News Digest: Gold Investment Demand Surges Amid Peak Global Risks in 2025

October 14, 2025

Gold prices reached unprecedented levels in 2025, recently testing the $ 4,000-per-ounce mark, driven by escalating global uncertainties. According to market analysis, this surge reinforces gold’s role as a safe-haven asset amidst what analysts describe as the highest global risk environment since December 1941.

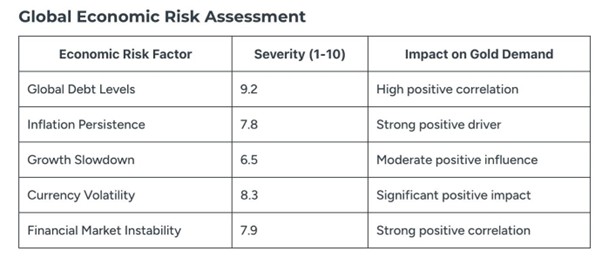

According to Discovery Alert, the price rally is supported by a confluence of factors, primarily record investment demand across physical gold, ETFs, and futures markets. This is coupled with historically elevated central bank purchases as institutions seek to diversify their reserves and reduce their dollar dependency. Other key drivers include persistent inflation concerns, growing global debt burdens (reaching $315 trillion in 2024), and intensifying geopolitical conflicts worldwide.

Source: Discovery Alert

A notable market phenomenon is the simultaneous price appreciation across multiple assets, including gold, silver, platinum, stocks, and bonds, suggesting unprecedented levels of global liquidity seeking investment opportunities across all classes. Silver, in particular, has experienced a parallel surge, establishing new record prices above $48 per ounce, reflecting both strong industrial demand and investment interest, mirroring gold’s safe-haven appeal.

Investment demand metrics for gold show significant year-to-date growth in 2025: Gold Futures are up 22.7%, physical gold is up 18.5% (driven by retail hedging), and Gold ETFs are up 12.3% (institutional allocation). For prices to stop rising, the underlying political, economic, financial, and social risks driving this demand would need to diminish significantly. The long-term outlook remains constructive, with projections suggesting continued appreciation for precious metals as structural global challenges persist.

End Notes