How REITs Are Adapting to the Shift Toward Green and Sustainable Real Estate

April 27, 2025

Real Estate Investment Trusts (REITs) are undergoing a transformative shift1, embracing green and environmentally responsible practices to align with the evolving demands of investors, tenants, and regulators. Once largely focused on maximizing yields and portfolio expansion, REITs are now incorporating Environmental, Social, and Governance (ESG) principles into their core investment strategies, ushering in a new era of sustainable real estate.

The ESG Imperative

Environmental, Social, and Governance (ESG) considerations are no longer optional, they are essential. From climate, conscious investors to global regulatory frameworks, the pressure on the real estate sector to act sustainably has never been greater. REITs are responding by adopting practices that reduce carbon footprints, increase energy-efficiency, and contribute positively to the broader community.

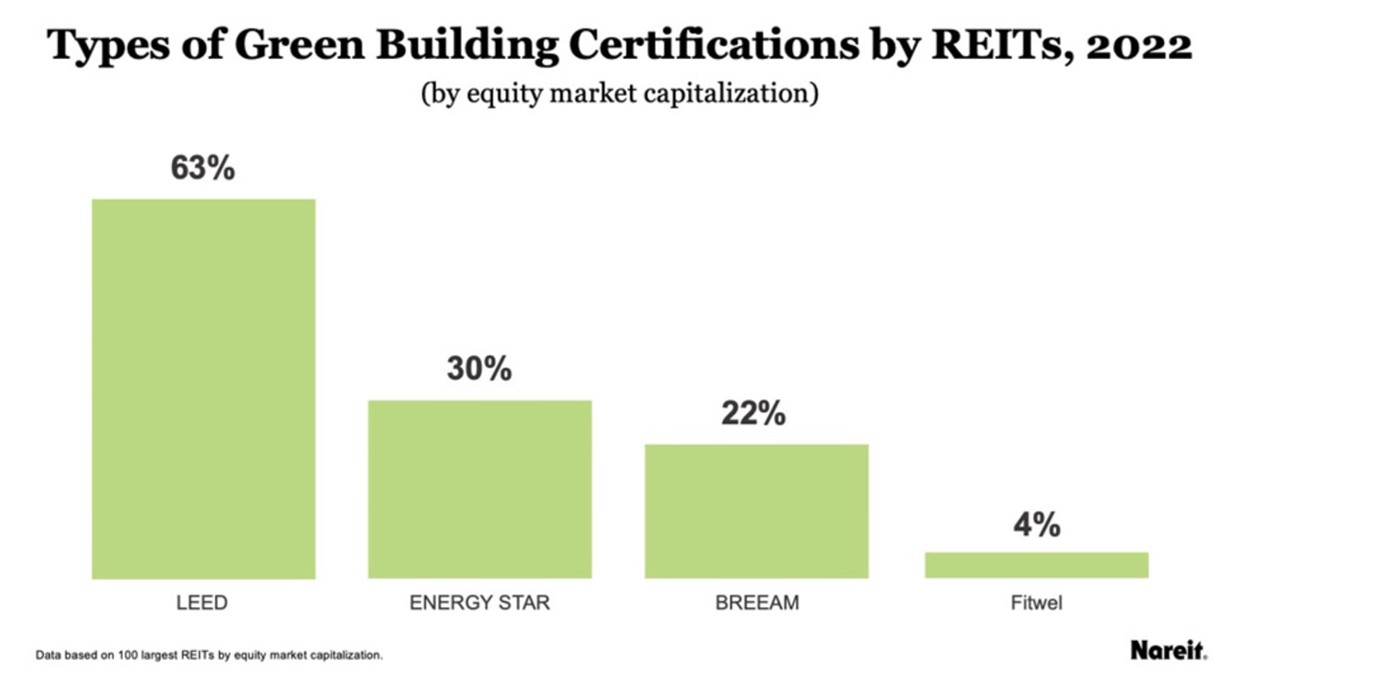

Green building certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are becoming industry standards. REITs investing in properties that meet or exceed these certifications are viewed as forward-thinking, responsible stewards of capital. These eco-friendly buildings often come with reduced operational costs, tax incentives, and heightened tenant demand, creating a win-win for both planet and profit.

Source: Nareit2

Source: Nareit2

Investing in Energy-Efficiency and Renewables

Modern REITs are directing capital toward the development and retrofitting of energy-efficient buildings. From smart HVAC systems to LED lighting and solar panels, properties in REIT portfolios are being upgraded to minimize energy consumption. Renewable energy installations, such as solar rooftops and wind turbines, are not just sustainability statements but long-term financial hedges against rising energy costs.

