How Hedge Funds Use Machine Learning to Generate Trading Signals

September 29, 2025

According to a 2024 SEC report1, funds deploying AI-driven strategies reportedly outperformed their peers by an average of 12%. This performance gap is now accelerating companies’ investment in technological advancements and reshaping how hedge funds generate market-beating returns.

What is Machine Learning?

Machine learning is a subset of artificial intelligence that relies on statistical methods to train models using historical data, thereby enabling them to forecast future results or categorize new data. Hedge funds utilize machine learning to empower traders, allowing them to identify crucial signals by analyzing both structured data, such as stock prices, and unstructured data, including news articles and social media sentiment. A holistic analysis of all the data gives a macroscopic view of the market, which is essential for anticipating asset price movements and managing risk.

In fact, a PwC report2 highlighted that hedge funds using alternative data and AI reported a 20% higher alpha generation in 2024 . The ability to correlate these unconventional datasets allows funds to uncover hidden market signals before they are reflected in prices.

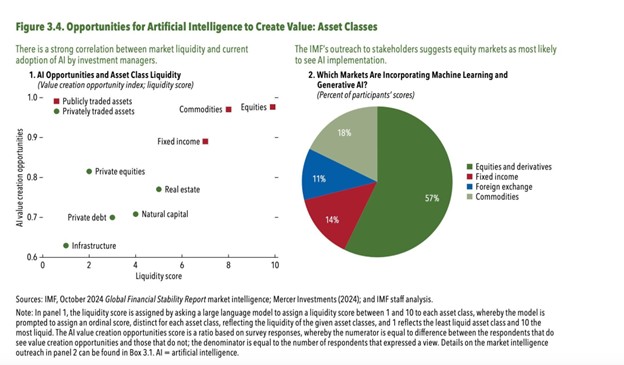

Source: International Monetary Fund3

The Role of Machine Learning in Hedge Funds

1. Alpha Generation

Machine learning models systematically process and analyze large-scale, multi-source datasets. These data sets include everything, from satellite imagery to transaction-level financial data, to uncover subtle, nonlinear predictive signals. These models identify latent inefficiencies often invisible to conventional statistical approaches. Thus, generating alpha by capitalizing on early identification and exploitation of emerging market opportunities.

2. Sentiment Analysis & Alternative Data Processing

Natural Language Processing (NLP) and related ML techniques provide automated analysis and quantitative assessment of unstructured data such as news reports, earnings call transcripts, and social media posts. These systems extract nuanced sentiment metrics and highlight catalytic events, providing a high-frequency, multi-dimensional lens on public perception and emerging price drivers that inform tactical decisions.

3. Algorithmic & High-Frequency Trading (HFT)

ML creates advanced trading algorithms capable of executing thousands of orders per second. These models identify micro-opportunities, optimize trade execution to minimize market impact, and dynamically adjust strategies in response to real-time market conditions, which is crucial for high-frequency and statistical arbitrage techniques.

4. Risk Management and Anomaly Detection

ML models take many portfolios into account and also look at what market movements/activity to identify possible risk factors. They are very effective in detecting unexpected types of behavior or any anomalous market situations. Thus, it allows the pre-emptive hedging as well as the dynamic risk adjustment in times of volatility or possible tail-risk events for which one can get underway.

5. Portfolio Optimization

Moving beyond traditional models, ML optimizes portfolio building by analyzing how assets are in relation to each other. Moreover, they also simulate endless future scenarios and carry out dynamic rebalancing and effective frontier maximization that aligns with risk-adjusted returns with constantly updating predictive inputs. All of this allows the right asset allocation based on the changing market dynamics.

Supervised, Unsupervised, and Reinforcement Learning

Machine learning used in hedge funds employs three different methods to train their models. These learnings depend on their goals and strategies and are mentioned below:

- Supervised learning: This type of learning involves training models on labeled historical data (e.g., stock returns) to predict future results. For instance, a fund might use data from thousands of past earnings reports to train the models. Thus, it becomes easier for the machine to predict which future reports will spark price moves.

- Unsupervised learning involves discovering patterns in unlabeled data and can help group assets into hidden states or identify unusual points. For instance, an unsupervised method could reveal that the same secret macro factor is actually influencing a set of “unconnected” stocks.

- Reinforcement learning: This learning is often used in algorithmic trading, where models learn to make sequential decisions, such as buy, hold, and sell, in a simulated environment to optimize returns.

Why is Traditional Machine Learning Important?

While hedge funds explore the vast world of AI, it is a critical strategic decision to select the right tool for every job. The choice of AI tool depends on the nature of the problem that the client needs to solve.

For instance, generative AI and large language models (LLMs) are good at tasks that require the use of everyday language and image analysis. These technologies are ideal for sentiment analysis of news and earnings calls, report summarization, and the classification of product reviews.

Similarly, the multimodal models (MFFMs) are the most advanced among AI models, and they are designed for the seamless integration of different types of data to perform comprehensive company analysis. They combine textual filings, presentation charts, and market data tables into a single, coherent insight.

However, traditional machine learning remains the primary choice for solutions that require highly detailed domain knowledge, utilize privacy-sensitive data, or already possess robust models. For instance: credit card fraud detection, high-frequency trading, and risk assessment.

The Challenges of Using Machine Learning in Hedge Funds

While the use of machine learning has brought significant advantages, there are still limitations to its use. Since there is a huge amount of money involved, the slightest inappropriate decision can lead to direct monetary losses. Some other challenges involve:

- Data Integrity: AI models can only work effectively when supported by high-quality data; hence, it is essential to have a data validation mechanism.

- Regulatory Compliance: The SEC has provided a set of guidelines that focuses on the transparency and accountability of AI usage. This can help bridge the gap between the speed of AI adoption and the existing regulatory landscape.

- Model Cannibalism: There is a possibility that some AI systems have been trained with data labeled by other AI systems similar to GPT-4 which makes the decision process opaque and the occurrence of herd behaviors.

- Black Box: Some AI models have complex and unexplainable behaviors. In such cases, the process of meeting regulatory compliance and providing transparency to the clients becomes difficult.

The Future of Machine Learning in Alpha Generation

Despite the challenges and limitations, the use of machine learning is becoming rampant in hedge fund operations. For instance, advances in generative AI, multimodal models, and quantum computing may lead to the creation of new frontiers in signal discovery.

Moreover, with the emergence of AI agentics, hedge funds may see autonomous systems that not only identify trading opportunities but also execute and manage complex strategies. Additionally, machine learning has improved signal generation, risk management, portfolio optimization, and trade execution. Thus, by replicating the complex dynamics of the market and mitigating severe risks, machine learning enables funds to manage their risk exposure in unpredictable markets while still seeking alpha (a hedge fund’s outperformance relative to a benchmark).

Thus, we can say that with the help of machine learning, hedge funds get a technological arm that aids in uncovering hidden signals in an ocean of data and transforming noise into opportunity. This technological advancement will reshape how hedge funds generate alpha. And this time, the fastest traders or the deepest Rolodex might not generate one, but it will be generated by those who are able to teach machines the best ways to uncover hidden patterns and make data-driven trading decisions.

Sources: