Elections and Market Gyrations – It Takes More Than Two to Tango

June 26, 2024

What makes 2024 a crucial year from a political perspective? Approximately 49% of the global population voting across 64 countries. However, in terms of importance to the global economy, the US elections scheduled for November are significant. In a rare coincidence, Americans will vote to elect their President barely five months after the British do.

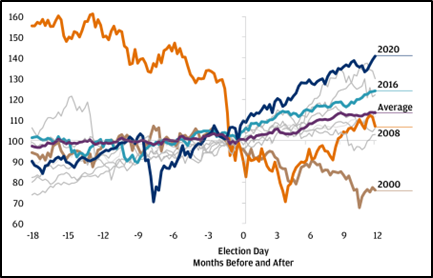

How will the market respond to these elections? While there is no simple answer, it must be reiterated that elections do not necessarily mean more uncertainty, nor are markets at their best behavior when faced with political duress. It should also be mentioned that most market gyrations revolve around two myths: first, that stocks do not perform as well in an election year; and second, that the markets will tumble if a particular party or candidate wins. Riding on these two myths, hedge fund managers often employ strategies that are possibly riskier in election years than otherwise.

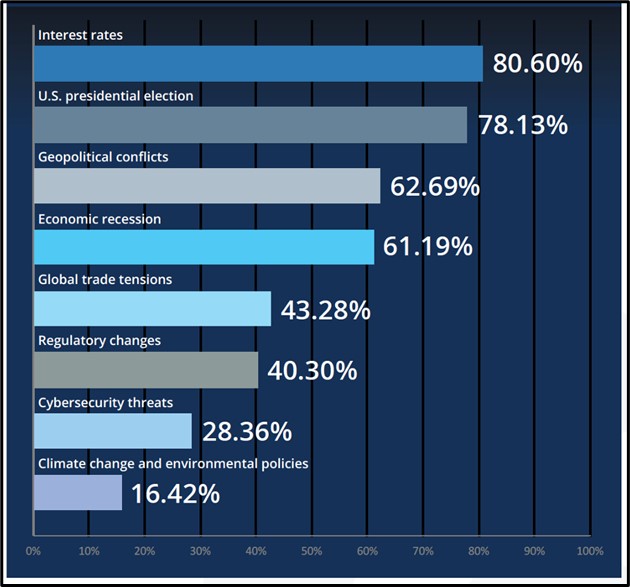

A recent survey of hedge fund managers in the wake of several general elections across the world suggested that high interest rates, geopolitical conflicts, economic recession, and global trade tensions as the key factors influencing their moves. And all of these have existed before 2024 as well. The managers said their strategies would remain largely unchanged from the past though the US Presidential elections could drive them towards some bold moves to mitigate risk and maximize alpha potential. More than half of the respondents to the survey said they would diversify investment allocations across multiple asset classes over the next 12 months, with economic and geopolitical factors getting a higher priority over others such as ESG criteria and climate policies.

(Source: JP Morgan1)

The reality is that an election year merely adds an additional layer of concern among investors who dwell over the future course of a country’s economic policies based on what political parties draw while framing their respective poll strategies. For example, the US elections slated for November would have debates over inflation and interest rates, but closer to D-day, imposition of higher import tariffs and the overall tax bill of Americans could take center stage. Similarly, elections in Europe, which have seldom had a significant impact on global financial markets in the past, could see some impact on select industries such as defense, and global projects with high levels of technology exposure. However, post the general elections in India, which saw the ruling regime retain power with a smaller majority, the markets could be expecting a rationalization of taxes across goods and services and personal incomes to increase cash in circulation.

The first off-the-blocks this election year was Russia where Vladimir Putin won a landslide victory to retain power for another six years. In the run-up to the elections, wages soared by double digits, the Ruble stabilized, and unemployment was at record lows. Though the war with Ukraine has resulted in several thousand fatalities, Putin’s win could gloss over these losses through higher spending to meet the pre-poll promises around social support to families, bigger pensions, mortgage subsidies, and compensation for loss of life in the conflict. With oil prices appearing stable, Russia could well direct its attention on recouping some of its lucrative European energy markets that were lost to sanctions as well as the blowing up of the Nord Stream gas pipelines. Putin’s success in broadening Russia’s trade could be gauged from the progress on creating a new gas hub in Turkey and a new Siberian pipeline to transport gas to China via Mongolia.

India’s general elections also saw the ruling regime return to power with Prime Minister Narendra Modi assuming his third term in office earlier in June. Though his party came back with a reduced majority, Modi has cobbled up an alliance to gain a majority in the Parliament. Equity markets crashed a day after the election results, wiping off close to $400 billion within a day, but subsequent trading recovered most of their losses. Top money managers say they shifted focus to large firms with strong fundamentals, turning away from small-caps and stocks that appeared overheated such as industrials, defense, and state-run companies. At the same time, hedge funds are hoping for continued economic growth led by some fiscal stimulus around the areas of rationalizing taxes on goods and services and personal incomes, that could put more money into the hands of consumers and fuel growth.

