Investment Allocation to Alternative Investment

January 31, 2022

Few numbers before we begin:

- Alternative investment in Asia region is set to reach $ 5 trillion by the year 2025.

- The compound annual growth rate of Alternate Investments in Asia is expected to around 25.2%.

- Over the next five years, alternative investments are projected to grow at a CAGR of around 9.8% on a global level.

- According to the 2021 EY Global Wealth Research Report, 61% of wealth clients in Asia Pacific will invest in alternatives by 2024, up from 37% compared other markets.

- In Asia Pacific, the percentage of high-net-worth individuals whose portfolio comprises of alternatives is set to nearly double in three years.

The pandemic has affected many aspects of our lives, in addition to causing new routines in our daily lives. Both our physical and financial well-being has been altered because of the epidemic.

In the wake of many job layoffs, many families had difficulty making ends meet. They were forced to rely on their existing savings since no other income stream was coming in. However, investment returns in traditional asset classes fell sharply as a result. Investors across all societal spectrums were thus adversely affected.

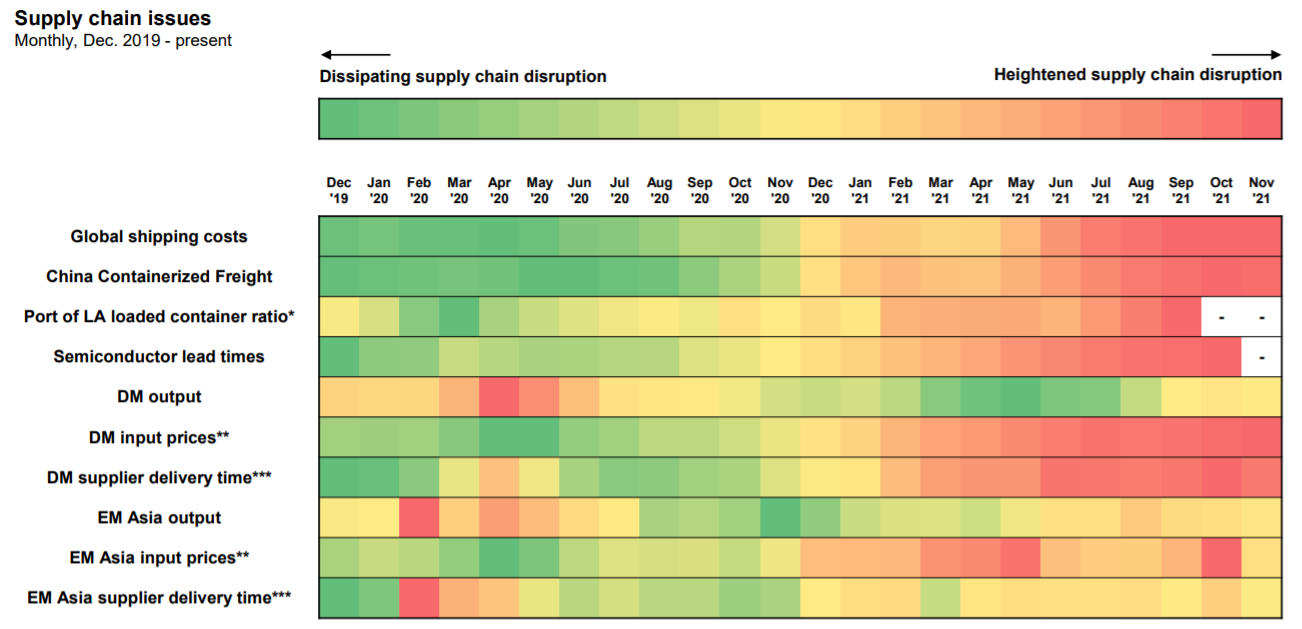

The COVID-19 pandemic-led global shutdowns massively disrupted supply chains across the globe, affecting companies’ operational performance, which in turn plummeted investors’ returns.

