Global Wealth Management in Times of Fear, Uncertainty, and Doubt

January 3, 2025

The global economy has entered an era characterized by volatility and unpredictability. Geopolitical tensions, rapid technological change, and shifting macroeconomic trends have created an atmosphere of fear, uncertainty, and doubt (FUD) among investors. Yet, amidst this chaos, wealth management has emerged as a crucial strategy for navigating turbulent waters and securing financial stability. This blog explores the importance of global wealth management in 2025, supported by data and insights, and highlights how it remains a prudent and rewarding investment approach.

The Current Landscape of Uncertainty

2025 presents a complex investment environment. Persistent inflationary pressures, central bank rate hikes, and geopolitical disruptions have left markets oscillating. For instance:

•Inflation and Interest Rates: Global inflation remains stubbornly high, with the IMF projecting an average global inflation rate of 6% in 2025 (IMF World Economic Outlook, April 2025). Central banks have responded by raising interest rates, further tightening financial conditions.

•Geopolitical Risks: Conflicts in Eastern Europe, trade tensions between major economies, and resource scarcity have exacerbated market volatility. According to a 2025 World Bank report, these geopolitical risks could shave off up to 0.5% of global GDP growth annually.

•Technological Disruption: AI, blockchain, and other innovations are reshaping industries, creating both opportunities and challenges for investors.

Such an environment underscores the need for strategic, diversified financial planning—a hallmark of professional wealth management.

What is Wealth Management?

Wealth management involves a comprehensive approach to managing an individual’s or family’s financial assets, focusing on long-term growth, preservation, and legacy planning. It encompasses various services, including:

•Investment Management: Tailored strategies for portfolio diversification and growth.

•Financial Planning: Addressing short- and long-term financial goals.

•Estate and Legacy Planning: Ensuring wealth preservation for future generations.

•Tax Optimization: Structuring investments to minimize tax liabilities.

Wealth management firms bring expertise, data-driven insights, and a holistic view of an individual’s financial landscape, making them indispensable in times of uncertainty.

Why Wealth Management Matters in 2025

1. Strategic Diversification

One of the key principles of wealth management is diversification—spreading investments across asset classes, sectors, and geographies to reduce risk. In 2025, diversification is more critical than ever:

•Asset Class Performance: According to JP Morgan’s 2025 Market Outlook , equities are expected to deliver modest returns (4%-6%), while bonds regain attractiveness with yields ranging from 3%-5% amid higher interest rates. Alternatives like real estate and private equity offer potential upside but require expert navigation.

•Geographic Allocation: Emerging markets like India and Southeast Asia show robust growth prospects, with GDP growth rates exceeding 6%, according to the World Economic Forum . Wealth managers can help identify opportunities in these regions while managing associated risks.

Diversification, guided by wealth management professionals, ensures a balanced portfolio that can withstand market shocks.

2. Emotional Discipline

Fear and greed often drive poor investment decisions during turbulent times. A study by Vanguard revealed that 40% of the value an advisor provides their clients is emotional. Wealth managers act as a stabilizing force, offering rational, data-backed advice to keep investors focused on long-term goals.

For example, during the market sell-off in early 2025, wealth managers advised clients to stay invested rather than panic-sell. This approach helped many investors participate in the subsequent recovery, underscoring the value of professional guidance.

3. Tax Efficiency

In a high-inflation, high-interest-rate environment, tax efficiency becomes paramount. Wealth managers employ strategies like tax-loss harvesting, asset location optimization, and charitable giving to reduce tax burdens.

4. Legacy and Estate Planning

Uncertainty often prompts individuals to reassess their long-term goals, including wealth transfer to future generations. Wealth managers provide critical support in:

•Estate Structuring: Utilizing trusts and wills to minimize inheritance taxes.

•Philanthropy: Establishing charitable foundations to leave a lasting legacy.

In 2025, with estate taxes increasing in several jurisdictions, wealth managers play a vital role in safeguarding intergenerational wealth.

Data-Driven Decision Making

Modern wealth management is increasingly powered by data and technology. Firms leverage advanced tools for:

•Risk Assessment: AI models predict potential risks, enabling proactive portfolio adjustments.

•Market Insights: Real-time data analysis identifies emerging trends and opportunities.

•Customized Solutions: Technology facilitates highly personalized investment strategies.

