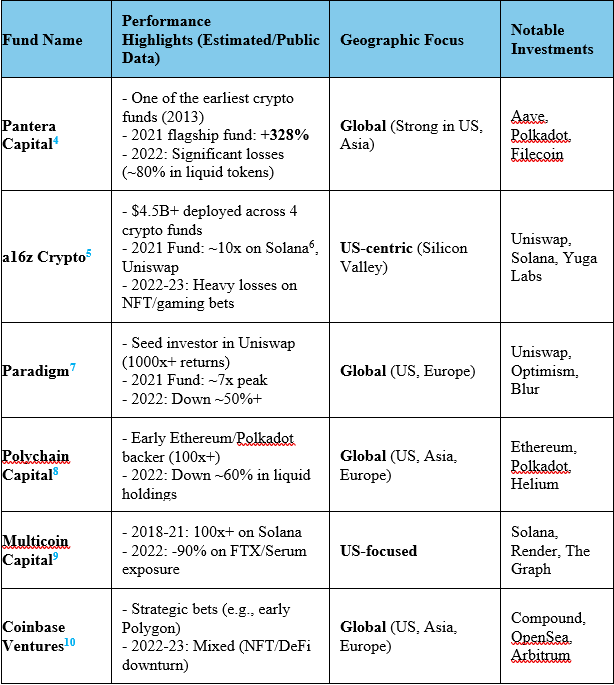

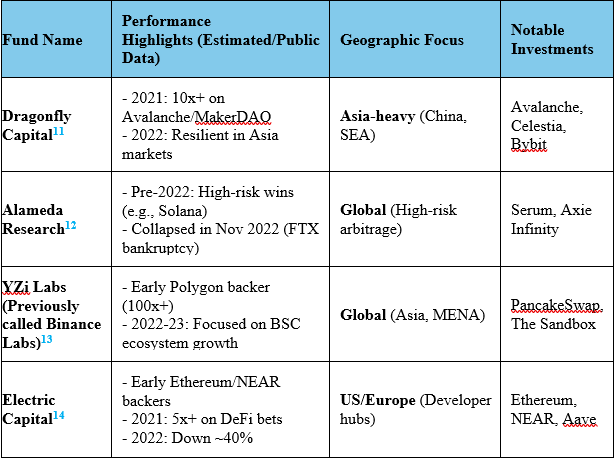

These funds invest in more than just Bitcoin and Ethereum. Increasingly, they are allocating capital to altcoins like Solana (SOL), Avalanche (AVAX), Cardano (ADA), and Chainlink (LINK), as well as DeFi tokens such as Aave (AAVE), Uniswap (UNI), and Synthetix (SNX). Some funds are even exploring stablecoin strategies, staking opportunities, and early-stage investments in blockchain startups. As the digital asset ecosystem diversifies, so do the portfolios of these hedge funds.

Regulatory Challenges: A Cloud Over Growth

Yet, for all their promise, crypto hedge funds face an uphill battle when it comes to regulatory clarity. Unlike traditional financial instruments, digital assets exist in a gray area. Are they commodities? Securities? Something else entirely? The lack of a consistent framework—particularly in the United States—creates significant uncertainty.

The Securities and Exchange Commission (SEC) under Chair Gary Gensler has argued1 that most crypto tokens qualify as securities and should be regulated as such. Meanwhile, the Commodity Futures Trading Commission (CFTC) sees assets like Bitcoin and Ethereum as commodities, falling under its purview. This jurisdictional tug-of-war creates confusion for hedge funds trying to structure compliant portfolios, maintain proper disclosures, and attract institutional investors.

Internationally, the landscape is similarly fragmented. While the European Union has taken steps toward clarity with the Markets in Crypto-Assets (MiCA) framework2, enforcement is still evolving. In Asia, regulatory approaches range from supportive in Singapore to outright bans in countries like China. Hedge funds with global strategies must therefore tread carefully, often hiring legal and compliance teams just to navigate cross-border asset management.

Investor Apprehension and Institutional Hesitancy

This murky regulatory environment doesn’t just affect fund managers—it reverberates across the entire investment ecosystem. Institutional investors, such as pension funds, family offices, and endowments, are wary of allocating capital to crypto funds without regulatory clarity. Questions around custody, tax treatment, risk disclosures, and asset classification make it difficult to conduct due diligence or assess the true risk profile of crypto hedge fund investments.

Even qualified custodians and fund administrators are cautious. Many service providers are hesitant to partner with crypto funds due to the reputational and compliance risks involved, further limiting scalability.

Innovation Outpacing Regulation

Perhaps the most ironic twist is that regulation is struggling to keep pace with innovation. New categories of digital assets3 are emerging at a breakneck pace—from NFTs and tokenized real-world assets (RWAs) to decentralized autonomous organizations (DAOs) and cross-chain interoperability tokens. These developments often fall outside existing legal definitions, forcing hedge funds to innovate in a vacuum, without regulatory guardrails or support.

Some hedge funds have adopted a wait-and-see approach, limiting exposure to only the most established tokens like BTC and ETH. Others are diving headfirst into uncharted waters, viewing regulatory ambiguity as an opportunity to capture outsized returns before the mainstream arrives. Both strategies carry risk, but the latter has been rewarded handsomely in past crypto cycles.

A Way Forward: Regulatory Sandboxes and Collaboration

To unlock the full potential of cryptocurrency hedge funds, regulatory reform is essential. Policymakers and financial watchdogs must engage with the industry to develop clear, pragmatic guidelines that balance innovation with investor protection. Some jurisdictions have implemented “regulatory sandboxes,” allowing firms to test new products in a controlled environment. This approach could be a model for larger economies seeking to encourage responsible experimentation.

Additionally, industry associations and hedge fund coalitions are beginning to advocate for clearer frameworks. Their lobbying efforts may eventually bear fruit, especially as the political narrative around crypto shifts from speculative hype to strategic economic importance.

Navigating Uncertainty with Cautious Optimism

Cryptocurrency hedge funds sit at the intersection of innovation and regulation. They represent a dynamic and rapidly evolving investment class capable of delivering exceptional returns—but also one fraught with regulatory and operational challenges.

For now, the most successful funds are those that combine deep technical understanding with legal prudence, positioning themselves to adapt quickly to regulatory shifts while delivering value to investors. As the global regulatory environment matures, these funds will be well-placed to lead the next wave of digital asset adoption—not just in crypto, but across the entire financial ecosystem. Until then, navigating this space will require patience, expertise, and a healthy dose of regulatory foresight. But one thing is certain: the future of hedge fund investing is increasingly digital—and those who master the regulatory puzzle will be its pioneers.

List of Top Crypto Funds and Their Investments