Global Oil Markets: Oscillating between Sluggish Demand and Geopolitical Crises

April 30, 2024

Global oil markets have been on a razor’s edge since the Russia-Ukraine conflict began in February 2022 and the Israel-Palestine conflict. Market experts are predicting a return to the $100 dollars plus per barrel days, last seen in March 2022. While the economic slowdown in the US and China and the resultant demand slump for crude kept prices in check, the better-than-expected manufacturing purchasing managers’ indices (PMI) from these two countries could contribute to a positive oil sentiment. Investors in these countries and India (the world’s third largest consumer) are betting on heightened demand for oil in the manufacturing and industrial sectors during the second half of 2024.

A news report1 quoted Russel Hardy, CEO of energy and commodity company Vitol, to suggest that spot crude prices could surge past $100 a barrel later in 2024 if the OPEC continues its production discipline and withholds crude from the global markets. The OPEC+ group had voluntarily implemented production cuts, removing around 5 million barrels per day to support oil prices for over five months over concerns of a global economic meltdown.

Markets expect oil prices to touch $100 a barrel

The latest surge in oil prices, which represents an increase of almost 20% since the start of 2024, took the commodity to $91 a barrel, fueled both by the widening conflict in the Middle East as well as the spike in expectations of robust economic fundamentals in the United States. In spite of the delays in rate cuts by the US Fed over higher-than-expected inflation numbers in March, strong retail growth raising hopes of better-than-anticipated industrial demand is another factor pushing up global oil prices, given its importance in the manufacturing and transportation industries.

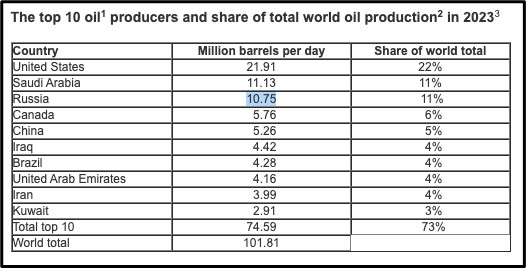

On the production side, besides the OPEC bloc, the major production avenues are the United States, Russia, and Canada with China and Brazil accounting for a much smaller share (around 4% each) of the global crude oil bucket. The production numbers from the top-10 sources are listed below:

(Source: US Energy Information Administration2)

China, India could lead the global oil demand spurt

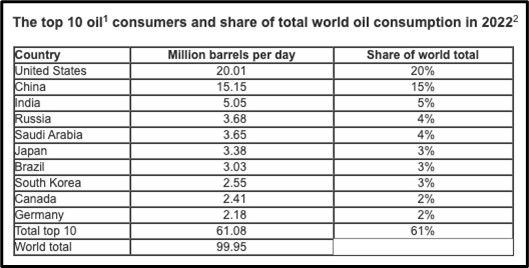

On the other hand, consumption patterns emerging at the moment indicate that the key growth drivers could be robust demand from China and India, which are the second and third largest consumers of crude in the world (see figure).

(Source: US EIA)

Market analysts are predicting global oil demand to touch around 1.9 billion barrels per day, which is around the levels it stayed at during 2023. However, a resurgence in the air travel industry in the first quarter of 2024 could well add to this demand, especially in the latter months. Overall sentiments, especially in the futures, remain bullish as seen by the purchase of $140 million barrels equivalent contracts in the six most important contracts, which incidentally was the fastest pace of completion in this segment in over four years.

What could change in the next couple of years

Expectations of market movements over the next 12 to 18 months are diverse. While the International Energy Association (IEA) sees oil demand at around the 1.2 million barrels a day mark, OPEC puts this number at 2.25 billion in 2024 and 1.8 million barrels in 2025. Production in March rose to 26.604 million barrels a day as against 26.601 million barrels in February. Saudi Arabia (9.04 million bpd) and Iran (3.19 million bpd) were the key contributors to this growth, which OPEC said required careful monitoring in the summer months amidst global economic cues.

Given this scenario, it is quite obvious that In the short to medium term, a lot would depend on how the OPEC+ grouping goes forward. If they continue with the production cuts amidst rising global tensions, prices could breach the $100 barrier and head further north. However, if they decide to call off the squeeze over global economic cues from the US, China and India, that are indicative of higher consumption, crude prices could ease up and return to the $80-$85 per barrel levels.

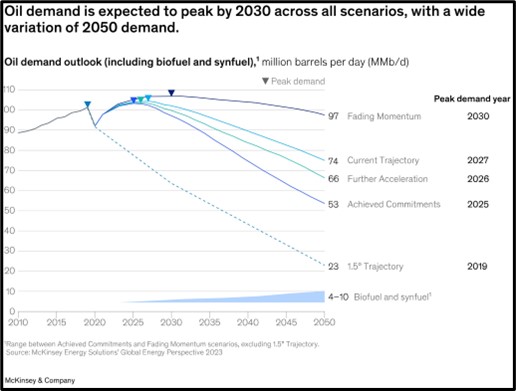

Source: McKinsey & Company3

Transition Woes

This brings us to the wide variation in the numbers quoted by the IEA. Analysts said the lower demand forecast has its origins in the sluggish economic growth witnessed for the whole of 2023 as well as the rising demand for electric vehicles. A Mckinsey report released early in January has predicted that oil demand, which slowed down in 2023, will continue to do so from here on till 2030, which is when it hopes the energy transition will actually kick in (see figure).

In conclusion:

At this point, it is difficult to predict the path that oil prices would take over the next 12 to 18 months, given that producers find themselves in a bind over reducing prices to fulfill the expected spike in demand. Given the spending growth, the US could witness inflationary pressures which then would keep the Fed from meeting its target of 2% rate of price rise – a precondition that it had laid out for cutting interest rates. In such a scenario, credit demand could falter and impact manufacturing and curtail energy demand. Therefore, it is safe to say that the global oil markets are facing a Catch-22 situation – one where production cuts would have to go first before normalcy returns.

Already there are signs that the markets could respond to the dollar index breaching the 105 threshold, a factor that exerts additional pressure on crude prices. Additionally, the escalation of tensions in the Middle East following Iran’s actions could be just the factor required to support crude prices at lower levels.