Meanwhile, setbacks during elections to the European Parliament prompted French President Emmanuel Macron to call a shock national vote. Now, this decision appears to have gone awry for his party, which is trailing to the far right. Pollsters believe that the National Rally, led by 28-year-old Jordan Bardella could win an absolute majority in the new parliament. Of course, the country saw several rallies across the states where protestors asked voters to “push back the far right, and not our rights.” The country’s two-round election system makes it difficult to predict which party could ultimately claim a majority in the lower house of parliament, handing that party the prime minister’s post, which is second in power to President Emmanuel Macron. In such a scenario, the euro, French stocks, and government debt will all hurt in the medium term at the European Union Executive as well. German Chancellor Olaf Scholz has already expressed concern about the far-right France. And with good reason, as Germany’s own far-right Alternative for Germany party too made gains during the European Parliament elections.

Already the snap elections in France have caused stocks to lose big while government bonds too could be in for a bit of bruising since big investors already moved away over high deficits, a prime reason for S&P cutting the country’s credit rating. Fears of reduced French compliance with EU rules around these matters have also been brought up by fund managers. However, a bigger worry for the markets revolves around how the EU executive, unlikely to see a major shift and made up of centrist voices, will go about trade. Besides plans for higher tariffs on Chinese electric vehicles, would the parliament add more trade restrictions? If so, would they brace themselves for retaliation that could hurt European auto stocks as well as impact the prices of dairy products, wine, airline parts, and such that China imports?

As these political expedients unfold in Europe, the equity markets have done rather well, having started 2024 strongly and gained around 10% in the period. The mid-term review of the economy has also been quite robust amidst receding energy shock and stability of prices among essential commodities. The cut in interest rates also augurs well. Though analysts do not expect inflation to decline to levels prevalent two years ago, they believe that it has fallen enough to warrant more cuts in lending rates that could put more money into the hands of consumers. Additionally, industry could revert to higher production goals and markets which could lead to a rise in real wages and possibly new jobs getting added.

While most of these election outcomes would bear a peripheral impact on the global economy, the world is watching the US Presidential elections with bated breath as some of the existing policies could witness a quick overturn. However, what most market analysts do agree with is that the core issue of inflation and high interest rates might not be influenced politically. In the past, the Fed has not shied away from tweaking rates in election years and is more likely to take good calls as they seek a soft landing of the economy without stalling growth. Any such pivot toward rate cuts requires careful navigation to ensure inflation continues to moderate and that growth doesn’t tip into recession.

On the policy front, Americans could find themselves voting for higher import tariffs in order to boost local production and gain new jobs in the process. Additionally, such a move could see a secondary impact on the dollar strengthening, as it had during the Republican presidency in 2016. Of course, this reaction faded within a short time, and in 2024 too we can expect a Democrat win to result in a smaller reaction in the forex markets. Another factor could be the approach towards the Tax Cuts and Jobs Act of 2017 that reduced the tax bills for most Americans. This is set to expire in 2025 and federal taxes would rise unless the provisions are extended. The Dems promise an extension of many provisions while the Reps say they would extend them all permanently. The problem is neither have articulated a solution to find offsets for the revenue loss which could potentially push bond yields higher on deficit fears.

(Source: Dynamo Frontline Insights on Hedge Funds 20242)

In fact, the data above shows that investor concerns have remained unchanged over the past couple of years. A report from global private banking group LGT suggests that political views over several issues are common this time round, be it the matter of reducing deficits to hiking tariffs for goods from China or reducing lending rates to fuel growth. Of course, the measures undertaken by the two regimes could be different with Reps cutting debt by reducing welfare programs whereas the Dems may do so by hiking corporate taxes. Hedge funds may place their bets on strategies around both, as well as on cutting interest rates as lower cost of borrowing would spur economic growth. So, it would be no surprise that hedge funds would keep a hawk eye on possible monetary policy shifts.

No surprises here as the hedge fund industry has faced headwinds for nearly a decade in their efforts to generate alpha returns. Subdued volatility led to fewer trading opportunities while a near-zero interest ecosystem hindered asset price discovery processes. The industry has displayed a positive association with higher inflation, higher rates, and better fund performance. In times of low inflation, hedge funds’ absolute returns halved those achieved by the US equity markets. From March 2022, the Federal Reserve raised short-term lending rates to over 5% which should aid hedge funds in strategies revolving around derivatives and short sales. Also, higher interest rate environments could provide more stress and distress opportunities which is a large component of the event-driven hedge categories.

In the overall analysis, it would be tough to specify the route that hedge fund managers take to hedge their bets around the political shifts that would directly impact half the global population and the rest indirectly. What we can say with confidence is that the US elections would be one that has the potential to impact the global market conditions and investment strategies the most. And hedge funds would already be getting ready to prepare for volatility as well as new opportunities that a political shift can introduce. One that could impact everything from regulatory systems to market sentiments.