Generating Alpha from the Carbon Class

February 24, 2023

As per reports, more than 90% of the global GDP1 is committed to net-zero carbon emissions and other greenhouse gas (GHG) equivalents. Carbon credits and their trading have been funding this decarbonisation. Globally, carbon trading has exceeded €850 billion, and it is projected to grow at a CAGR of 21.14% during 2023–2028, matching the size of major commodity markets. A majority of the value of these credits is concentrated in the regulatory compliance markets, in which large emitters are mandated to buy permits to cover emissions exceeding their caps. In 2022, €683 billion worth of credits were traded in the world’s largest compliance market—EU’s emissions trading system (ETS). The demand for permits spurred by geopolitical events has increased the price per permit from €7 in 2017 to a €98 in 2022. There has been a quadruple increase in the number of voluntary credits, and the growing demand from corporate net-zero commitments is expected to expand the carbon market upward of $50 billion in 20302. Given this, carbon markets present unique opportunities to investors. They hedge the effect of climate policy on earnings and present in-built inflation-adjustment systems. Owing to their low correlation with other asset classes, carbon credits lower portfolio risk, and allow diversification. These features make carbon credits worth considering as an investment strategy.

Credits worthy of investments

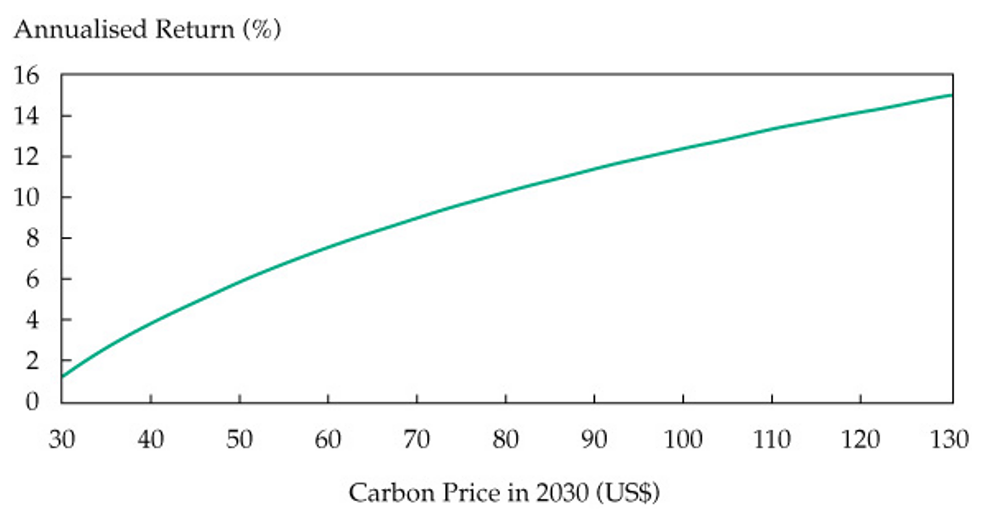

The high pricing of carbon credits presents a strong incentive to investors to switch to a sustainable future. Specifically, carbon permits touched €100 per metric ton on the European market for the first time last week, and most funds trading carbon credits futures contracts have made significant gains over the past 3 months3. The betting on carbon futures can also be attributed to their ability to provide a hedge against the investment risk arising from a switch to renewable energy. Institutional investors and hedge funds have used carbon futures to diversify portfolios, given that these credits move independently from stocks and bonds. Concerning the direct exposure to the voluntary carbon markets, investments in carbon credit futures, such as the EU allowance futures, has proven beneficial for retail investors. Relative to other futures, certain carbon credit futures have been providing meaningful exposure to the growth of the carbon markets with less risk and volatility. While the risk may be attributed to their exposure to the euro, which has been declining, the appreciation in dollar may still help carbon credits retain their hedge4. Although the hedging effectiveness of carbon futures is lower than that of commodities such as precious metals and agriculture futures, they provide better hedging and diversification performance than energy futures. Overall, carbon as an investable asset class may be attractive for long-term investors because of its high liquidity, low correlation, and risk premium. Despite its high volatility, its risk-adjusted returns have overtaken equities, bonds, and commodities. If carbon prices continue to surge, which would be critical to ensure the alignment between global emissions and Paris Agreement goals, this may lead to a forecasted risk premium of between 6–12% in 20305.

Strategies that fuel growth

For investors, both compliance and voluntary carbon markets represent one of the most important opportunities of the entire sustainability revolution. However, the carbon market may not be appealing as a single asset, and hence investors must consider it as part of a multi-asset portfolio. Investors should build diversified portfolios, wherein each building block conforms to the Paris agreement. Understanding carbon metrics6 across each asset class and combining those with forward-looking decarbonization rates will help investors to decide which asset class to replace. An emphasis on climate transition by incorporating forward-looking data can help reduce risks and seize opportunities in companies/countries well-positioned to exploit from the transition to a low-carbon economy. Investors should consider screening and employ indexes to eliminate exposure to certain segments. Factor portfolios also allow investors to consider broad and persistent return drivers. They also facilitate alignment to the Paris Agreement by systematically incorporating decarbonization standards7. In this context, investors can gain by ensuring that their allocations are in high quality portfolios that deliver significant benefits. Investors can also use alpha-seeking strategies to understand exposures that contribute to the transition and reduce emissions, thereby generating alpha.

Risks and rewards

Investors can capitalize from the growth in the global carbon market by focusing on funds with diversified holdings. These low-carbon funds will reduce investors’ exposure to dirty companies and motivate them to make green investments. Carbon can also be considered by investors when hedging against risks emerging from the stock markets. Investors with an equity market risk can hedge their positions using carbon futures. While futures hold risks, most carbon funds have been witnessing an upward price performance. This provides a good reference for investors planning to wet their feet in carbon trading.

End Notes

1. https://www.lombardodier.com/contents/corporate-news/ft-rethink/2023/february/carbon-markets-the-emerging-asse.html

2. https://www.lombardodier.com/contents/corporate-news/ft-rethink/2023/february/carbon-markets-the-emerging-asse.html

3. https://www.barrons.com/articles/eu-carbon-price-milestone-how-to-invest-481ffdb2

4. https://carboncredits.com/carbon-credit-futures-how-does-it-work/

5. https://jai.pm-research.com/content/early/2022/06/11/jai.2022.1.166#:~:text=We%20calculate%20a%20forward%2Dlooking,and%20climate%20change%20policy%20objectives.

6. https://www.blackrock.com/institutions/en-us/insights/investment-actions/multi-asset-approach-net-zero

7. https://www.blackrock.com/institutions/en-us/insights/investment-actions/multi-asset-approach-net-zero