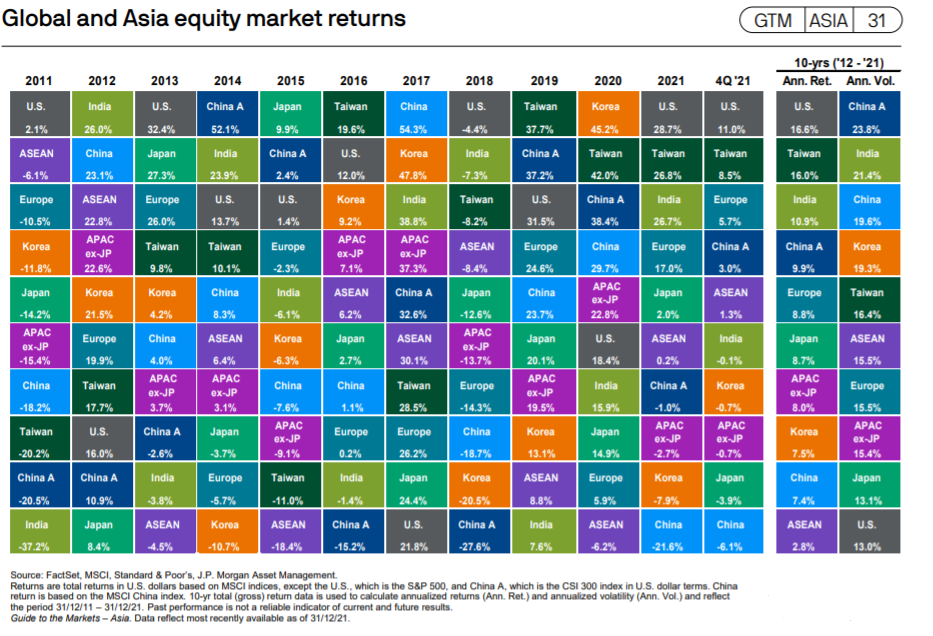

Source: J.P. Morgan Stanley Asset Management

Investor sentiment was further affected as markets saw failing investment strategies.

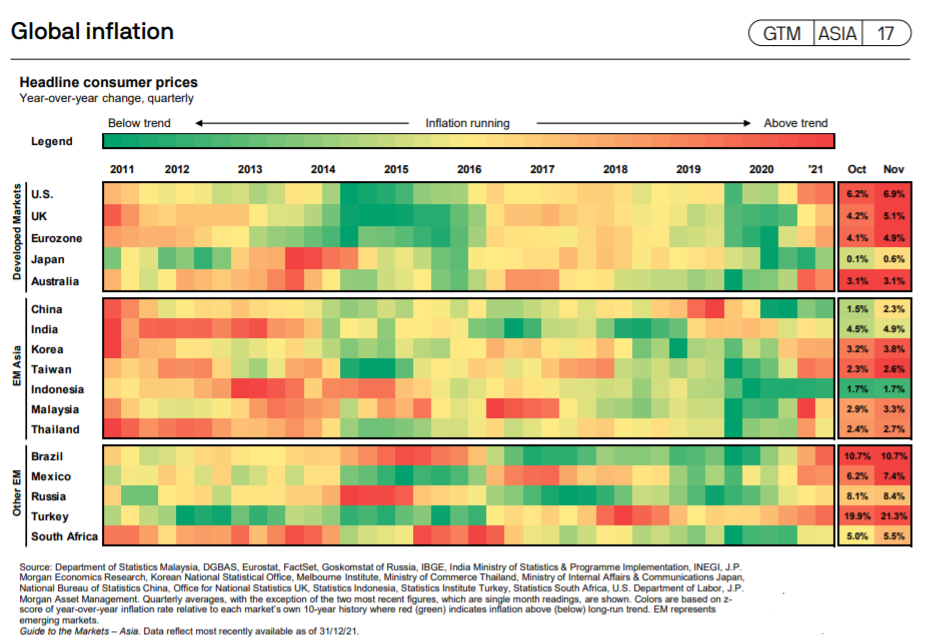

Although the markets are regaining their strength, the high inflationary trends marked at the end of 2021 are expected to persist through the first quarter of 2022. After that, it will steadily decline as the year progresses.

