GP Stakes Private Markets Strategy

August 28, 2023

Private markets strategies, such as private equity, private credit, real estate, and infrastructure funds, offer investors the potential for attractive returns over the long term. However, these strategies typically have very long lock-ups and can be difficult to access.

One way to access private markets strategies is by investing in funds that then buy stakes in these underlying private market funds (also known as GPs). These private markets GP strategies typically do not have very long lock-ups, like the underlying private equity or private credit funds.

What are Private Market Strategies?

Private market strategies invest in assets that are not traded on public exchanges. This can include a wide range of assets, such as private equity, private credit, real estate, and infrastructure.

Private equity funds invest in private companies, typically with the goal of improving their operations and then selling them for a profit. Private credit funds provide loans to private companies. Real estate funds invest in real estate assets, such as office buildings, apartment buildings, shopping malls, and industrial properties. Infrastructure funds invest in infrastructure assets like roads, bridges, airports, and utilities.

Because they invest in assets that are difficult to liquidate quickly, private market strategies are unsuitable for many investors. Private markets strategies can also be difficult to access because they are typically only available to accredited investors – individuals or entities with a high net worth or income.

What are GP Stakes Funds?

GP stakes funds invest in the management companies of private equity, private credit, real estate, and infrastructure funds. These management companies are responsible for sourcing, underwriting, and managing the investments for their funds.

By investing in GP stakes funds, investors can gain access to a diversified portfolio of private market funds without having to invest in each fund directly. This can make it easier for investors to access private markets strategies and to manage their risk exposure.

A recent Pitchbook1 article discussed how private equity firms are taking stakes in their industry peers: GP stakes give investors access to the underlying business model and revenue from management fees, as well as being a strong diversification strategy. For PE firms, GP stakes can be a source of liquidity and capital.

Advantages of GP Stakes Funds

There are several advantages to investing in GP stakes funds, including:

- Reduced lock-ups: GP stakes funds typically have shorter lock-ups than the underlying private market funds. This means that investors can access their capital more quickly if they need to.

- Diversification: GP stakes funds offer investors exposure to a diversified portfolio of private market funds. This can help investors to reduce their risk exposure and to generate more consistent returns.

- Access to top managers: GP stakes funds can also give investors access to some of the top managers in the private markets industry. These managers have a proven track record of success in generating returns for their investors.

- Lower fees: GP stakes funds typically charge lower fees than the underlying private market funds. This is because GP stakes funds are typically structured as limited partnerships, which means that the managers of the funds have a significant alignment of interests with their investors.

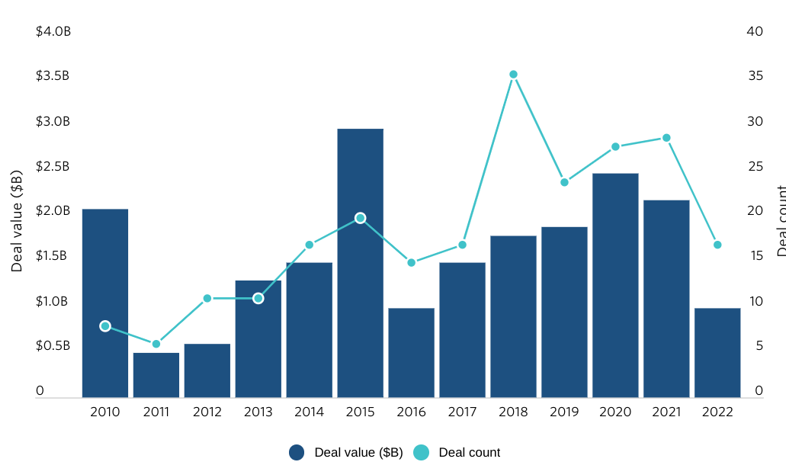

Private equity investment in GP Stakes

Image via Pitchbook2

Additional Considerations

When considering an investment in a GP stakes fund, investors should carefully consider the following factors:

- Investment horizon: GP stakes funds typically have a long-term investment horizon (10 years or more). Investors should consider whether this is suitable for their investment goals.

- Risk tolerance: GP stakes funds are a relatively new investment strategy, and there is a limited track record. Investors should carefully consider their risk tolerance before investing in GP stakes funds.

- Fund fees: GP stakes funds typically charge lower fees than the underlying private market funds, but there is still a range of fees that can be charged. Prior to investing, investors should carefully compare the fees of different GP stakes funds.

- Fund manager: Investors should carefully evaluate the track record and experience of the fund manager, as both factors will affect the performance of the fund in question.

- Investment strategy: Investors should carefully understand the investment strategy of the GP stakes fund before investing.

Conclusion

In conclusion, private market strategies, though having historically delivered attractive returns for investors, are often characterized by long lock-up periods and limited accessibility. To overcome these challenges, GP stakes funds have emerged as a valuable investment vehicle. They provide investors with a unique opportunity to indirectly access a diversified portfolio of private market funds.

Of course, potential investors should also exercise caution and carefully consider all factors before investing in GP stakes funds. Conducting thorough due diligence on fund managers and understanding the specific investment strategy is also crucial for making informed investment decisions.

In a world where accessing private markets can be challenging, GP stakes funds provide an alternative avenue for investors to participate in these strategies while managing their risk exposure. As with any investment, prudent decision-making and a clear understanding of the associated risks and rewards are essential for success in the realm of GP stakes funds.