News Digest: Key Drivers Behind Emerging Market Outperformance in 2025

November 26, 2025

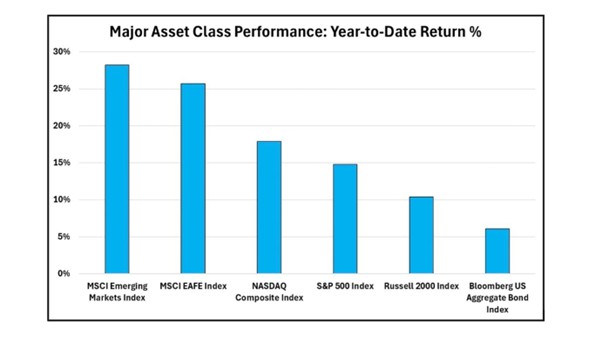

The MSCI Emerging Markets Index outperformed major domestic indices through the first nine months of 2025, surging 28.2% year to date, despite high geopolitical tensions and trade uncertainty. This strong performance is driven by several interconnected global themes and structural factors, with the Chinese market exerting only a limited influence.

Returns shown are year-to-date, through 9/30/2025. Measured in US dollars on a total return basis

Source: Advisorpedia

As per an article in Advisorpedia, the primary driver is the global AI race, which has disproportionately benefited certain EM economies. Tech stocks in Taiwan and Korea were major contributors, with the latter market soaring 58% year to date, driven by demand for semiconductors and hardware for AI expansion.

Additionally, shifts in global trade and supply chains have influenced market returns. New tariff agreements and price pressures are forcing companies to relocate manufacturing, benefiting exporters of industrial and precious metals. South Africa, for example, saw a 57% gain in 2025.

Investor caution over sovereign debt and trade uncertainty has pushed gold prices up nearly 50%, to over $4,000 per ounce. These factors, alongside broader global sentiment, have pushed the US dollar lower by about 10% year to date. A weaker dollar is a powerful tailwind for international companies that borrow in dollars but generate local-currency revenue, thereby improving their profit margins.

Finally, EM remains attractive due to valuation discounts. Trading at approximately 14x forward earnings, EM offers a significant discount compared to the S&P 500’s 23x and the NASDAQ’s 25x. Optimism persists as corporate earnings and economic data continue to exceed expectations globally.

End Notes