Litigation Finance: How It Works and Why It Matters

July 23, 2023

It’s an old story: the small business without the money to sue a big fish. A perfectly valid claim abandoned for want of funds.

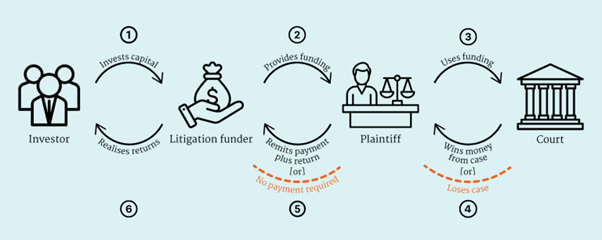

Enter a litigation funder. Litigation financing is a form of private equity wherein an unrelated third party provides capital to a claimant involved in litigation in return for a portion of any financial recovery that may result from the lawsuit.

Image via GAO1

Litigation finance can be a valuable tool for plaintiffs who have strong cases but lack the financial resources to pursue them. For example, a plaintiff who has been injured in a car accident may not be able to afford to pay for the legal fees associated with a lawsuit. Litigation finance can provide the plaintiff with the funding they need to hire an attorney and pursue their case. They also leverage AI-enabled analytics tools to advise the plaintiff on the best legal strategy.

Types of Litigation Finance

Litigation finance usually focuses on either commercial or consumer markets. Commercial litigation funders typically invest in large-scale business disputes, such as breach of contract, breach of fiduciary duty, antitrust law, and intellectual property matters. They may also invest in international arbitration cases. Consumer litigation funders, on the other hand, tend to invest in smaller-dollar cases, such as personal injury, medical malpractice, and mass tort matters. Our discussion focuses on commercial litigation finance.

There are several types of commercial litigation finance:

- Single-case funding

- Appeals funding and asset monetization

- Benefits for Large Companies

- Law Firm Portfolios

For this article, we will consider single-case funding, or ‘fees-and-costs’ funding. Litigation funders can provide funding to plaintiffs to help them pay for the fees and costs of litigation. This can be structured in a variety of ways, including as a pure contingency fee arrangement, a hybrid arrangement, or a working capital loan. Funders can invest at any stage of a case, including at the outset or midstream.

There are two main types of single-case funding: third-party litigation funding and contingency fee financing.

Third-party litigation funding is a type of litigation finance in which a third-party investor provides funding to the plaintiff in exchange for a share of the proceeds of the lawsuit. The third-party investor bears the risk of the lawsuit, and the plaintiff does not have to repay the funding if they lose the case.

Contingency fee financing is a type of litigation finance in which the plaintiff’s attorney agrees to provide funding to the plaintiff in exchange for a percentage of the proceeds of the lawsuit if the plaintiff wins. The attorney bears the risk of the lawsuit, and the plaintiff does not have to repay the funding if they lose the case.

Litigation finance has a number of benefits for plaintiffs. It can help plaintiffs bring cases to court that they could not otherwise afford to pursue. Access to funds also ensures access to the best possible legal representation. Litigation funders also deploy AI-powered analytics tools to determine the best legal strategy for the plaintiff, increasing the chance of success.

Furthermore, a legal claim is an asset that can be used to secure funding. Small businesses can secure funding from a litigation finance company against this asset. The funding can be used to pay for the legal fees and costs of defending the lawsuit, and it can also be used as ’working capital’ to keep the business afloat during the lawsuit.

However, there are also some risks associated with litigation finance. First, the plaintiff may have to give up a portion of their eventual settlement or award. Second, the plaintiff may be required to pay back the funding if they lose the case. Third, the plaintiff may be required to share confidential information with the litigation financier.

Overall, litigation finance can be a valuable tool for plaintiffs who have strong cases but lack the financial resources to pursue them. However, it is important to carefully consider the risks and benefits of litigation finance before entering into a financing agreement.

The Growth of Litigation Finance

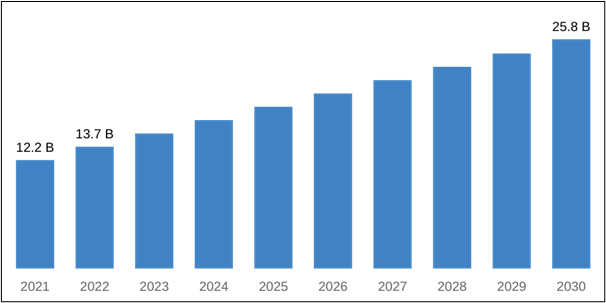

In 2019, the global litigation finance market was valued at $7.5 billion. By 2025, the market is expected to grow to $15 billion.

Image via Custom Market Insights2

Since then the litigation finance industry has grown steadily. Custom Market Insights anticipates that the demand analysis of the Global Litigation Funding Investment Market will reach approximately USD 25.8 billion by 2030, at a CAGR of 9%.

The growth of the litigation finance industry is due to a number of factors. First, the cost of litigation has increased significantly in recent years. This has made it more difficult for plaintiffs to afford to pursue lawsuits. Second, the legal system has become more complex, making it difficult for plaintiffs to navigate the system without legal representation. Third, the availability of litigation finance has made it easier for plaintiffs to obtain the funding they need to pursue their cases

There is also discussion around the ethics of litigation financing. These discussions revolve around three primary issues: champerty, disclosure, and fee sharing.

- Champerty: This refers to the doctrine of champerty that forbids third parties to a lawsuit from funding litigation fees and costs in return for a financial interest in the outcome. However, champerty has been in decline in the US; states that still have the law on their books have moved towards limiting its scope. In 2020, Minnesota’s Supreme Court acknowledged3 that “[s]ocietal attitudes regarding litigation have changed significantly. Many now see a claim as a potentially valuable asset, rather than viewing litigation as an evil to be avoided.” The court concluded that ‘an outdated common-law rule that bluntly prohibits funding is inappropriate’.

- Disclosure of funding documents: Litigation finance documents and communications are often not discoverable during litigation. Many courts over the years have concluded that they need not be disclosed on the basis of:

- funding documents being irrelevant to the case itself, or

- funding agreements being protected from disclosure by the work product doctrine, even if relevant.

- Fee sharing: Rule 5.4 of the New York Rules of Professional Conduct that govern the legal profession provides4 that lawyers generally “shall not share legal fees with a non-lawyer”. However, despite at least two NY courts ruling that litigation funding does not violate Rule 5.4, the New York City Bar Association’s Professional Ethics Committee issued Formal Opinion 2018-5, according to which lawyers cannot enter into financing arrangements where “the lawyer’s future payments to the funder are contingent on the lawyer’s receipt of legal fees or on the amount of legal fees received in one or more specific matters.”

Within months, a Bar Association Working Group concluded that litigation financing was good for the legal system and that Rule 5.4 should be amended to expressly permit such transactions between law firms and funders.

Conclusion: The Future of Litigation Finance

The litigation finance industry is growing rapidly, and it is expected to continue to grow in the coming years. This growth will be driven by a number of factors, including the increasing cost of litigation, the complexity of the legal system, and the availability of litigation finance. Discussions around the ethics of litigation finance are also rife, which reflects a push from within the legal profession to evolve in step with societal changes.

Litigation finance is a valuable tool for plaintiffs who have strong cases but lack the financial resources to pursue them. Access to litigation finance will democratize access to justice, a fundamental requirement for any society. The growth of litigation finance and the ethical discussions around it represent a strong societal movement in that direction.