Music Royalties: A Growing Asset Class in 2023

December 15, 2023

The music industry, once dominated by record labels and radio airwaves, is experiencing a paradigm shift. With the rise of streaming platforms and digital ownership, a new asset class is garnering attention: music royalties. The pioneering “Bowie Bonds” of 1997 continue to cast a long shadow, paving the way for music royalties to emerge as a distinct asset class of alternative investments.

Uncorrelated Returns in a Volatile Market

With ongoing market volatility and rising interest rates, investors seek assets offering stable, predictable yields over extended periods. Music royalties offer just that, with consistent, uncorrelated returns decoupled from traditional asset classes like equities and fixed income.

Key Attributes of Music as an Asset Class

- Long Copyright Protection: In many countries, including the US and signatories to the Berne Convention, owners retain rights to their musical compositions for 70 years after the death of the author. However, for sound recordings, the protection period varies by country and can range from 95 to 120 years.

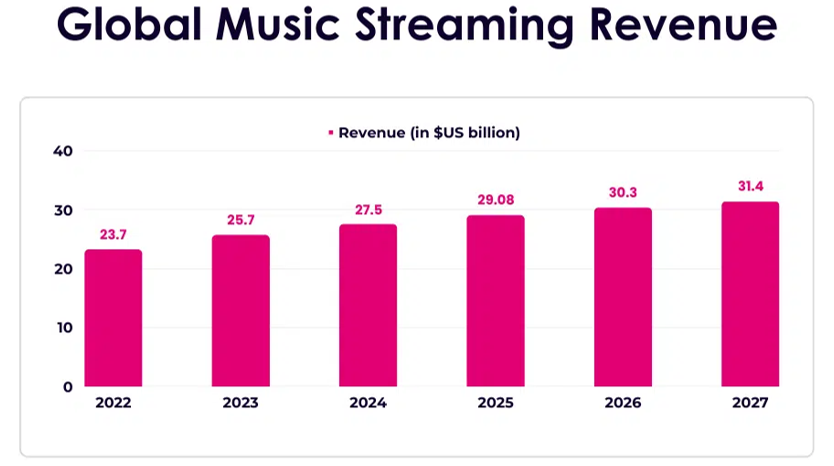

- Streaming Boom: On-demand streaming fuels music consumption, driving rapid growth in the recorded music sector. In 2023, the industry is expected1 to reach a market size of $41 billion.

- Low Volatility: Music, particularly from established artists, exhibits remarkably low volatility. Revenue may fluctuate, but predictable shelf life and track record mitigate risk.

Image via Digital Virgo2

Perfect for Yield-Seeking Investors

Music royalties deliver recurring, periodic cash flows with stable predictability, making them ideal for investors seeking:

- Steady income: Similar to a quasi-annuity, music royalties provide consistent returns over time.

- Portfolio diversification: Their uncorrelated nature adds diversification to traditional portfolios.

Growth Drivers in 2023

- Digital Domination: Streaming now accounts for over 70% of recorded music sales globally, further stabilizing royalty cash flows.

- Exponential Streaming Growth: On-demand audio streaming continues to surge; over 4 trillion songs were streamed in the US in 2023. The global music streaming market is estimated3 to grow at a CAGR of 7.4% from 2020 to 2027, to reach $46.9 billion in 2027.

- Institutional Investor Interest: Blue-chip firms, endowments, and pension funds are actively acquiring music rights, driving up transaction value and volume.

The “Financialization of Music”:

The significant increase in music royalty transactions over the past few years signifies the growing financialization of music. This trend is expected to continue in 2024 and beyond, attracting diverse investors seeking alternative asset classes with stable returns and low correlation to traditional markets.

While music royalties offer attractive features like stable yields, low correlation, and portfolio diversification, several crucial aspects warrant careful analysis before investing. Here’s a breakdown of key considerations:

- Platform Capabilities and Data-Driven Approach: Partnering with established platforms with strong artist, publisher, and IP owner connections provides access to under-monetized assets for potential value appreciation. Evaluating music IP requires a data-driven approach, analyzing song and artist performance, genre trends, royalty structures, and channel penetration to develop accurate cash flow projections and manage risk effectively. Effective asset management is crucial, including initiatives like content placement in films/TV (synchronization), new licensing arrangements, and early collaboration with artists/songwriters to maximize catalog value and reach.

- Music Catalog Diversity: Song popularity typically follows a predictable pattern, peaking early and stabilizing after 5-7 years. Seasoned catalogs offer predictable consumption patterns due to extensive historical data enabling accurate modeling. Newer songs and “hits” may lack such data but offer potential for high growth. Diversification across songs, artists, genres, vintages, and delivery channels mitigates the risk associated with single blockbusters and shifting consumer preferences.

- Valuation Multiples and Value Creation: While multiples have moderated recently, iconic catalogs like Springsteen’s or Dylan’s still command high valuations. Catalog size, diversity, maturity, and fan base size are key drivers. Seeking under-monetized assets with the potential for long-term value creation remains a viable strategy.

- Regulatory Environment and Recent Enhancements: The music industry enjoys a supportive regulatory environment, with notable advancements like the 2018 Music Modernization Act streamlining licensing and collection for digital platforms. The 2022 mechanical royalty adjustment increased streaming and digital sales royalties by 44% and 32% respectively, further benefiting rights holders.

- Potential Risk Considerations and Mitigation Strategies: Copyright infringement and reversion have emerged as concerns. Mitigating these risks involves ensuring the chain of title across prior owners, securing indemnifications, and retaining full control over royalty shares across publishers, writers, artists, and labels.

Investing in music royalties presents a unique opportunity to tap into the ever-evolving music industry. With its potential for stable returns, low correlation, and long-term growth, this asset class can be a valuable addition to a diversified portfolio. However, careful due diligence and a thorough understanding of the risks and considerations involved are essential before making any investment decisions.