Global Copper Prices tied to EV and AI-led Innovations

April 28, 2024

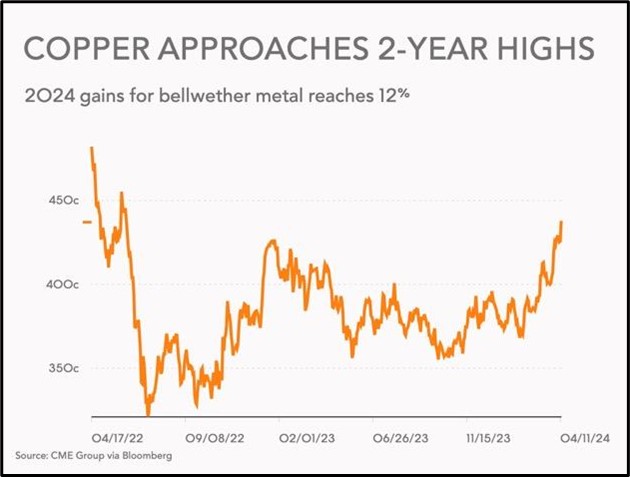

Global copper prices appear poised for a smart spike over the next few years that could take its global market size to $504.93 billion by 2033 from $308.67 billion in 2023, growing at a CAGR of over 5%1. Early tailwinds are already visible in the form of mining supply disruptions amidst growing demand from electric vehicle makers and the growth in data center operations required to fire up the AI boom. Copper touched levels last breached in early June 2022 with prices crossing $9690 per ton in the third week of April. While a demand spurt from the fast-growing EV market and the growth of data center business worldwide in preparation for AI-led technology innovations was expected, what added to the positive sentiment were reports of Chinese smelters cutting output by as much as 10% to curb overcapacity following several years of relentless expansion.

Source: Bloomberg2

While there is consensus that copper is headed for a bull run over the next five to six years, the latest spurt can be ascribed to the closure of a massive mining operation in the Panamanian jungles. The mines were shut down following massive protests, and the outcome is that 1.5% of the global copper supply has since ceased2. At a time of widening supply-demand imbalances caused by rapid spike in green energy projects and more people buying electric vehicles, this closure puts to nought production of five million EVs per year – that’s how much copper was mined from Panama. Market analysts have forecast copper supply to grow at just 0.7% as against the previous forecast of 2.3% at the end of 2023.

While spot prices climbed nearly 12% in 2024, the futures, which had appeared bleak at the start of the year, are now rebounding by close to 13% during this period and not without reason. On top of the closure of Panama’s Cobre mines, came reports of a further sanction on Russian copper by the United States and the United Kingdom. These sanctions are intended to squeeze the revenue streams from metal exports by Russian companies. Starting April 13, the US and the UK barred the London Metal Exchange (LME) from accepting new Russian production of metals such as copper, nickel, and aluminum. These trends led Bank of America to state unequivocally that a “copper supply crisis” was on. In a note, the bank said, “[T]ight copper mine supply is increasingly constraining refined production: the much-discussed lack of mine projects is finally starting to bite,” The economic-bellwether commodity could hit $5.44 a pound by 2026, representing a 27% upside from its current prices.

The Growing Chinese Copper Challenge

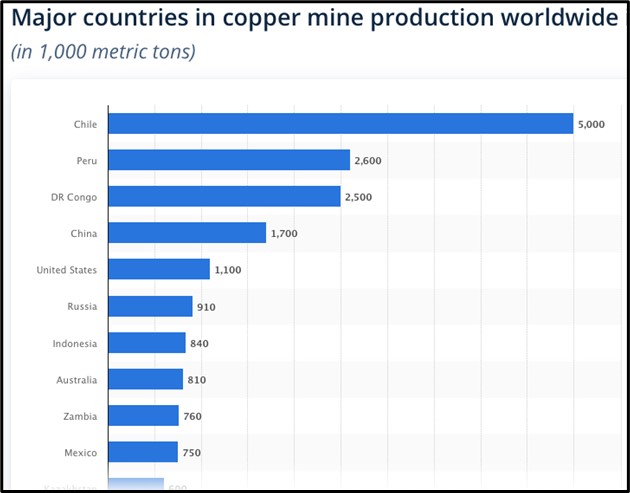

While a large majority of copper production comes from Chile and Peru in South America and Congo in Central America (see image below), the consumption patterns being witnessed in China and the United States could well define future price movements. Being the world’s largest producer and consumer of copper materials, China is utilizing this abundance to its advantage in construction, electronics, and the electric vehicles industry. On the one hand, satellite data indicates smelter inactivity in China rising on an average of 8.5% in the first quarter of 2024 compared to 4.1% a year ago, while on the other, their smelters are starved for the metal where concentrate cargos are being acquired at lower than usual treatment charges.

The Shanghai Metals Markets estimates that China produced 26 million tons of semi-wrought copper and copper alloys in March despite operating rates dropping by over 69%. The country imported more than half the world’s refined copper output of 27 million tons in 2023. In the first quarter of 2024, it imported 1.38 million tons of unwrought copper, a near 7% spike over the previous year while copper concentrate imports stood at 2.3 million tons in the same period, a 15.3% spike over 2023 numbers.

(Source: Statista)

In Conclusion

Overall, one can say that the growing demand for green energy transition and a declining US dollar could further support copper. Copper prices on the LME touched an all-time high of $10,730 per ton last March and analysts are predicting that they could soar by as much as 75% over the next two years. With 60 signatories backing a plan presented at the recent COP28 climate change conference to triple global renewable energy capacity by 2030, copper demand should further spike. In fact, Bank of America Securities forecast4 higher renewable energy targets could boost copper demand by an extra 4.2 million tons by 2030, which could send prices to 15,000 a ton by 2025.