Source: J.P. Morgan Stanley Asset Management

Even though inflation is sometimes detrimental to the markets, investors should not be alarmed. If inflation teeters to the side of moderation and leads to steady rate increases over the term in a way that doesn’t impede growth, it may be a profitable move.

Having said that, investors should not ignore the prospect of stagflation or the dangers associated with stubbornly high prices – at least not exclusively. The pace of global economic growth is unlikely to revert to its early pandemic pace over the next 12 months. However, it’s likely to slow from the staggering pace of past years.

The guide to portfolio allocation in 2022

The infamous 60/40 portfolio allocation rule – that is, 60% of a portfolio held in equities and 40% in bonds is under scrutiny as investors are looking beyond traditional investments to improve their risk-adjusted returns.

Why is there a need to look beyond the 60/40 rule?

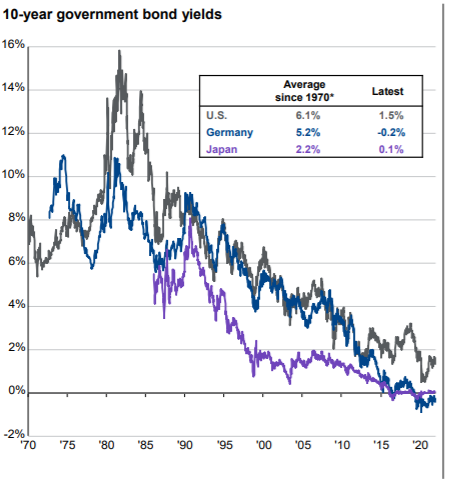

1. The Falling Bond Yields

Source: J.P. Morgan Stanley Asset Management

When observing the trend of bond yields, a prudent investor is bound to wonder whether bonds can provide either the returns or downside protection they once offered.

The current market expectations are set to see a slow rise in the interest rates. As bond yields and bond prices are inversely related, when the bond yield increases, the bond prices will fall.

The second part of this equation would cause the equity valuations to drop as bond yield increases thereby triggering a decline in stock market.

Since bond prices are declining, the effectiveness of bonds to protect against portfolio losses is also decreasing.

For example: If the FED rate increases, bond yield increases from 3% to 4% bringing the bond price down from $100 to $85. Moreover, the share price also decreases as bond yields increase. Thus, the downside in equity is no longer offset by bond prices.

It is not that bonds can no longer dampen volatility; it’s just that they may not be able to do it as well as they used to. In particular, a low bond yield would limit downside protection.

