Keep them streaming: Music royalties as an emerging asset class

February 28, 2022

Remember the ‘Bowie Bonds’1 scheme launched way back in 1997 by the late legendary musician David Bowie? By securitizing the rights to Bowie’s royalties in the U.S. into tradeable debt, those pioneering music bonds, in many ways, set the foundation stone for what we are witnessing today – the emergence of a new asset class in alternatives investing, namely music royalties.

The quest for uncorrelated returns

In a market environment characterized by relatively subdued volatility and low interest rates for several years now, many investors are seeking stable – and predictable – yields over a long time horizon. With valuations across asset classes hitting all-time highs in recent years, amid ultra-easy monetary policies, music royalty cash flows offer the promise of generating consistent, uncorrelated returns that are not linked to the vagaries of other asset classes such as equities, fixed income or credit.

Key attributes of music asset class

Owners of copyrighted music hold these rights for up to 70 years2, and have a claim on revenues generated from the same being played anywhere in the world. And, as consumption of music keeps soaring in the age of on-demand, streaming content, the aggregate value of the recorded music sector continues to increase rapidly. In 2020, the value of recorded music rose by 7.4%3, with 443 million consumers paying for licenses to stream music.

Another attribute of music as a remarkably resilient uncorrelated asset class is its low underlying volatility, particularly in the context of large catalogs belonging to marquee artists whose content keeps enchanting fans spanning different generations. While the royalty owner’s revenue may impact the income generated from music royalties, the variance in the latter occurs in sync with a predictable shelf life and an identifiable track record for the concerned music artist.

This makes music royalties, which deliver recurring, periodic cash flows in a reasonably stable manner, a perfect avenue for yield-seeking investors who want a steady, quasi-annuity kind of asset class in their portfolios.

Growth drivers

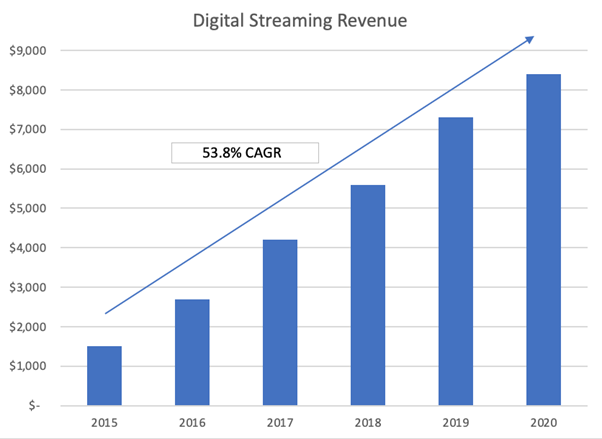

On the supply side, digital streaming has radically upended the economics of music royalties, accounting for over 60%4 of recorded music sales worldwide, and making royalty cash flows more stable. Demand for music streaming and subscription services continues to rise exponentially, with on-demand audio consumption rising 26.3%5 worldwide in 2021, reaching 2.74 trillion songs streamed.

After a 15-year cycle of lower sales due to piracy and declining popularity of physical albums, recorded music is now enjoying a renaissance thanks to digital streaming. And, consequently, more investors are increasingly confident of owning music IP assets.

Moreover, the COVID pandemic has accelerated the growth of music royalties as an alternative asset class. With live performances and in-person collaboration among musicians getting massively impacted over the last two years, several artists opted to monetize their content via different means of royalty payments – including publishing rights – in turn, attracting more investors.

Many blue-chip private equity firms, endowments, insurers, pension funds and other institutional investors have been snapping up the rights to songs from musicians who are struggling to make money from gigs and tours, or do not want to deal with the world of streaming royalties.

On the demand side, the enhanced predictability of royalty cash flows, combined with the structural and seemingly irreversible growth trend in streaming, continues to lure many non-traditional investors into this asset class – thereby driving up prices paid for publishing revenue streams.

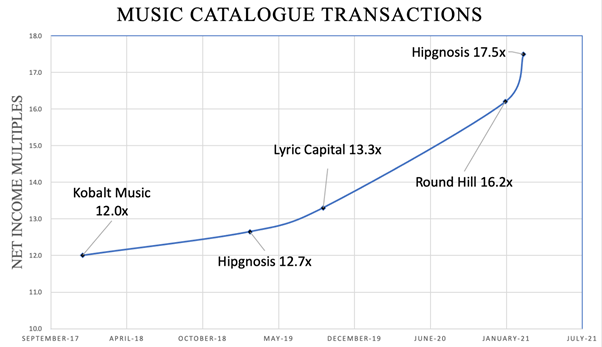

Testament to this growing ‘financialization of music’ is the significant jump in the number and value of music royalty transactions over the past 30 months.

Conclusion

Overall, given the prevailing paucity of recurring income-generating assets in conventional financial markets, music royalties do merit a consideration, from a portfolio construction standpoint. Their ability to deliver uncorrelated, diversified income streams would also enable investors to diversify their holdings, and generate differentiated, risk-adjusted returns over a long time frame.