GP-led secondaries: Solving the liquidity crunch

December 26, 2022

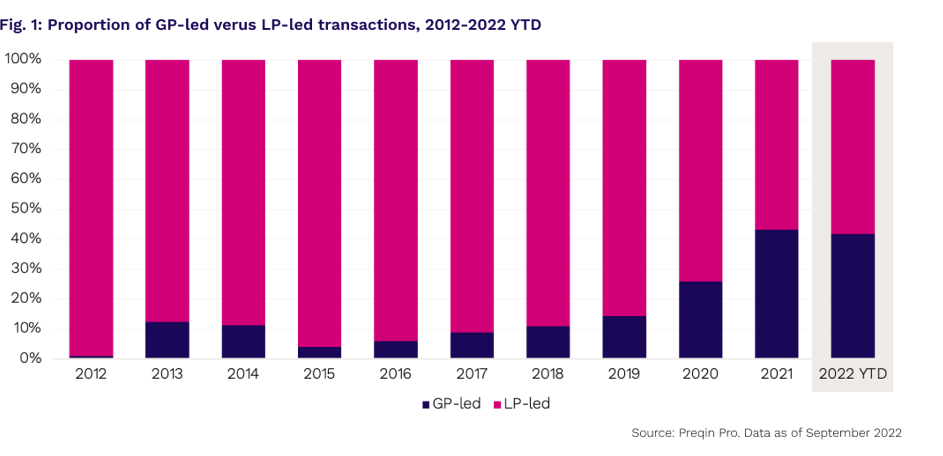

The private equity secondary market emerged in the 1980s, characterized by one-off transactions between a small number of LPs and buyers. These transactions involved investors seeking liquid assets on one side and on the other had buyers exploiting these arbitrage opportunities. Earlier, secondary transactions looked at both LP and GP stakes. However, as LPs withdrew from distressed funds during the pandemic, GPs took the lead in rebalancing their portfolios. The earliest GP-led transactions1 occurred in the mid-2000s. Over the decades, GP-led secondary transactions have become key to secondary transactions and exit strategies. GP-led secondaries comprise approximately half of the secondary market transaction volume, accounting for 46% of the total secondary volume in 20212, and these transactions are expected to reach $300 billion over time.

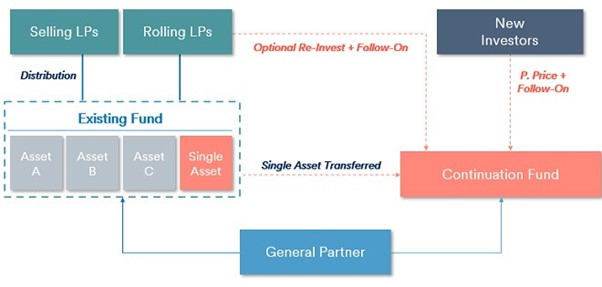

GP-led transaction schematic

From zombie to trophy assets

There was a time when GP-led secondaries were used by zombie funds to inject life into their poorly performing assets at or near the end of their initial term. This meant a secondary buyer could sidestep collaborations with a single LP and create an opportunity to deal with all the LPs in a fund. It also resulted in coordinating with the GP of that fund to structure a bespoke liquidity solution3. These deals increased the volume and exposure of GP transactions and catalyzed the birth of a coherent GP-led market, which today features high-quality assets and top-tier GPs. In the early years (Phase 1) of the GP-led market, from 2010 to 2015, liquidity solutions were provided for poorly performing funds resolving a mismatch between assets and expiring funds. In 2015, GP-led activities went mainstream (Phase 2). During this period, large cap sponsors employed GP secondaries to structure their portfolios. GPs were considered to hold the assets for a longer duration, secure additional capital, and generate liquidity for LPs. Finally, in 2018 (Phase 3), GPs began to use these options to hold on to their high-performing assets while providing a liquidity option for LPs. This period, also called the “rise of the trophy assets,” witnessed sponsors increasingly using single-asset continuation funds as an alternative to traditional exit routes for their most promising assets.

High volume and bullish trends

The market for GP-led secondary transactions remained buoyant in 2022 despite the uncertain macro environment, with market volume for H1 2022 standing at $24bn4 and expected to exceed USD 200 billion by 2025. While this represents a 17% decline from the volume in H1 2021, it is 71% higher than the prior peak in the corresponding period in 2019. In the Stifel/Eaton Partners GP Advisory Survey5, more than 55% and 11% of the respondents, who were global investors of GP-led secondary transactions, stated that their investments in GP-led secondary transactions exceeded $100 million and $500 million, respectively, in H1 2022. Approximately, 42% of investors are currently allocating at least half of their capital in current funds to GP-led deals. The proportion that preferred multi-asset structures accounted for 68%, and 62% stated their plans to increase allocation to GP-led secondaries by end- 2022. The past 12–186 months have also seen a rise in single-asset transactions. Single asset deals will continue to present a significant proportion of the GP-led deals if investors position themselves strategically to underwrite an opportunity where they can perform bottom-up analysis, instead of focusing on diverse portfolios more vulnerable to macro factors.

Game-changing drivers

Several drivers7 have been piquing investors’ interest to GP-deals. These include GPs’ positive selection bias, strong alignment, higher effective discounts owing to outdated reference dates, accelerated value creation from trophy assets, lower management fees and tiered carry structures, high underwriting targets, reduction of blind pool risk, and in-depth portfolio information. On the LP side, GPs provide early returns from an illiquid investment, locking in gains and generating liquidity that can be diverted to meet other needs. They also allow LPs to rebalance their private market portfolios, sell non-core holdings, retain equity ownership, and shift portfolio exposures.

Leading a GP-led transaction

Despite the volatility, GP-led deals have accelerated with every economic shock. This can be attributed to their potential to manage high-quality assets and clear the rack of zombie funds easily. Given this, GP-led deals have proven to be a useful portfolio management tool to generate returns and meet investor objectives. In order to lead a GP-led transaction, secondaries groups collaborate directly with GPs as their trusted partners and take a disciplined approach to underwriting, structuring, and negotiating complex transactions. GPs are also be encouraged to communicate the rationale for complex transactions to LPs, seek advisory support to ensure fair pricing, and provide comprehensive information that can help LPs assess transactions. These endeavours can contribute toward making GPs a valuable liquidity source in both the upside and downturn.