Magnificent Seven Stocks: A Much-Needed Course Correction

July 25, 2024

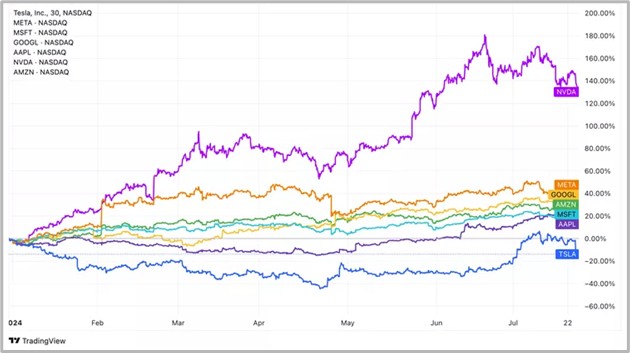

The Magnificent Seven highflying mega-cap stocks erased a whopping $1.7 trillion in value from the markets in July within two weeks. It was described as their worst performance post the ChatGPT rollout in November 2022. The sell-off intensified on Wednesday (July 24) pushing the Nasdaq Composite to its first decline of 3% or more in 400 trading days. Tech giants, cumulatively worth about $16 trillion on Tuesday, nosedived in the next trading session leading the S&P 500 to drop 128 points – these seven shares accounting for almost 85 of those. The key index lost 2.3% – the worst since December 2022 – while the Dow Jones lost 1.2% or 504 points. Nasdaq’s 3.6% decline was its largest skid since October 2022, when the Federal Reserve cranked up interest rates to control inflationary pressures.

The Magnificent Seven Plunge: What Exactly Happened?

So what exactly happened here and why did investor sentiment suddenly turn cold? Especially since none of these seven companies had announced quarterly results, nor was there any specific event that could have led to the sudden meltdown. Trade analysts blame the initial spike and the fall on the frenzy created by artificial intelligence and its expected business impact. They sent stocks to new heights in the first six months of 2024 and when skepticism over potential AI payoffs rose, they simply shifted away to small and midsize companies across the market. Especially, those that could benefit from a cut in the interest rates that they expected from the US Federal Reserve.

Source: TradingView via Investopedia

Ironically, early results from both Tesla and Alphabet (Google’s parent) seemed to articulate these very fears. Tesla reported a 45% decline in profits as AI development costs rose and the average vehicle sales prices dropped, causing its shares to plunge 12% in a session. Alphabet too reported a similar scenario with $13.2 billion spending on tech infrastructure in the quarter – a requirement for AI research. The company also forecast that capex would remain around the same levels for the rest of the year. The result: Alphabet shares fell 5%.

Traders’ fears came to a head on Wednesday when the market reacted negatively to these results and wondered how the others in the Magnificent Seven grouping would fare – results from Amazon, Apple, Meta, Microsoft, and Nvidia are expected soon. The single-day bloodbath wiped off a whopping $768 billion in market value, which, according to Dow Jones Market Data, was the biggest since Meta Platforms (as Facebook) went public in 2012. The results of both Tesla and Alphabet (which were higher than market estimates) are now spreading the concern that others in this grouping too might show robust sales figures but with a very high capex. Which makes the likelihood of more turbulence around the Magnificent Seven a distinct possibility in the short term. Stocks linked to the emerging AI story for industries like semiconductors left their shares in the lurch. Super Micro Computer dropped 9.1%, Broadcom shed 7.6% of their value, while Qualcomm and Advanced Micro Devices lost more than 6% on a single day.

Where Did All This Money Eventually End Up?

An immediate and perceivable shift was visible on July 24 (black Wednesday), but indications were visible for close to 18 months now. Over this period, the ascendance of the Magnificent Seven shielded broader indices across industries that were shaky. As the US Fed appeared to be getting closer to its first rate cut in more than two years, other sectors such as consumer staples, healthcare, defense, and energy moved into the green zone. Lockheed Martin rose 2.8% to an all-time high while AT&T saw its biggest gain of 2024. Though the Russell 2000 index did slip 2.1% in consonance with the tech meltdown, it still outperformed the S&P 500 by 10.9% in July, making it the largest in more than 24 years.

A section of Wall Street analysts believe that equity market leadership is shifting with smaller companies could end up benefiting more from an imminent cut in lending rates as they have been exposed to higher rates in the form of floating-rate debt. This probably could be a factor behind investors hedging their bets on Big Tech towards stocks that stand to gain in the short run from the US Fed’s decisions. They noted that yields on the 10-year Treasury Bills held steady on Wednesday at 4.285%, indicating a rough proxy around rate expectations. The general feeling among traders is that several factors could be lined up for a potential correction in the markets, more specifically with the Big Tech stocks. These include the upcoming quarterly results of the likes of Amazon and Microsoft as well as early indicators of a rate cut expected from the US Fed’s policy meeting slated for the week.

What Does the Future Hold for The Magnificent Seven?

The importance of large-cap stocks in a market is not new. The monthly report from Vanguard earlier this year notes that only 72 stocks accounted for half the market’s total returns since 1926. The trend held strong despite excluding the mega-cap tech growth that inspired acronyms like FAANG (Facebook, Amazon, Apple, Netflix, and Google) or the more recent Magnificent Seven – a term inspired by the 1960 movie of the same name. Now, these seven stocks have accounted for close to half of the S&P 500’s total gains in 2023, as per Morgan Stanley. Over the past five years, shareholders of this lot received a combined annualized return of over 46% – while the S&P 500 returned just 13%.

Source: TradingView via Investopedia

Questions about how far they can keep up this frenetic growth were bandied about last year and grew louder in 2024 amidst concerns over AI not delivering their promised returns. Some analysts highlighted the outperformance of these seven shares while noting that a correction was imminent. That AI proved to be a question many wanted to ask did not help, nor did the more practical moves by fund managers to reallocate to more value-oriented avenues that have underperformed in an economy battling inflation and high cost of money. Of course, nobody on Wall Street believes that the Magnificent Seven would be going anywhere, nor do they question the claims of AI as a technology for the future. It is just that the hype was blowing hot, and someone decided to let some of it out.