How Family Offices Are Allocating Capital to Hedge Funds

March 17, 2025

Family offices—those discrete yet powerful private wealth management firms for ultra-high-net-worth families—are quietly reshaping the hedge fund landscape. In a time marked by market volatility, inflationary pressures, and geopolitical uncertainty, these long-term-oriented investors are increasingly turning to hedge funds in search of alpha, diversification, and downside protection.

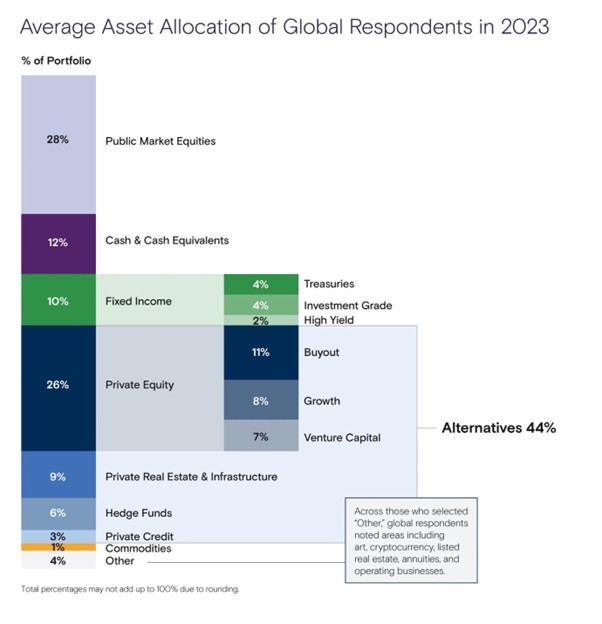

But how exactly are family offices allocating capital to hedge funds today? Overall, hedge funds now represent approximately 3% of global family office assets, while private equity accounts for 7.3%. By comparison, equities remain the dominant asset class, comprising about 35% of family office portfolios on an equal-weighted basis, with fixed-income accounting for roughly 22.4%. Collectively, private equity, private real estate and infrastructure, hedge funds, and private credit account for 44% of holdings. While many expect to maintain their current allocations over the next 12 months, there will be movement, with a considerable number of family offices expecting to increase their holdings in private equity, private credit, and private real estate and infrastructure.

The Growing Influence of Family Offices

According to Goldman Sachs’ 2023 Family Office Investment Insight Report1, 44% of surveyed family offices currently allocate capital to hedge funds, with the average allocation hovering between 7% and 15% of total AUM, depending on region and family risk appetite.

Source: Goldman Sachs Insights2

The Appeal of Hedge Funds for Family Offices

Unlike pension funds or endowments, family offices have longer investment horizons, greater flexibility in risk tolerance, and unique multi-generational goals. This makes them ideal limited partners for hedge funds seeking “sticky capital” that does not flee at the first sign of volatility.

Family offices also seek to diversify away from traditional 60/40 equity-bond portfolios, which have underperformed in recent years. Hedge funds provide exposure to alternative return streams.

Furthermore, in uncertain markets, long/short equity and global macro strategies can act as hedges against tail risk. For wealth preservation–focused families, this is key.

According to a Goldman Sachs report on Family Offices titled Eyes on the Horizon3, family offices continue to hold outsized allocations to alternatives. Collectively, private equity, private real estate, and infrastructure, hedge funds, and private credit account for 44% of holdings. While many expect to maintain their current allocations over the next 12 months, there will be movement, with a considerable number of family offices expecting to increase their holdings in private equity, private credit, and private real estate and infrastructure.

The Top Strategies for Gaining Family Office Capital

According to Preqin insights, these are the most popular hedge fund strategies among family offices today:

- Multi-strategy Funds: These offer a diversified basket of hedge fund strategies under one roof, ideal for family offices seeking exposure without picking individual managers.

- Long/Short Equity: Still a mainstay, this strategy gives family offices equity exposure with the potential to hedge downside risk.

- Global Macro: These funds take directional bets on interest rates, currencies, and macroeconomic trends. In today’s inflationary and rate-hiking environment, family offices see macro funds as a timely play.

- Quantitative Strategies: Family offices are warming up to systematic hedge funds that use AI, machine learning, and big data to trade. These funds appeal to younger generations, leading the next wave of family office leadership.

What’s Changing in Allocation Behavior?

- Fee Sensitivity Is Rising: While hedge funds traditionally charged “2 and 20,” family offices are increasingly negotiating lower fees, preferring managers with strong transparency and performance-linked terms. Over 58% of family offices say they are unwilling to pay full fees unless a fund delivers above-benchmark returns (UBS, 2024).

- Direct and Co-Investments: Family offices are not just investing passively. Many now demand co-investment rights or even direct stakes in hedge fund management firms. For example, Blue Pool Capital (the family office of Alibaba’s Joe Tsai) has backed multiple hedge fund startups in exchange for equity stakes and preferential access.

- Values-Based Investing: Younger family members are pushing for hedge fund strategies that align with environmental, social, and governance (ESG) values.

According to the Eyes on the Horizon report, at least 15% of the FOs are planning to increase their allocation to hedge funds, while a huge 74% say that there will be no change in the allocation.

Today’s family offices are acting more like institutional investors. When selecting hedge funds, they prioritize typical parameters such as Proven track records over multiple cycles, Strong operational infrastructure, Transparent risk management, cultural fit, and values alignment. Many FOs are also moving to a formal structure by hiring former institutional consultants to help vet and monitor hedge fund investments—signaling a shift toward greater professionalism in family office investment processes.

The Future: A Two-Way Street

Hedge funds and family offices are developing a more symbiotic relationship. For family offices, hedge funds offer sophisticated tools to preserve and grow capital. For hedge funds, family offices offer loyal, long-term capital that can anchor funds through volatile markets.

Going forward, we can expect this relationship to deepen as Hedge funds tailor offerings to family office needs while the Family offices increasingly seek customized SMA structures. Additionally, the generational transition brings new priorities such as Impact investing, ESG, Tech focus, Quant focus, Cryptos, Digital Assets, etc.

The world of family offices is changing—and so is their approach to hedge fund investing. In the face of market uncertainty, they are doubling down on diversification, risk-adjusted returns, and innovative strategies that hedge funds are uniquely positioned to offer. They are also demanding more: more transparency, more alignment, and more customization.