REITs are also exploring net-zero energy strategies, aiming for buildings that produce as much energy as they consume. These properties, once viewed as aspirational, are increasingly feasible due to advancements in green technology and growing public-private partnerships.

Challenges and Opportunities in Integrating ESG Factors into REITs

As Real Estate Investment Trusts (REITs) increasingly embrace Environmental, Social, and Governance (ESG) principles, they are faced with a dual reality: navigating a complex landscape of compliance challenges while seizing the potential to unlock long-term value and investor appeal.

The Hurdles: Compliance Complexities and Financial Realities

1. Regulatory and Compliance Pressures

For REITs, aligning with ESG goals is no longer optional, it is a growing expectation from both regulators and investors. Yet, this journey is far from straightforward. The regulatory environment is fragmented and rapidly evolving, especially across regions. A clear example is the European Green Deal, which has set ambitious emissions targets affecting building codes and construction practices. REITs operating globally must remain agile, continuously adapting their strategies to remain compliant.

Failure to meet such standards could delay project approvals or even halt development altogether. Regulatory bodies are increasingly demanding robust ESG strategies before granting clearances. ESG is no longer a check-the-box exercise: it needs to be embedded into the operational DNA of property management.

2. Financial Investment vs. Long-Term Returns

Implementing ESG-aligned upgrades, such as retrofitting buildings for energy-efficiency, sourcing sustainable materials, or installing renewable energy systems, requires significant upfront capital. These investments can temporarily impact cash flows, particularly in legacy portfolios.

However, the financial case for ESG integration is compelling. ESG-compliant properties often yield operational savings and are more attractive to investors seeking sustainable, risk-mitigated portfolios. With growing interest from ESG-conscious funds, REITs ignoring these trends risk not only regulatory setbacks but diminished access to capital.

3. Rising Stakeholder Expectations

Tenants, employees, and investors now expect real estate portfolios to reflect environmental and social responsibility. Green buildings are no longer niche; they are a mainstream requirement. Tenants prefer eco-friendly, healthier spaces; employees want to work for value-driven employers. Failing to meet these expectations risks not only reputational damage but also potential churn, whether in leases or talent.

The Upside: Unlocking Value Through ESG

1. Attracting Ethical Investment

Sustainable REITs are becoming magnets for a new wave of ethical and impact investors. These investors are not just looking for returns, they are seeking alignment with environmental and social goals. Energy-efficient, low-emission, and community-friendly properties offer a compelling combination of values and value.

REITs with clear ESG mandates often enjoy improved market positioning and investor sentiment. These portfolios command higher valuations, face lower regulatory risks, and exhibit stronger tenant retention, key metrics for long-term growth and stability

2. Catalyzing Innovation and Future-Proofing Portfolios

ESG adoption is also driving a wave of innovation across the real estate sector. Smart building technologies, sustainable materials, and data-driven facility management are transforming how properties are designed, built, and operated. Proptech 4.0 solutions, for example, enable REITs to monitor energy usage in real-time, predict maintenance needs, and enhance tenant experience.

Other advancements, such as green roofs, water recycling systems, and air purification tech, not only improve building performance but also contribute to community wellbeing. These innovations enhance asset longevity, adaptability to regulatory shifts, and environmental resilience.

3. Building Long-Term Value

ESG-aligned REITs tend to weather economic and regulatory turbulence better. They are structured around principles that promote resilience, properties that cost less to operate, attract loyal tenants, and align with the global shift toward sustainable urban living.

By focusing on ESG, REITs are not just meeting today’s demands, they are building future-ready portfolios. These portfolios are primed for consistent performance, reduced volatility, and enhanced reputation.

Attracting the ESG Investor

The green transformation is not just about compliance or conscience; it is about capital. ESG-focused investors, including institutional players like pension funds and endowments, are channelling more money into REITs that can demonstrate sustainable practices and measurable impact. These investors are attracted to REITs with robust ESG reporting, transparent governance, and a proactive approach to environmental stewardship.

As ESG becomes an essential filter in portfolio construction, REITs that fail to adapt risk being overlooked by a growing segment of the capital markets. On the other hand, those that embrace the green mandate are positioning themselves to benefit from greater investor confidence, higher occupancy rates, and long-term valuation resilience.

