ESG Funds: Cautious Optimism after a Robust 2023

July 23, 2024

Top hedge funds worldwide raked in record profits in 2023 amidst a resurgence in the stock markets with the top 20 leading funds generating $67 billion in investment profits. Market data revealed that in the pre-pandemic-era rally of 2021, this figure stood at $65 billion. In 2022, these funds earned $22.4 billion, while a year later, the industry recorded gains of $218 billion post-fees. According to a report , the top 20 funds have made profits worth $755.4 billion since inception, which stood well above the figure of $655.5 billion in total managed assets, proving yet again that hedge funds invested smartly in higher-risk and more non-traditional assets than mutual funds.

These funds finished the first half of 2024 in positive performance territory, posting returns of around 5.8% through the end of June, despite the markets remaining choppy over concerns of an imminent cut in Fed rates, muddled inflation, and oscillating data around job creation in the United States. According to another report , hedge funds failed to beat the S&P 500 thus far in 2024, which climbed by 15% during the first six months. Data from Goldman Sachs indicated that hedge funds rotated out of tech stocks, especially chipmakers, in recent times, and poured the money into financial stocks, commodities, and ESG.

A Robust 2023 for Sustainable Funds

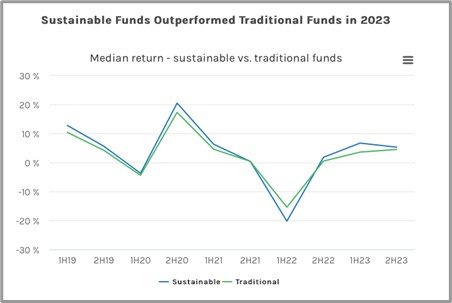

Sustainable funds outperformed several of its traditional peers across major asset classes and regions in 2023. A report from Morgan Stanley says median returns during the year

(Source: Morgan Stanley)

stood at 12.6%, which was substantially higher than the 8.6% returns of traditional funds. Though the growth came in the first six months of 2023, investor demand showed strength with assets under management growing 15% from 2022 levels to $3.4 trillion. The year saw ESG funds returning to their long-term trend of outperformance as more individual investors combined competitive financial returns alongside sustainability in their strategies.

These funds, which usually seek out growth stocks and longer-duration bonds, remained at a disadvantage for most of 2022 as turbulent market conditions resulted in value stocks and shorter fixed-income bonds becoming a priority. However, these conditions shifted in 2023 with more macroeconomic stability causing growth equities to bounce back, resulting in this asset class performing the best with median returns of 16.7% for the year compared to 14.4% realized by traditional equity funds. Sustainable fixed-income funds saw median returns of 10% as against 6.4% achieved by traditional ones. However, it must also be noted that while ESG indices did outperform non-ESG counterparts, several funds struggled to meet their respective benchmarks, largely as a result of higher rates, the poor performance of widely held ESG stocks, and a rise in the anti-ESG sentiment.

Growth Journey Continues Into 2024 As Well

Another noteworthy factor was the strong showing was limited mostly to the first half of 2023, both in terms of fund performance and AUM growth. The median returns were around 7% in the first half (as against 3.6% of peers), they underperformed in September and October before rallying over the next two months for a median return of 5.3% for the second half, a modest increase over the 4.5% returns achieved by other funds. The first six months saw AUM accounted for almost three-quarters of the $136 billion inflows, with almost 87% of it domiciled in Europe, followed by 10% in the Americas and 4% for the rest of the world. Of course, this does not mean that only European assets were in focus as funds with a global investment universe accounted for 42% of the sustainable AUM. However, funds in Europe saw inflows of $146 billion while those in North America had outflows of $13 billion, though the latter was driven more by procedural changes to some of the funds.

Over the first few months of 2024, ESG fundraising witnessed a revival according to Preqin’s ESG in Alternatives report. It noted that about $55 billion was raised by end-April with Europe accounting for a major 68% share in the activity. The fundraising was largely dominated by the infrastructure asset class, which accounted for 44% of all ESG fundraises through April and continued to challenge private equity funds for investor capital. Within this segment, renewable energy deals came to the fore with 14,995 such deals happening over ten years with a deal value of $769 billion. The report further noted that $282 billion of capital was raised by 528 ESG-themed funds over 2021 and 2022, as against only $226 billion by 629 such funds over the prior seven years.

Will The “Woke” Sector Rise Further and Account For More?

In spite of a good 2023, ESG is among the most beleaguered financial labels on Wall Street, derided as “woke” and anti-capitalist. Amidst all these negative sentiments, about 16% of the $156 billion raised by private credit funds in 2023, went into products targeting ESG goals, the biggest share since 2014. What makes this development more interesting is that it coincides with reduced loan access to green ventures that aren’t innovative enough to appeal to VCs or large enough to get the infrastructure funders. Analysts believe that this is the gap that ESG hedge funds could bridge in the next few years.

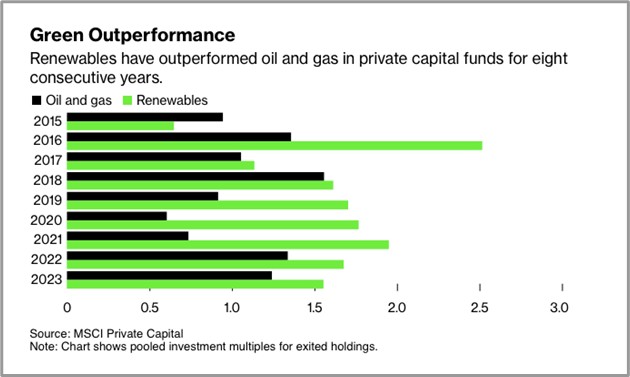

A Bloomberg report notes that in recent times private capital funds consistently made more money on renewables investments than in their holdings in oil and gas. Those that exited renewables in 2023 made 1.6 times their initial investments, compared with 1.2 times for oil and gas, making it the eighth consecutive year of outperformance (see figure below).

Source: Bloomberg

Funds are zeroing in on smaller green loans to mid-sized companies that are then packaged into portfolios for institutional investors. These players often focus on minding the contentious issues while serving markets where value is being created. The US regional banking crisis of 2023 lent a helping hand as small green ventures became fund-starved, opening up an entire fragmented and distributed industry to investors who were ready and waiting. This shift also comes on top of high interest rates and rising bank capital requirements which means that even companies seeking a transition to clean energy could be deprived of capital. Delegates attending Bloomberg’s Sustainable Finance Forum in London in June made the point that for climate solutions, providers will require small financial commitments to start delivery.

In the ultimate analysis, we can safely assume that the general weakness across ‘green’ stocks in 2023 could result in more attractive multiples over the next ten to twelve months with lower interest rates helping reduce the interest-carry for corporates and consumers, resulting in a positive tailwind for renewables. However, what could keep ESG hedge funds in play may be a result of the pro-environment governments polling poorly thus far and the possibility of a triumph in the United States too looking more than likely. This, despite Joe Biden dropping out from the race against Donald Trump. However, market analysts believe that both enterprises and political parties appear to be getting on the same page when it comes to the benefits of clean energy and the jobs it can create in their districts.