Cryptocurrency Hedge Funds: Where Are They Headed?

June 28, 2024

Crypto hedge funds came on the scene more than a decade ago around the time Bitcoin had breached the $65 mark. Thereafter a series of such funds appeared on the scene, including a few that the parent company created upon perceiving the opportunity of investing exclusively in digital assets via blockchain-based processes. They have hit the headlines over the past few months when Bitcoin exchange-traded funds (ETFs) saw significant activity, first ascribed to a surge in overall investment, but later tempered to reveal a strategy shaped largely by hedge funds. According to a media report1, as of June 25, spot Bitcoin funds saw net outflows of $14.42 billion, the highest since the period between April 24 and early May. On June 25 as we wrote this report, the trend was again reversed with an inflow of $31 million.

Market Volatility and Hedge Fund Strategies

While analysts and investors differ in their views as to the reason for this volatility, there is an underlying belief that these shifts are being shaped largely by hedge fund strategies. These funds, which are largely focused on digital assets, have provided investors seeking exposure to the crypto market by offering diversification, liquidity, and potentially higher returns. These institutional investors, who hold a sizable majority of the world’s $98 trillion investable assets, have dominated the equity markets in the past, accounting for a big chunk of all trading. Since the approval of the BTC ETF, this has changed as Bitcoin’s finite supply of 21 million has witnessed robust demand.

Over the past few weeks, there were notable inflows into the Bitcoin ETFs to the tune of between $2 billion to $4 billion, signaling a healthy interest among hedge funds in these digital assets. However, they note that while interest in futures has grown, other indicators like funding rates haven’t been as aggressive, suggesting that hedge fund trading strategies are at play in this segment. Capitalizing on the yield difference between spot and futures could be one such strategy that explains the volatility. Given that the funding fee is around 20%, investors could be acquiring spot Bitcoin and shorting Bitcoin futures, to neutralize their net positions that allow them to capture the aforesaid yield difference.

The Journey of Crypto Hedge Funds

Before going into the details of these transactions, it is important to understand the crypto journey of hedge funds itself. A recent research report2 suggested that 34% of crypto-dedicated hedge funds have a three-plus-year track record with more than half of these starting between one and three years. Assets under management (AUM) of these funds jumped to $15.2 billion in October-December last of which funds following fundamental strategies held $11.4 billion, quant directionals at $1.8 billion, and market-neutral funds holding $1.9 billion. On the fund-raising side, global VCs in crypto and blockchain raised $5.75 billion in 2023 across 58 funds, which was way below the record performance of $37.2 billion (262 funds) in 2022. However, the overall exposure to the crypto market is still low at 3.5% of global fundraising.

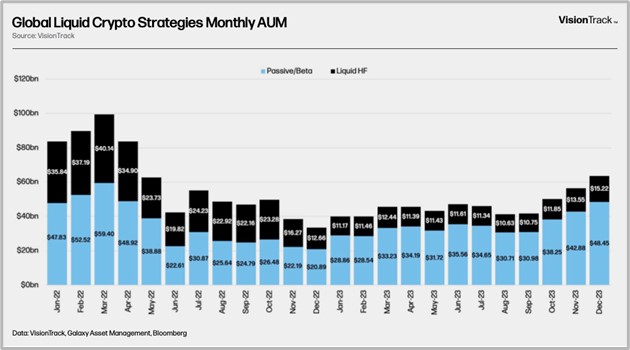

Recent data (see table below) indicates that crypto hedge funds grew their total AUM between September to December. Passive offerings including single-asset vehicles and multi-asset index products dominated with the last four months of 2023 witnessing the sharpest growth in liquid fund strategies – from $41.7 billion to $63.7 billion, accounting for three-quarters of the total. Crypto-dedicated liquid hedge fund AUM grew in the fourth quarter with the top-20 of these still holding around 71% of total hedge fund AUM. This was marginally higher than the 75% share that they held at the end of 2022, which saw tough times for the digital asset alongside new entrants joining up in anticipation of growth.

Source: 2024 Institutional Crypto Hedge Fund & Venture Report, Vision Track3

Influence of Hedge Funds on Market Liquidity

The growing interest in cryptocurrency among hedge funds reaffirms the perspective among fund managers that they can influence market liquidity. They can potentially assist the scale and growth of projects to a critical mass of users and network effects. Stronger networks result in better velocity that brings higher liquidity, though the concomitant market volatility does bode a risk, as we saw in recent weeks. Then there are also the regulatory uncertainties such as the United States SEC initiating a probe into Ethereum Foundation’s governance model. However, with the issue having blown over, the markets are now anticipating an Ethereum-based fund coming up soon.

Another feature that merits our interest revolves around crypto venture deal activities, with 2023 witnessing $9.8 billion of deal value across 1,998 deals, as per data provided by Galaxy Research. This number had touched $31.9 billion across 3,795 deals in 2022. The report said capital constraints caused funds to touch deployment capacity with later-stage winners taking most of the value. In the last quarter of 2024, such deals captured nearly 15% of the deal count and 16% of the deal value. The report noted that the crypto venture fundraising market was struggling over six previous quarters, more consolidation in top portfolio companies was only to be expected. Amongst them, only eight exceeded a deal value of $100 million.

Risk Mitigation Strategies, Challenges, and Potential Rewards for Investors

Fund managers operating crypto ETFs have already factored in these potential risks as well as the challenges of hacking or fraud because these markets are self-regulated. Crypto funds use multiple risk mitigation strategies such as diversification, hedging, and holding cash reserves when complex market challenges emerge. These crypto funds adopt a more nuanced approach through the aggregation of portfolios of multiple underlying crypto hedge funds, which in turn provide investors with a curated selection of strategies. Of course, there are swings and roundabouts in this approach as well.

The crypto market is still in its infancy and evolving rapidly to a point where it could prove to be overwhelming to even fund managers. Today, crypto fund managers are using due diligence as their panacea for differentiation. However, it is an expensive proposition for investors since hedge funds themselves do not represent a low-cost investment option and in this case, additional efforts towards risk mitigation and growth means additional fees. In addition to closely monitoring several crypto funds across the world, these funds also need to use their networks to open the doors of some funds that are closed to new investors. Such funds usually prefer offering additional capacity to existing investors who have qualified after due diligence instead of entertaining new associations. Of course, there could also be contractual obligations with existing investors that require changes.

From the point of view of investors, crypto-led fund of funds can generate uncorrelated returns though it does require an infusion of larger capital due to the high minimum investment amounts charged by these hedge funds. To reap such rewards, investors must be ready to cough up fees, in addition to those charged by the underlying hedge funds. Some would see this as a reduced return while others may consider it worth their peace of mind as a fund of such funds tends to diversify their portfolio as mentioned earlier in this article. As with hedge funds, investors need to research the fund’s strategy – whether it involves active trading or long-term holdings. Data around historical performance is a must, especially around such occasions as we witnessed over the past few weeks. Additionally, investors would do well to seek transparency around management fees, performance fees, etc., and closely track the risks around the regulatory environment, which is continuously evolving as we speak.

In Conclusion: The Institutionalization of the Crypto Market

Overall, the crypto-led hedge funds are contributing to the development of an institutionalized crypto market. These investment vehicles are adding liquidity to the system and an opportunity for the industry to continuously reinvent itself alongside the crypto market itself. As this investment landscape evolves, there could be more opportunities for investors to put their money into hedge funds that invest in other crypto-led funds to access diversified exposure to the digital assets market. This also allows investors an easy navigation into the complex crypto market with added confidence.