Interest Rates – The Markets Are Pining, But Will the Fed Acquiesce Soon?

February 19, 2024

The latest economic indicators coming from the United States suggest a revival. According to S&P Global1, business activity in January picked up and inflation appeared to abate, with prices of some products falling to their lowest levels in more than 40 months. There was good news on the labor front too as the country created 353,000 jobs during January of 2024, way beyond the expected 185,000. And yet, the Federal Reserve stuck to its guns of maintaining rates around the 5.25% to 5.5% levels at its meeting on January 31 – making it the fourth straight time that policymakers in the US have opted to hold the rates steady, starting from September 2023.

To state that the Fed is straddling a tough position is stating the obvious as it is difficult to be patient when everyone is urging action. Chairman Jerome Powell refrained from sharing definitive timelines on decreasing the rates, relying on “more data” while acknowledging the good progress. Looks like the 2% inflation target continues to be carved in stone. As for the markets, their reaction to the Fed’s take on the economy was lukewarm as US equities moved lower post the announcement, despite the overall expectation of the rates remaining steady. Analysts believe that Powell’s comments could have deflated hopes of a rate cut as early as March.

When can the rate cuts actually materialize?

If anything, the Fed statement2 appeared to suggest that a rate reduction in this quarter or possibly even in the next could be misplaced. The Fed said it wouldn’t cut rates “until it has gained confidence that inflation is moving sustainably towards 2%”. In the same breath, the statement also noted that “Russia’s war against Ukraine is causing tremendous human and economic hardship and is contributing to elevated global uncertainty.” While predicting rate cuts in the first half of 2024, S&P Global also points to some trends that could hamper the pace of reduction in the inflation figures. The report said companies reported rising delays in getting raw materials due to challenging trucking conditions and weather-led transportation delays. This caused a lengthening of manufacturing lead times for the first time in over twelve months. Militant attacks on shipping lines as well as the drought in the Panama Canal were also cited as an upside risk to inflation.

