News Digest: The Great Bifurcation: Hedge Fund Fees Settle into a Two-Tier Reality

January 28, 2026

The legendary “2-and-20” fee structure is officially a relic of the past. As of early 2026, the hedge fund industry has fractured into a two-tier market in which fees are determined by a rigorous “value-for-alpha” calculation. According to the H1 2026 Hedgeweek-AIMA Allocator Survey, 33% of allocators are now actively negotiating lower fees, up significantly from six months ago.

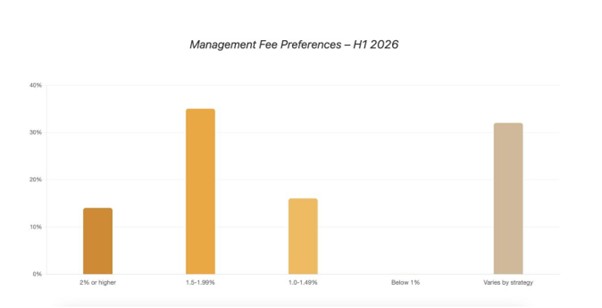

A new industry standard has emerged: the 1.5%–1.99% management fee range. Preference for this band jumped from 21% to 35% this year, signaling a decisive shift away from premium pricing for standard strategies. For the “middle-tier” manager-those delivering solid but not exceptional results-the 1.5/15 structure has shifted from a negotiating starting point to a hard ceiling.

The industry is now defined by extreme bifurcation:

- The Elite Tier: High-performing platforms delivering consistent 20%+ net returns can still command management fees of 6% to 8%. Large institutions ($5bn+ in assets) remain willing to pay for genuine, uncorrelated alpha and capacity-constrained strategies.

- The Commodity Tier: Managers offering beta-like exposure or replicable strategies face intense pressure to slash fees. If a strategy is perceived as “stabilizing” rather than “return-maximizing,” allocators are unwilling to pay a premium. Notably, the rationale for hedge funds as “return maximizers” has collapsed from 56% to 29%.

Despite a strong 2025 (averaging 15% net returns), scrutiny from allocators has only intensified. The industry has reached a state of maturity in which fees correlate directly with risk-adjusted performance and downside protection. For managers, the message is clear: demonstrate undeniable differentiation, or prepare to accept commoditized pricing. There is no longer a comfortable middle ground for “pretty good” performance.

End Notes