Flexing the Private Debt Muscle in Tough Times

January 31, 2023

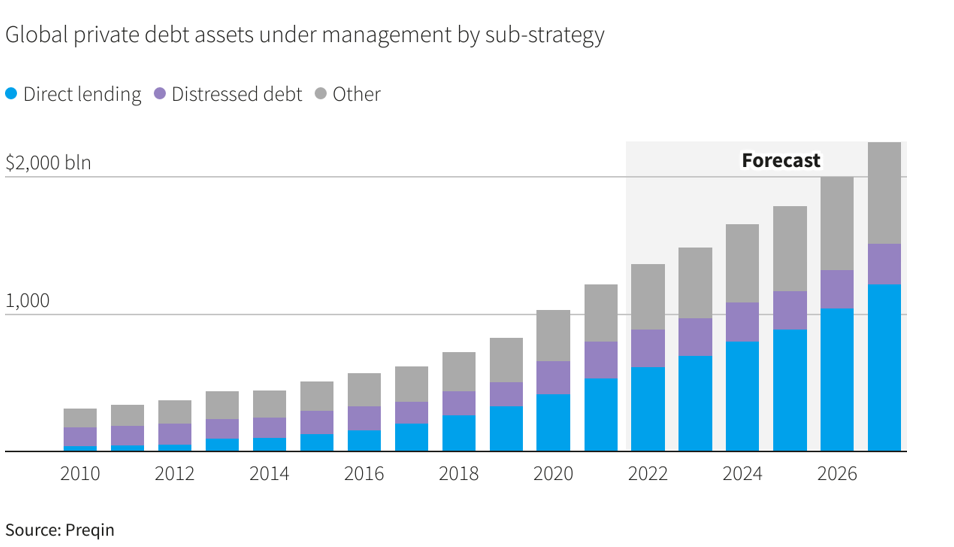

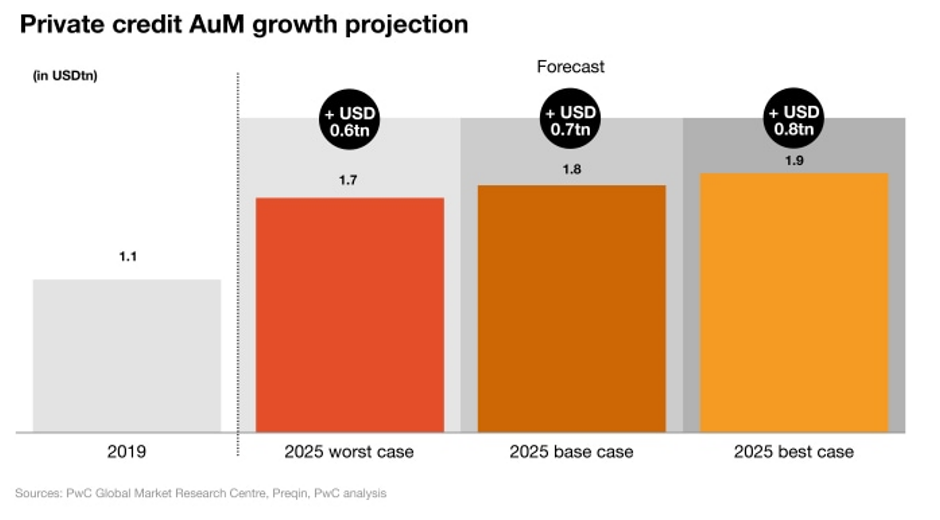

Private debt has been an opaque asset class, but it has achieved stellar growth in the past decade. Despite deceleration in deal flow and fundraising, private debt reached1 $1.4 trillion assets under management globally at the end of 2022 and is expected to reach $2.3 trillion by 2027. Spanning across a wide risk–return spectrum and portfolio goals, the private debt market has become the hunting ground for high-flying finance professionals and asset managers. They are eyeing bigger chunks of this $1.4 trillion market while ditching the classic 60/40 stock-and-bond portfolio for a diversified mix comprising 10% assets in private debt2. While war, recession, and inflation proved choppy for financial markets in 2022, these volatile events provided unique advantages to the private debt investors. These advantages include private debt’s ability to generate high contractual cashflows and robust yield premium3 (e.g., 150bps and 300bps for private senior and unitranche loans, respectively) in a volatile interest rate environment. Private debt also offers diversification to investors looking at a secure income stream. While opportunities abound, private debt investors might hit a speed bump because of the looming threat of high default rates.

Red flags for private debt investors

Experts see the rising default rate as the biggest risk4 facing investors in 2023. Although private debt provides adequate protection from inflation, if borrowers fail to service the debt burden by passing costs to customers or absorbing them, private debt investors will face losses from the surging default rates. In a move to release their bloated balance sheets after a prolonged period of on-and-off quantitative easing, central banks in Britain, Norway, Switzerland, the Euro zone, and the US have ramped interest rates. Although the global rate hike5 of an average 230 bps in 2022 is expected to weaken to less than 20 bps, reports suggest a rise in default over the next 12–15 months and a rise in speculative-grade default rate6to 3.75% by September 2023. Coupled with macro volatility, the exposure of asset managers to covenant-lite loans and relaxed underwriting practices has intensified the risk environment for the private debt investors in the high- and medium-risk sectors. This environment presents a double-edged sword. The floating rate feature of private debt has made it an attractive option, given that coupon rates are expected to increase7 with a hike in central banks’ rates, on one hand. On the other hand, the rising rates have also increased the lucrativeness of fixed-income portfolios8. In case of a protracted recession, non-accrual and problem loans may erode returns of private debt funds if they do not restructure portfolios and raise funding costs. Although the volatility may drive investors to exercise prudence when making allocations to middle-market direct lending, deal terms have shifted in favor of the lenders.