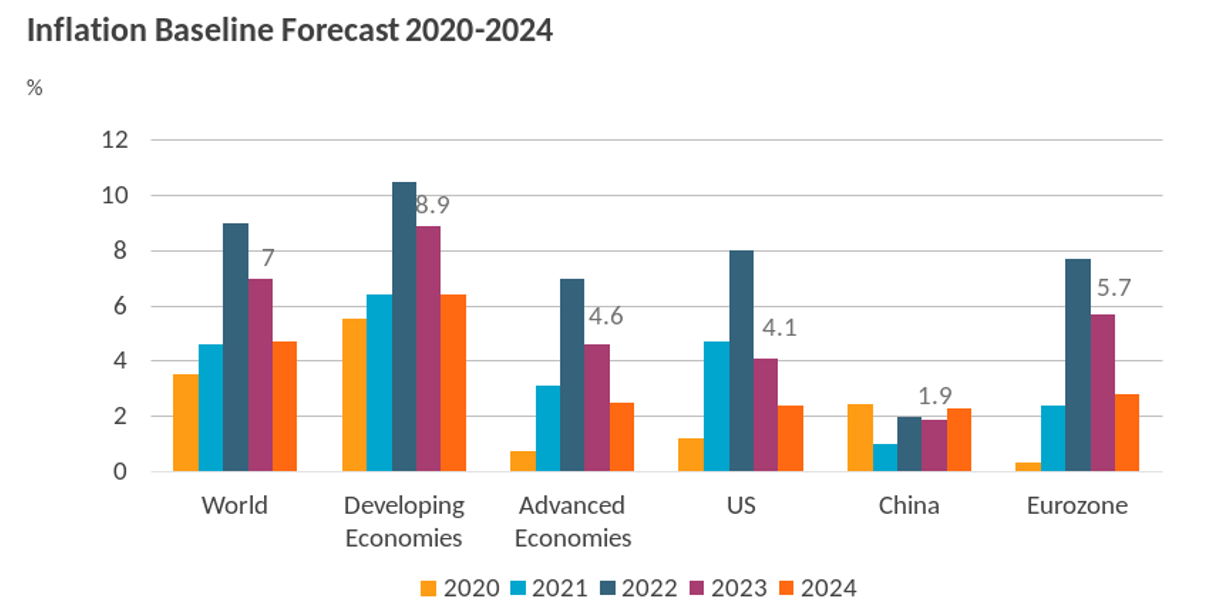

Image via Euromonitor International3

The path remains uncertain for now

Besides Powell’s cryptic statement over inflation still being “too high”, his concerns about making consistent progress at reining it in at 2 percent not being assured is what creates this uncertainty. Of course, the one thing that the Fed disclosed is that the policy rate was likely at its peak for this tightening cycle and that based on the economic evolution from this point onwards, the possibility of “dialing back policy restraint at some point this year” was more than likely. If this sounds like good news, there was some more coming in the way Powell spoke about the string of positive data that came from the labor market, and supply chains that pointed to an overall normalization or a soft-landing.

While the markets are likely to be buoyed by these indicators, the absence of benchmark numbers and the duration of this wait-and-watch period is another factor creating this uncertainty. From the last quarter of 2023, the markets have been aching for a rate cut, a sentiment that has waxed and waned. The futures market was counting on the rate cuts to start in March, something that the Fed has now effectively ruled out due to some of the reasons mentioned above. By the looks of things, Powell is merely sticking to the 1977 directive from Congress that asked the Fed “to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”

For now, it appears as though two parts of the Congress’s brief conflict. Stable prices and their nemesis – runaway inflation – are the first. The rate dropped below 3% in recent times but is still above the Fed’s target. Powell may have looked at history for help. In the 1980s, the Fed had to tame double-digit inflation but ended up cutting rates too soon. The outcome was two recessions. The second conflict is around maximum employment where the rate has been below 4% for two years. The US has been as close to maximum employment as it has been in decades and when interest rates are as high as they were, the economy is expected to slow down resulting in huge job losses. This hasn’t happened as no real recession has materialized.

Are the markets ahead of themselves?

Some analysts perceive this as good news, especially in the wake of Powell’s statement that he would not wait for inflation to get to 2% before cutting rates as it would be too late. Wait for too long and the Fed would overshoot, is how he described the mood while noting that it takes some time for policy to get into the economy, affect economic activity and affect inflation. This means the battle against inflation could result in a conflict with the Fed’s efforts to keep employment high.

Are the markets getting ahead of themselves? Maybe not, given that the general expectation is around a 125 basis point reduction in the rates for the entire year. The trend could start in June and run up to the end of December, according to the S&P Global note. This comes alongside the IMF’s recent forecast of higher global growth resulting from the “unexpected strength of the US economy” and the fiscal support measures in China. The report pegged global growth in 2024 at 3.1% followed by a 3.2% expansion in 2025 with large emerging economies such as India, Brazil, and Russia also doing better than what was previously thought. All of this made the Fund believe that there was now a reduced likelihood of a hard landing, despite commodity price spikes, supply chain issues, and geopolitical volatility in Ukraine and the Middle East. However, the Fed appears to be wary of risks around energy prices that could reduce consumer spending. This is probably why Powell believes that the job market growth and an easing of inflation should strike the right balance.

Given this backdrop, it would be interesting to see how hedge funds prepare for the rate cuts when it happens. For starters, rate cuts could potentially reduce returns on fixed-income investments and negatively impact strategies such as relative value arbitrage and fixed-income macro. It could also spike up the value of future cash flows that could make growth stocks and private equity more attractive and benefit long/short equity and private equity strategies. Rate cuts could also increase leverage capacity that potentially benefits market-neutral and event-driven strategies using it. Overall, it would reduce borrowing costs making short-selling less expensive.