Gold, Silver sees headroom for further hardening

April 18, 2024

Prices of precious metals – specifically gold and silver – have pushed higher in recent weeks amidst expectations of a Fed rate cut that could potentially weaken the US dollar. Weak economic data and jitters around the banking industry saw a straight 5% spike in bullion prices across just four trading sessions in the first week of March, topping a previous high achieved in December. However, the yellow metal breached $2,300 in April 20241, sailing past the previous $2,150 level from March.

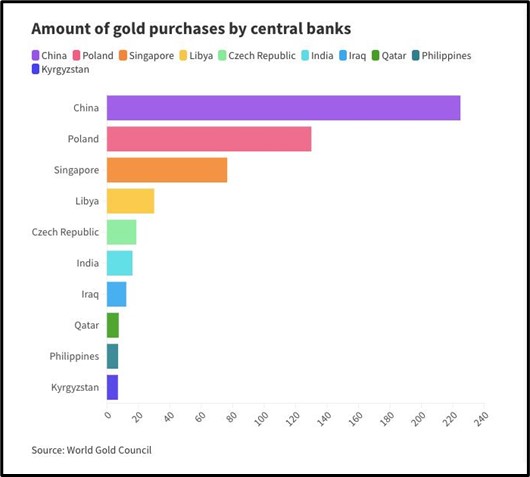

Market analysts believe that gold prices have some more headroom for growth during 2024, bolstered by the sustained purchases by central banks (See figure below).

Image via Sahm Capital2

Moreover, the US Federal Reserve leaving the rates unchanged yet again only rekindles hope of a recovering economy that could see rates being cut in the second half of the year. Given that gold prices tend to share an inverse relationship with interest rates, it could become more appealing compared to fixed-income assets such as bonds that yield lower returns when the rates decline. They also note that physical purchases of gold in recent times have also given the yellow metal a lift with strategists attributing a $100 spike in prices to significant futures buying. The World Gold Council said central banks, which bought historic levels of gold over the past two years, resulted in prices hardening even in a high interest rate regime and a strong dollar.

Another factor that could push gold prices up further is the strong physical demand that is fuelled by its appeal as a safe haven amidst geopolitical uncertainties. Take the case of Russia and China which have been the two largest buyers, both at central bank levels as well as in consumer demand. China was the largest buyer of gold in 2023 as the country battled weak economic growth caused by an embattled real estate sector. Poland too snapped up gold to offset any economic instability amidst the Russia-Ukraine war next door. To add to this spurt in central bank purchases, gold prices also hardened due to retail purchases as investors in China, India, and Turkey sought to diversify from other asset classes.

While China overtook India to become the world’s largest gold jewelry buyer in 2023 with consumers acquiring 603 tons (a 10% spike over 2022), India saw consumption dipping by 6% to 562.3 tons during the period though investments in gold bars and coins grew 7%, with the RBI purchasing 8.7 tons of gold in January – its highest purchase since July 2022. Given these numbers, the WGC said Turkey too doubled its gold demand amidst unrelenting consumer inflation, limited availability of alternative investments, and domestic political uncertainty during the presidential elections last year.

Given that most of the economic and political dynamics could well change in 2024, where does it leave gold? A poll conducted by Reuters last October said gold prices will average $1986.5 through the year – a number that already looks out of whack with the current price of $2351.3 (as of the week ending April 12, 20243). On its part, the WGC had projected a drop of 40 to 50 basis points in longer maturity yields to coincide with a 75 to 100 points cut in interest rates. While we await movement from the US Fed, the conflict in the Middle East and some uncertainties around elections in the US and India could act as tailwinds for gold for the rest of 2024. While it may unwind some of the sharp gains, should central banks slow down their purchases amidst lowering rates, the geopolitical tensions and global growth concerns could result in the yellow metal sustaining its sheen through 2024 and beyond.

While gold seems destined for a longer run, does silver also command the same sentiment in the markets? Opinion appears to be divided as some experts quote historical evidence to suggest that when the gold-to-silver ratio enters the 80 to 100x range, a rally is imminent for the white metal. They argue that such a ratio is a stretch indicator that suggests silver to be extremely undervalued in relation to gold. Others note that silver’s fate could be determined by scenarios beyond those that caused gold prices to harden over the past year. Prices could harden if industrial demand increases, especially in electronics, solar energy, automotives, and healthcare. Analysts believe that silver prices seem to be benefiting now due to a revival in industrial demand and not inflation. And its lower valuation compared to gold could make silver more attractive to investors even when inflation does cool off and the Fed rate cuts start to kick in. There could even be a scenario in the short term where silver could outperform gold in a growing economy where inflation is under check.