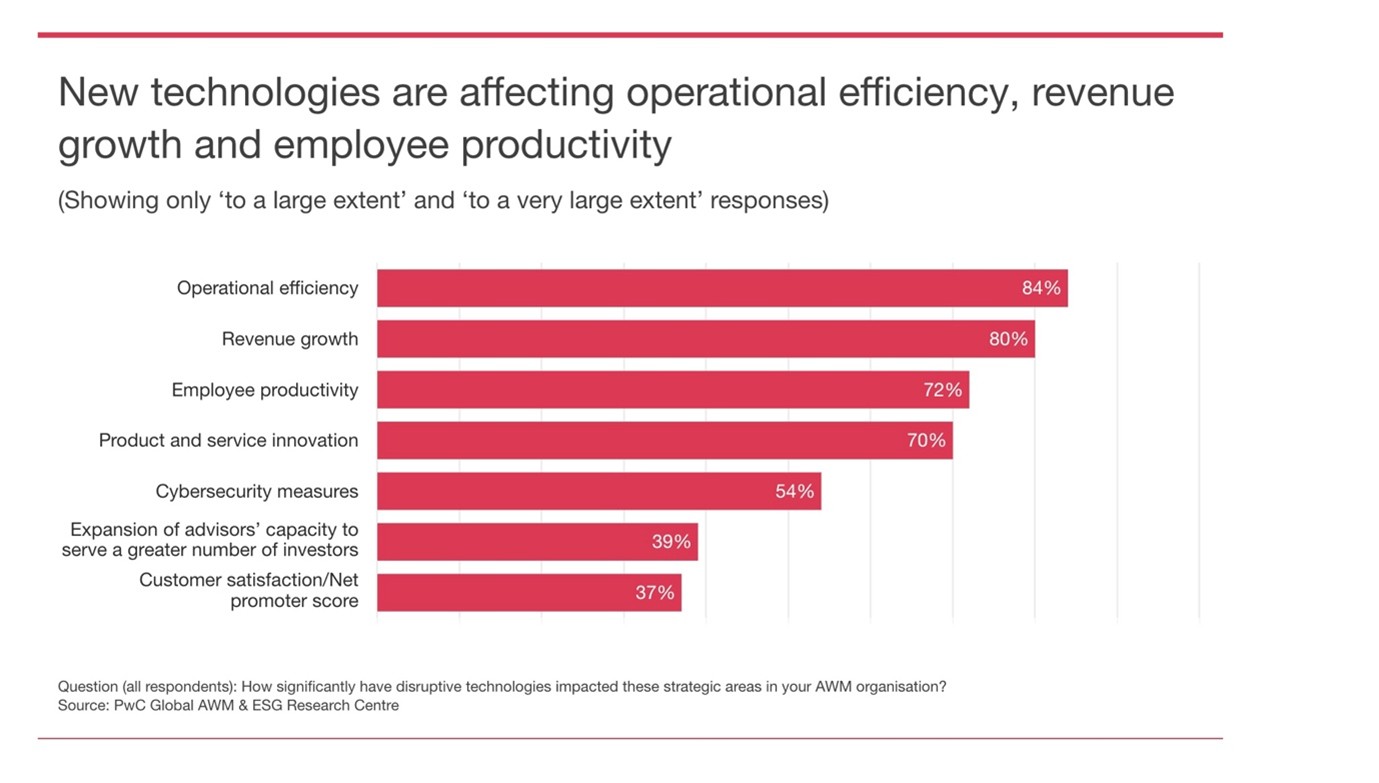

Recently, PwC, conducted a survey to gauge how significantly disruptive technologies have impacted strategic areas in an AWM organization.

Source: PwC Global

Some of the use cases in Wealth Management could be:

1. Navigating the 2022-2025 Volatility

A mid-sized business owner working with concerns about preserving capital amid inflation with a wealth management firm with concerns about preserving capital amid inflation. By introducing a mix of inflation-protected bonds, global equities, and alternative investments—there could be a growth outpacing inflation.

2. Planning for Generational Wealth

The second use case could be that of a high-net-worth family engaging a wealth manager to develop a multi-generational plan. Through strategic estate planning, the family could plan for reduction of estate taxes while ensuring philanthropic goals were met via a donor-advised fund.

The Outlook for Wealth Management in 2025

Wealth management’s importance is set to grow as markets remain unpredictable. Key trends shaping the industry include:

•Sustainable Investing: ESG (Environmental, Social, and Governance) investing continues to attract attention, with global ESG assets projected to exceed $50 trillion by 2025, according to Bloomberg.

•Digital Transformation: Technology is enhancing client experiences through robo-advisors, mobile platforms, and AI-driven insights.

•Globalization: Wealth management firms are expanding their reach, helping clients access opportunities in emerging markets and alternative investments.

Why Wealth Management is a Smart Choice

Investing in professional wealth management is not just about growing wealth—it’s about peace of mind. Key benefits include:

1.Expertise: Access to seasoned professionals who understand complex market dynamics.

2.Customization: Tailored strategies aligned with individual goals and risk tolerances.

3.Holistic Approach: Comprehensive solutions encompassing investments, taxes, and estate planning.

4.Resilience: Proven ability to navigate crises and deliver consistent returns.

In an era marked by fear, uncertainty, and doubt, wealth management offers a beacon of stability and foresight. By leveraging expert guidance, diversified strategies, and advanced technology, investors can safeguard their financial futures while capitalizing on emerging opportunities.

As we move further into 2025, the value of wealth management will only increase, empowering individuals and families to achieve their financial goals amid an ever-changing landscape. Whether you are a seasoned investor or just beginning your journey, partnering with a trusted wealth management firm is a prudent step toward long-term prosperity.