News Digest: Alphabet’s Century Bet-The 100-Year Bond Returns

February 13, 2026

Alphabet is shattering financial norms with the tech sector’s first 100-year bond since 1997. As part of a massive multi-currency debt blitz, Google’s parent company is making its debut in the Sterling (GBP) market, targeting ultra-long-term investors such as pension funds and insurers.

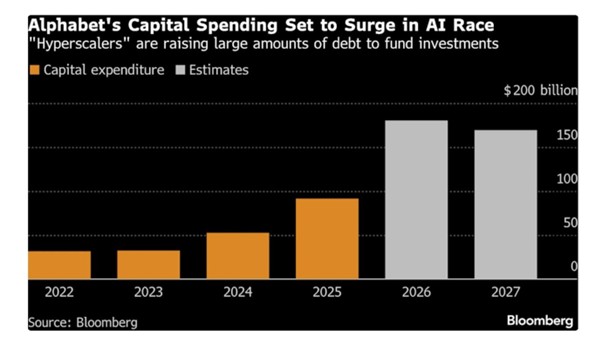

This isn’t just a routine refinancing; it’s the fuel for an unprecedented AI arms race. Alphabet’s 2026 CapEx is projected to hit $185 billion-exactly double its 2025 expenditure. Morgan Stanley expects total borrowing by “hyperscalers” (Alphabet, Meta, Microsoft) to reach $400 billion this year, up from $165 billion in 2025. Beyond Sterling, Alphabet is marketing a seven-part USD transaction and planning its first-ever Swiss franc notes.

While governments and universities dominate the 100-year market, tech firms rarely join due to the threat of technological obsolescence. Motorola was the last tech giant to issue a century bond in 1997. Meanwhile, retailer J.C. Penney issued one in the same year, only to file for bankruptcy 23 years later. These bonds are hyper-sensitive to interest rates. Similar 100-year notes issued in 2021 by the Wellcome Trust are currently trading at just 44.6 pence on the pound.

Alphabet is betting its ecosystem will remain the “Single Source of Truth” for the next 100 years. By tapping every possible investor class, from structured finance to centenarian funds, it is securing the deepest liquidity pool in corporate history to dominate the AI era.

End Notes