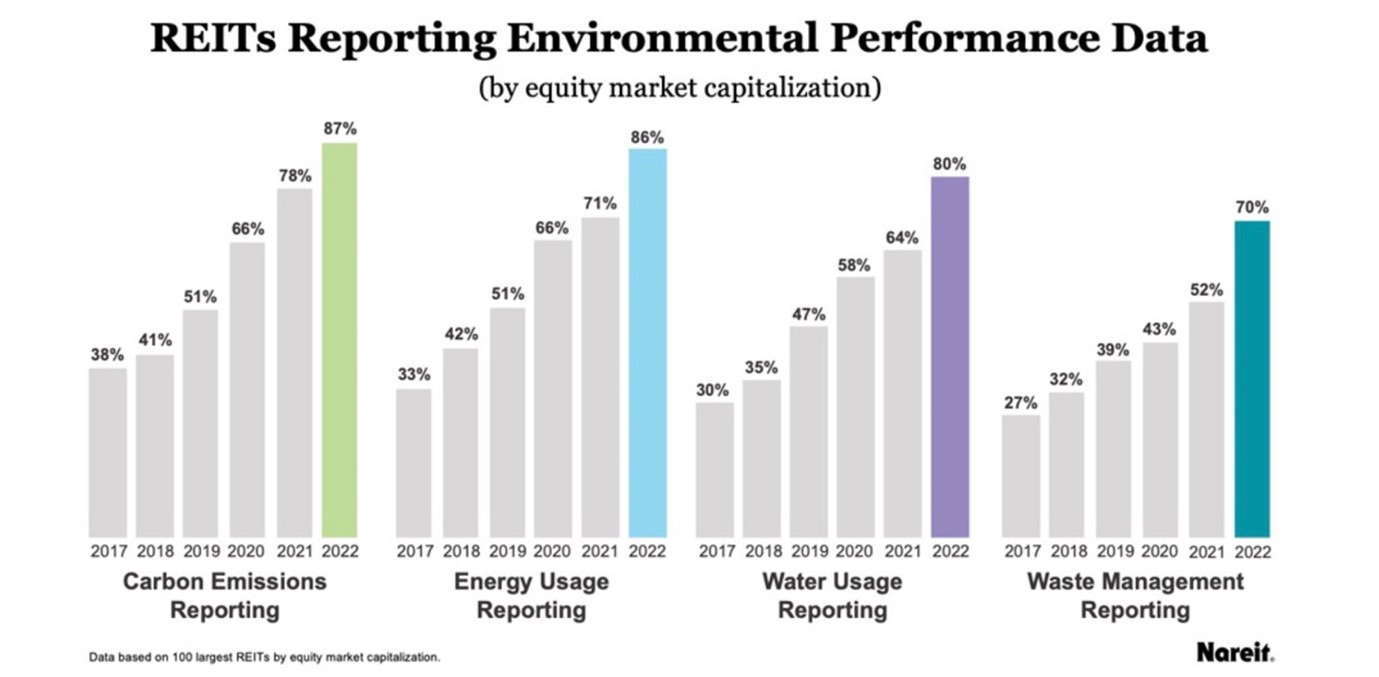

Source: Nareit3

Source: Nareit3

Social Responsibility and Community Engagement

Beyond energy and emissions, REITs are also expanding their ESG footprint through social initiatives, supporting affordable housing, improving tenant wellbeing, and engaging with local communities. A holistic ESG approach recognizes that sustainable real estate is not just about buildings, but also about the people who live, work, and interact within them.

ESG as a Strategic Imperative

For REITs, integrating ESG is not merely a compliance challenge, it is a strategic imperative. Yes, there are costs and complexities. But the rewards – access to ethical capital, long-term tenant loyalty, operational efficiency, and enhanced market value – are undeniable.

As investor priorities evolve and the world shifts toward sustainability, REITs that lead on ESG will not only outperform in the market, but they will also help redefine what responsible real estate looks like for the next generation. For the real estate industry that faces mounting scrutiny over its environmental impact, REITs stand at a crucial intersection of opportunity and responsibility. The transition to green and sustainable assets is no longer a trend, it is a strategic imperative. With the global emphasis on ESG only set to grow, REITs that innovate, invest, and lead in sustainability will not only secure their place in tomorrow’s market but also help shape a more sustainable world.

1. https://assets.kpmg.com/content/dam/kpmgsites/in/pdf/2023/11/sustainable-real-estate-an-opportunity-to-leverage.pdf.coredownload.inline.pdf

2. https://www.reit.com/investing/reits-sustainability/reits-and-environmental-stewardship

3.Same as above