Global Oil – Contradicting signals send prices into a tizzy

August 24, 2024

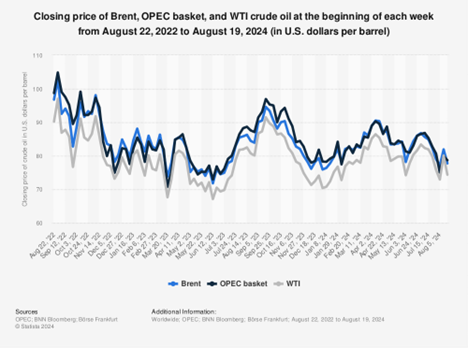

Global oil prices gyrated to recent conflicting economic cues from China and the United States. Prices dropped below $75 a barrel despite an overall spike in demand by 870,000 barrels per day in the second quarter of 2024, as a contraction in China limited further gains. The nervousness came through when Brent Crude gained 2% on August 15 over positive cues from the US only to shed them within twenty-four hours as investors tempered expectations of demand from China, the world’s top oil importer. Prices remained little changed over the first couple of weeks in August (closing at $79.68 a barrel for Brent Crude). Most of the market commentaries centered around two factors:

Market commentary around the recent gyrations revolved around a few points, chiefly the anticipated growth in demand from Western countries over the second half of 2024 and the deterioration in China’s economic growth outlook. The overall global economic well being presented mixed signals such as Japan’s recent interest rate hike and the recent positive macroeconomic data from the US. Into this mix, the persistent geopolitical tensions in the Middle East and Ukraine added further fuel, amidst OPEC+ cuts further tightening the market. While demand reduced, but not to cause panic, so did supply in the wake of production cuts.

Source: Statista

Traders believe that the green shoots of growth emerging from the US might not offset the slump in demand from the world’s top importer of crude, given that Chinese refineries have sharply cut crude processing rates in July over tepid fuel demand. Right on cue, the OPEC+ cut its forecast for oil demand growth in 2024 as did the Paris-based International Energy Agency (IEA), which felt that demand could remain sluggish in 2025 as well.

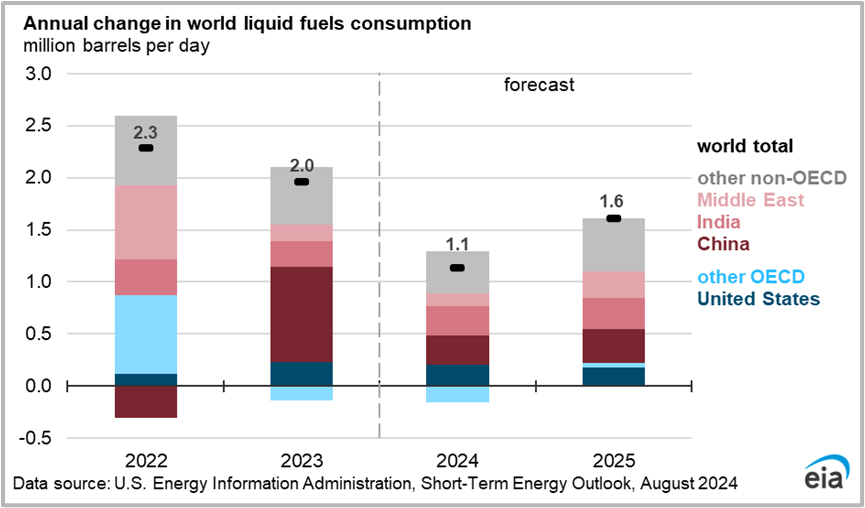

Demand Has Dropped, But Only Compared to 2023

The OPEC group and the IEA cut their respective forecasts for oil demand growth over the softness in China, with the latter even slashing growth potential for the whole of 2025. At the time of writing this post, Brent crude futures had settled up $1.28 (1.6%) at $81.04 a barrel while US West Texas Intermediate crude futures rose $1.18 (1.53%) to $78.16. As mentioned earlier, the second quarter of 2024 did show growth in oil demand with future growth expectations getting tempered to about a million barrels per day – both in the second half of 2024 as well as through 2025. In comparison, growth during 2023 logged in about 2.1 million barrels a day. Analysts argue that the markets could have overreacted to the decline in the pace of growth now.