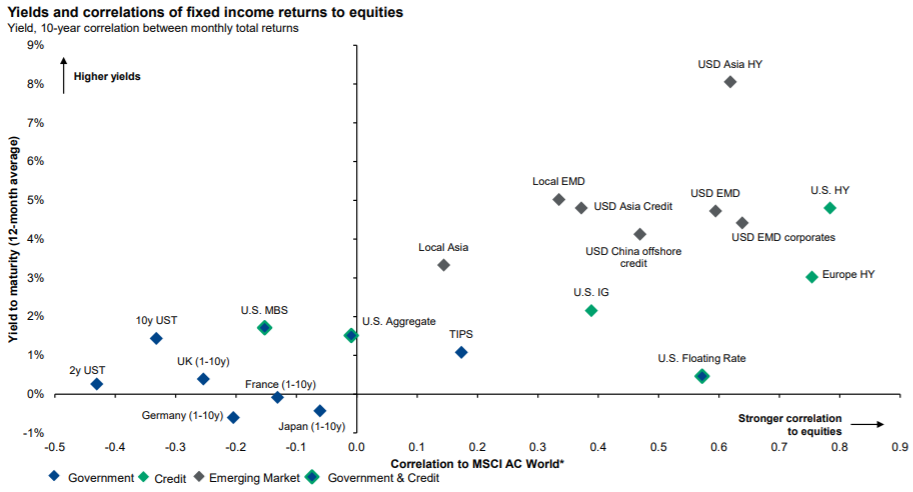

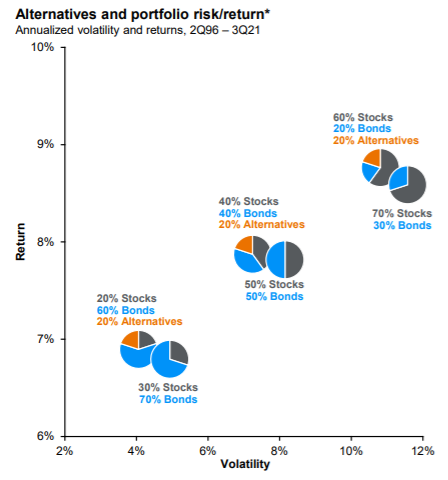

Source: J.P. Morgan Stanley Asset Management

11. Inflated Equity Valuations

Over the past year, central banks have flooded the market with liquidity, stretching valuations. As prices have moved higher, future-expected return projections have become more challenging. It’s tough to see more upside when everything is already expensive. Most analysts expect stock returns in the single-digit range. This creates uncertainty about improving risk-adjusted returns for investors.

Source: J.P. Morgan Stanley Asset Management

The 60/40 investor’s dilemma can therefore be thought of from both sides. Consequently, due to the volatility in the current traditional products, investor sentiment regarding strategies for portfolio allocation is bound to change.

In what ways can investors respond?

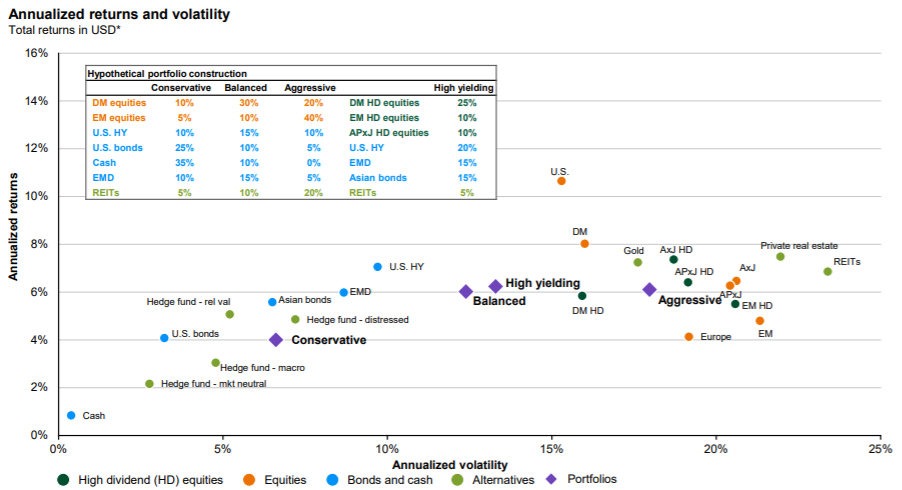

Investors should consider ways to generate higher returns and mitigate risk beyond allocating more to traditional instruments in the current environment. Moreover, the relevant question is about the assets held in those conventional assets and their overall proportion in the portfolio.

Investors willing to think differently can get more returns during this ultra-challenging time by exploring alternatives beyond traditional assets.

A variety of alternatives that rely on explicit or implicit inflation pass-through mechanisms, such as certain types of real assets, should show attractive returns when adjusted for risk. Private debt with a higher yield, particularly those with floating interest rates, may protect against rising interest rates. In addition, hedge funds and private equity can help diversify public stocks and provide alpha.

Source: J.P. Morgan Stanley Asset Management

To conclude

Tossing all your eggs in one basket isn’t the answer. Given the inflationary trends and yield movements along with equity valuation, there is little guarantee that 60/40 investment strategies will succeed.

Alternative investments have low correlations with equities and volatility, so when combined with these two asset classes, they demonstrate the capability to innovate and to improve outcomes without adhering strictly to 60/40.