Gold’s $4,000 Milestone: The Enduring Safe-Haven Thesis in a Fragmented World

November 30, 2025

Gold has always held a special status in human history, serving as a medium of exchange, a store of value, and, crucially, a reliable hedge against chaos. As the world navigates escalating geopolitical friction, persistent inflation concerns, and a fundamental loss of faith in debt-driven financial systems, the price of gold is not just rising-it’s reflecting a structural shift in global asset allocation.

The recent, sustained multi-year rally, which has pushed the yellow metal beyond the symbolic $4,000 milestone, is not a speculative testosterone-induced spike. It is a calculated move driven by two powerful, long-term forces: central bank diversification and a deep-seated investor retreat from conventional sovereign debt and fiat currencies. This is the enduring safe-haven thesis playing out in a world increasingly defined by political fragmentation.

The Foundation of the Rally: Central Bank Buying Spree

The most significant and underreported factor driving the gold rally is the unprecedented buying volume from central banks, particularly those in the Global South and emerging markets. These institutions are no longer solely focused on managing domestic monetary policy; they are actively diversifying their national reserves away from the U.S. dollar.

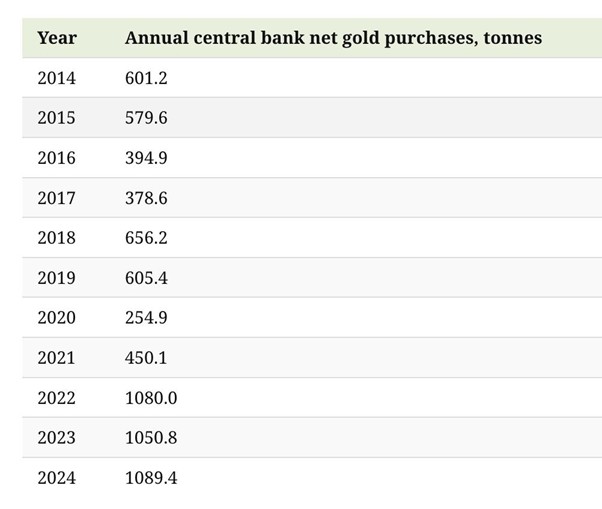

Source: VisualCapitalist1

It is interesting to note that from 2014 to 2016, central banks bought 1,575.7 tons. From 2022 to 2024, they purchased 3,220.2 tons, doubling purchases from nearly a decade earlier.

De-Dollarization and Geopolitical Hedging

In the wake of various sanctions and the weaponization of the dollar-denominated financial system, many nations are re-evaluating the risk of holding vast reserves in U.S. Treasuries. Gold, as a universally accepted, non-sovereign, and non-confiscatable asset, offers a vital escape route.

According to data from the World Gold Council2, central bank net purchases have reached historic highs over the past few years. This acquisition is not about short-term trading; it’s a strategic, multi-decade rotation aimed at reducing geopolitical exposure. Countries seeking greater economic sovereignty view gold as the ultimate insurance policy against a fragmented global order.

This demand creates a structural “floor” for gold’s price. Unlike speculative investment demand, central bank buying is sticky, price-insensitive, and motivated by national security, ensuring sustained upward pressure on the price irrespective of short-term interest rate movements.

Erosion of Confidence: The Debt-Driven Crisis

The second pillar of the $4,000 thesis is the profound and fundamental erosion of confidence in the global financial system itself. This loss of faith manifests in two key areas: sovereign debt and fiat currencies.

The Sovereign Debt Bomb

Global sovereign debt levels have soared to historic, peacetime highs. The sheer volume of this debt raises existential questions about its ultimate solvability, particularly as debt-servicing costs rise due to higher interest rates. Investors-both institutional and retail-are rightly concerned that governments, faced with a binary choice between default and inflation, will choose the latter.

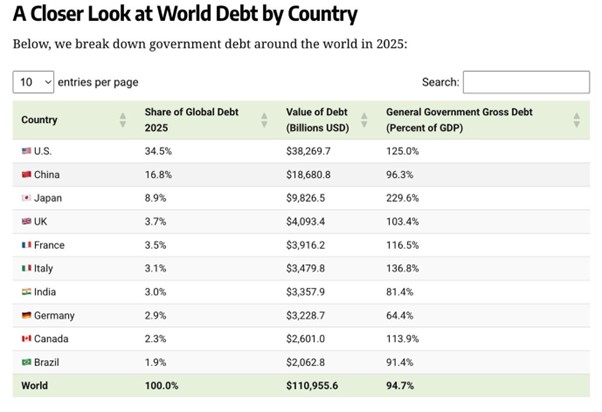

Source: Visual Capitalist3

As a result, the Fiat currency is facing a crisis of trust. Global public debt is currently US$111 trillion, with the top 5 economies accounting for over two-thirds of that total. A very high debt level, and consequently a high debt-to-GDP ratio, can lead to inflation, a slow, insidious form of default that erodes the purchasing power of money held in bonds or cash. Gold is the traditional antidote to this monetary debasement. When fiat currencies are viewed as instruments of endless, necessary dilution, gold, which cannot be printed, digitized, or manipulated by any single government, becomes the only accurate measure of wealth preservation.