The IEA, which advises industrialized countries, noted that weak growth in China, following the post-Covid surge of 2023, is significantly dragging on global gains. So, the post-pandemic bounce from China is what has faded away now, while the rest of the parameters indicate positive signs. For starters, IEA expects demand to strengthen from Western economies, especially the United States, which consumes one-third of the global supply of gasoline. It predicts a strong summer driving season in the US with supply-side cuts by OPEC+ further tightening the market to shore up prices. “For now, supply is struggling to keep pace with peak summer demand, tipping the market into a deficit,” IEA says , while predicting demand to rise by 950,000 barrels per day in 2025, which however is 30,000 bpd lower than forecast earlier.

Is a Short-Term Production Cut Unlikely?

On its part, OPEC too reduced its expectations of global demand growth, albeit for the first time since July 2023. While the reasons were similar to those proffered by the IEA, these numbers further highlighted the dilemma faced by the wider OPEC+ group over raising output from October. That it scaled down growth projections for 2024 from 2.25 million bpd to 2.11 million bpd in its latest report indicates the split in demand forecasts over differences around China’s slowdown on the one hand and the transition to cleaner fuels on the other.

However, OPEC’s estimates are obviously higher than market estimates and those of IEA, which raises the moot question of whether the larger OPEC+ grouping would actually go ahead with their plans (announced on August 1, 2024) to unwind recent layers of cuts of 2.2 million bpd from October. The group has implemented a 5.86 million bpd output reduction (about 5.7% of global demand) since 2022 to bolster the market. In a statement after the OPEC+ (which includes Russia) meeting, the group said the most recent voluntary cut of 2.2 million bpd proposed till September could be phased out, paused, or reversed, based on conditions.

The Chinese slump could play a part in the short term. Slower offtake of oil and other commodities in recent weeks suggests that a turnaround in the economy is taking more time than expected. There is also the slump in demand for retail housing that is further indicative of a slump. Analysts held the view that oil demand growth for the first seven months from the US and China failed to meet expectations, with the fading of renewed recession fears that led to a global stock and bond sell-off earlier in August, seems to become the silver lining now. Both OPEC and IEA expect second-half demand to correct in the weeks ahead. This is a distinct possibility given that the second half is the period of highest consumption as it includes peak driving season, Northern Hemisphere harvest and purchases to prepare for the winter. Analysts believe that demand should touch 2.3 million bpd for its full-year estimates to fructify in toto.

Will Prices Go North or South? Or Stay Static?

Over the medium term, global oil demand appears to be headed towards a stable one million barrels per day, with a meaningful shift in the drivers now becoming apparent. Chinese demand has slumped for four consecutive months amidst lower industrial inputs, including those for the petrochemical sector. However, this was considerably offset by higher demand from the developed economies, especially the United States. We saw these numbers have an impact on the OECD oil consumption data which shifted from a 300,000 bpd annual contraction in the first quarter of 2024 to a 190,000 bpd growth in the second quarter.

Source: EIA

That the OPEC+ still taking a wait-and-watch approach to unwinding their voluntary production cuts isn’t surprising. IEA data indicates that global inventories could build by an average 860,000 bpd next year in case non-OPEC+ supplies increase by around 1.5 million bpd in 2024 and again in 2025. This would easily cover the expected demand growth, and it is worth mentioning that the Americas quartet – US, Guyana, Canada, and Brazil – could account for three-quarters of the non-OPEC+ supply gains in each of these two years.

Supply struggled to keep abreast of peak demand and tipped the market into a deficit now, resulting in global inventories taking a hit. In June, they fell by 26.2 million barrels with crude oil stocks dropping by 40.9 million barrels despite the Chinese building up inventories. We are also witnessing a spike in oil products by 14.8 million barrels, supported by large build-ups in the US LPG market. This trend continued in June and July where total crude inventory stocks lost ground to oil products, leading to a squeeze in refinery margins that could potentially result in an upset and shift in refinery activity over the coming months. Given these contrarian scenarios, oil prices may revolve around $80-$85 per barrel in the coming months.