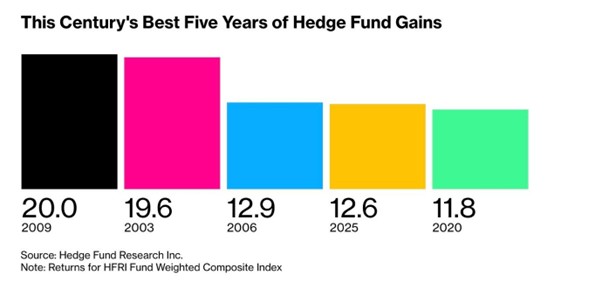

News Digest: Hedge Funds’ Best Return since 2009

January 14, 2026

The hedge fund industry achieved its most profitable year since 2009, posting average returns of 12.6% in 2025. This $5 trillion sector saw a historic $71 billion inflow, reversing a decade-long trend of capital flight as investors favored strategies to capitalize on global volatility. Giants like Millennium and Citadel saw double-digit gains, while Bridgewater’s flagship Pure Alpha II surged 34%. Private firms like BlueCrest Capital netted a staggering 73%. Equity-focused funds led broad categories with 17.3% returns, fueled by artificial intelligence stocks and a resilient S&P 500, marking a significant resurgence for active managers and sophisticated stock pickers.

This performance was driven by a “perfect storm” of geopolitical shocks (including U.S. tariffs and Middle East conflicts) and macroeconomic uncertainty regarding interest rates. Macro traders thrived in this instability, while the multi-strategy model became the preferred entry point for institutional allocators seeking diverse alpha. However, as 2026 begins, experts warn that “extreme greed” and high leverage could signal a looming reality check. Despite these risks, the industry maintains momentum, as falling financing costs and a revitalized M&A pipeline expand opportunities for merger arbitrage and relative-value strategies, shifting interest away from struggling private credit and equity sectors.

End Notes