Political Turmoil as a Catalyst

Political uncertainty acts as a turbocharger for the gold rally. From regional conflicts and the breakdown of established global trade blocs to heightened political polarization within major economies, volatility is now the norm.

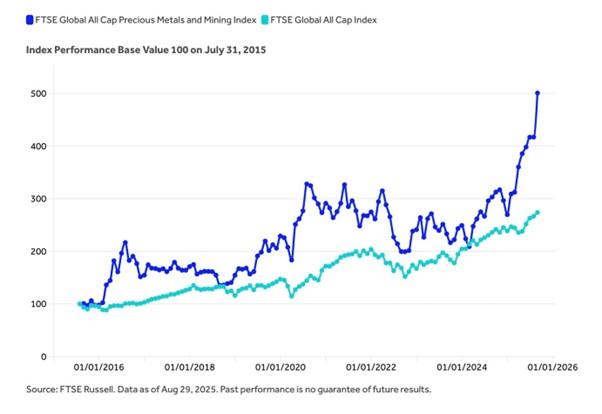

As we have seen in 2025, the safe-haven appeal of gold is directly proportional to global instability. When complex political risks emerge, investors seek simplicity and reliability. This flight to gold is evidenced by significant inflows into gold-backed exchange-traded funds (ETFs) and direct physical purchases during periods of intense geopolitical stress. Gold’s lack of a counterparty risk-it is not someone else’s liability-makes it the preferred asset when trust in institutions is at its nadir. As of the end of August 2025, the FTSE Global All Cap Precious Metals and Mining Index was up 86% in the year to date, outperforming our flagship global equity benchmark, the FTSE Global All Cap Index, by over 70%.

Source: LSEG4

Silver: The High-Beta Hedge

While gold captures the headlines, its industrial counterpart, silver, often serves as a “high-beta” play on the same macro themes. Silver, with its dual role as a precious metal and a vital industrial commodity (essential in solar panels and electric vehicles), tends to track gold’s movements but with amplified volatility.

The gold-silver ratio analysis provides an additional analytical perspective, with current ratios around 80:1 suggesting silver remains undervalued relative to historical norms. A ratio normalized to 50:1 or lower could drive silver prices substantially higher, regardless of gold’s absolute performance, as the gold-to-silver ratio compresses a typical signal that a sustained precious metals bull market is maturing-silver often plays catch-up. Its lower price and higher percentage moves make it an attractive hedge for those anticipating not only financial instability but also a long-term, inflation-driven surge in industrial commodity prices.

Is This A New Era for Gold (And Silver)?

2025 has witnessed structural changes across all the determinant metrics. The geopolitical shocks brought about due to conflicts in Europe, Tariff uncertainties from the US, and the resultant nationalistic economic shifts by major economies and/or economic affiliations, sticky inflation, and a thematic shift in global economics – from efficiency to security – have led to erosion of faith in fiat currencies and a need to hedge for the imponderables. The path to the $4,000 milestone is not paved by temporary panic, but by permanent structural changes. According to a World Gold Council/YouGov survey of central banks5, 95 % the respondents indicated that the Central Bank’s reserves would grow in 2025, suggesting that the sustained gold rally is a clear, unambiguous signal that the established financial architecture, built on unquestioned faith in sovereign debt and the dollar’s supremacy under historic duress. Similarly, silver’s journey to nominal all-time highs around $54 represents the most significant technical breakthrough in silver markets since the 2011 peak. Market observers noted the particular significance of silver breaking above the $30 level, which had served as significant resistance for 11 years. Breaking above this threshold indicates a technical breakout of substantial importance for the long-term price trajectory.

The combined force of central banks diversifying for geopolitical safety and private investors seeking refuge from monetary debasement creates a powerful and enduring demand profile. Gold is no longer just an asset to hold during a crisis; it is an essential component of strategic reserves and private wealth preservation in a new, fragmented, and increasingly uncertain global economy. For those seeking proper stability in chaos, gold’s enduring safe-haven thesis remains the strongest game in town. As a corollary, it will be folly to ignore silver, which, while playing catch-up to gold, could prove to be a breakaway investment theme and act as an additional bulwark in the precious metals category.

Sources:

2. https://www.gold.org/goldhub/gold-focus/2025/10/gold-hits-us4000oz-trend-or-turning-point