Opportunities amidst the gloom

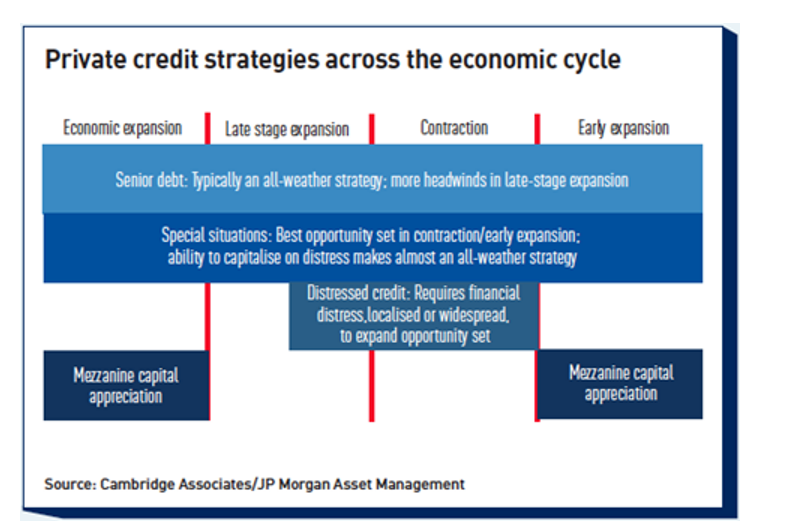

Private credit has enough dry powder that companies can access in the downturn. This is corroborated by 51% of the 61 institutional investors that participated in the 2022 EY Global Alternative Fund Survey9. Limited partners have also increased their allocations10 to private debt by 10% of their overall portfolio to generate coupon income from floating rate assets. Regionally, in Europe, bank lending cuts owing to regulatory reforms has driven companies to switch to non-banking private debt lenders. The rapid rate hike in the UK, relative to Continental Europe, has pivoted investors toward situation-driven strategies. In the US and Asia, low investor confidence in public capital has expanded opportunities for private credit deal flow11, especially involving large-cap companies. This can be partially attributed to the premiums offered by private debt, especially for opportunistic, distressed, and subordinated debts. Given this, analysts suggest investors to consider senior direct lending for benign markets and distressed and subordinated debts for challenging markets. In fact, European markets battered by war and energy crisis have been offering stressed and distressed opportunities12 wherein investors are buying bad loans at steep discounts from companies and banks facing liquidity constraints. Besides opportunistic credits, the private debt market presents varied strategies such as specialty finance, net asset value loans, and asset-backed lending. These strategies enable investors to get uncorrelated returns from a diversified portfolio, and hence protect investors from inflation and random events.

Saving grace during tumultuous times

Private debt has been persistently delivering outsized returns through the changing market conditions. Its resilience has been attributed to the floating rates insulating portfolios from market uncertainty. The lower loan-to-value ratio, widening spreads, low defaults and loss rates, and high recovery rates make private debt a saving grace during tough times. Although the risk of high default rates has shaken markets, investor selection, deal structuring, legal expertise, and contractually negotiated protections can help investors mitigate risks and borrowers tide through the economic unknowns.

End Notes

1. https://www.investmentmagazine.com.au/2022/11/private-debt-draws-investors-with-improved-structures-and-pricing/

2. https://www.bloomberg.com/news/articles/2022-12-15/kkr-calls-for-shift-to-private-credit-for-losing-60-40-portfolio#xj4y7vzkg

3. https://www.blackrock.com/institutions/en-us/literature/investor-guide/2023-private-markets-outlook.pdf

4. https://www.im.natixis.com/en-institutional/insights/what-is-the-biggest-risk-and-opportunity-for-private-debt-in-2023

5. https://seekingalpha.com/article/4570509-q1-2023-fixed-income-outlook-opportunity-amid-volatility

6. https://www.bloomberg.com/news/articles/2023-01-04/european-debt-defaults-seen-surging-in-echo-of-covid-turmoil#xj4y7vzkg

7. https://www.forbes.com/sites/chriscarosa/2022/12/24/yes-you-can-benefit-from-rising-rates-heres-how/?sh=1c61575e129b

8. https://www.marketwatch.com/story/bonds-are-back-pimco-says-as-stock-market-becomes-less-attractive-11673458360

9. https://www.ey.com/en_us/news/2022/11/ey-global-alternative-fund-survey-finds-substantial-investor-confidence-and-increasing-maturation-in-alternative-asset-management-industry?utm_source=newsletter-loannote&utm_medium=email&utm_campaign=pdi-loannote-subscriber&utm_content=21-11-2022

10. https://pitchbook.com/news/articles/2023-outlook-private-debt-direct-lending-opportunistic-credit

11. https://www.blackrock.com/institutions/en-us/literature/investor-guide/2023-private-markets-outlook.pdf

12. https://www.blackrock.com/institutions/en-us/literature/investor-guide/2023-private-markets-outlook.pdf