Navigating the US Real Estate and REITs Cycle Amidst Rising Rates and Shifting Market Dynamics

May 31, 2023

The US real estate market, including Real Estate Investment Trusts (REITs), is subject to various factors that influence its cyclical nature. Recent developments, such as rising interest rates, controlled banking crises, and limitations on retail real estate fund withdrawals by Blackstone, have added complexity to the market. This blog post aims to examine the current state of the US real estate and REITs cycle against the backdrop of these events, shedding light on potential implications and strategies for investors.

Source: Seeking Alpha1

Rising Interest Rates and Real Estate:

From March 2022 to May 2023, the Fed embarked on a series of interest rate hikes. This has been the fastest increase in interest rates in decades, and it is still unclear if rates will rise further. All of this has had an impact on borrowing costs as well as investor sentiment.

- Impact on Borrowing Costs: Rising interest rates increase the cost of borrowing for real estate developers, potentially impacting their ability to finance projects. Higher borrowing costs can reduce the profitability of real estate investments, leading to a slowdown in the market.

- Shifting Investor Sentiment: Rising interest rates can alter investor sentiment, as fixed-income investments become relatively more attractive compared to real estate. This shift may lead some investors to reallocate their capital away from real estate and into other asset classes, impacting demand and pricing.

Controlled Banking Crises and Real Estate Market Stability

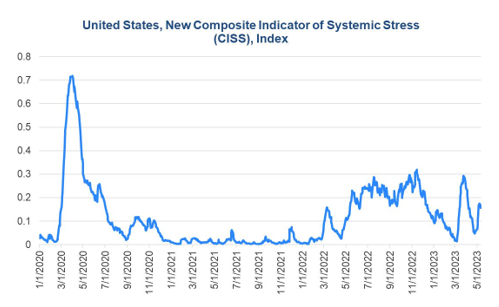

Experts feel2 that the USA may have gotten past the worst of the banking crisis; however, financial markets are still stressed. From a $70 billion daily average, money being withdrawn by banks from the Fed has reduced to $12 billion.

- Regulatory Measures: When banking crises occur, regulators often implement measures to stabilize the financial system. These measures can include stricter lending standards and increased oversight, which may affect the availability of credit for real estate investments. The Fed is reportedly anticipating some degree of financial tightening (such as a 25-basis-point hike in interest rates), which is more likely to impact banks than consumers who refrain from purchasing items for which they need financing.

- Market Confidence: Banking crises can erode market confidence, leading to a decrease in investor appetite for real estate assets. Investors may become more cautious, potentially slowing down the pace of transactions and affecting the overall health of the real estate market.

Source: ConferenceBoard.org3

Blackstone’s Retail Real Estate Fund Limitations

- Liquidity Concerns: Limitations on withdrawals from Blackstone’s retail real estate fund reflect liquidity concerns in the market. Such limitations can arise when market conditions make it challenging for fund managers to sell underlying assets to meet redemption demands.

- Investor Impact: Limitations on withdrawals can create uncertainty among investors, potentially causing them to reassess their allocations to real estate funds. This can lead to potential redemptions and a downward pressure on real estate fund valuations.

Source: SeekingAlpha4

Navigating the Current Real Estate Cycle

There are a few steps that one could envisage to effectively navigate the real estate cycle such as diversification, focusing on fundamentals, actively working on asset management, and conducting regular risk assessments.

- Diversification: Amidst shifting market dynamics, diversification is key to mitigating risks. Investors should consider diversifying their real estate holdings across different sectors and geographic locations to reduce exposure to specific risks associated with individual markets.

- Focus on Fundamentals: Regardless of market cycles, focusing on fundamental factors such as location, property quality, and cash flow potential remains crucial. Investments in well-located properties with strong tenant demand and stable cash flows are more likely to weather market fluctuations.

- Active Asset Management: Active asset management is essential during uncertain times. Proactive measures such as improving property performance, optimizing operating expenses, and renegotiating lease terms can enhance the resilience of real estate investments.

- Regular Risk Assessment: Investors should regularly assess their risk exposure and monitor market conditions. This includes staying informed about regulatory changes, interest rate movements, and any shifts in investor sentiment that may impact real estate valuations and liquidity.

Conclusion

The US real estate and REITs market is subject to cyclical influences, including rising interest rates, controlled banking crises, and limitations on retail real estate fund withdrawals. While these factors pose challenges, they also present opportunities for savvy investors. Diversification, focusing on fundamental factors, active asset management, and regular risk assessment are crucial strategies to navigate the current real estate cycle successfully. By staying informed and adaptable, investors can position themselves to seize opportunities, manage risks, and achieve long-term success in the dynamic US real estate and REITs market.