News Digest: The Netflix-Warner Deal: An Audacious Bet That Might Just Get Through

December 9, 2025

Even before the ink was dry on the Netflix acquisition of Warner Bros, the knives were out. Critics from both sides of the pond were quick to denounce the deal. The arguments were along expected lines: that the combined entity would become a monopoly, or that the total subscribers, numbering around 450M, would lead to higher prices and harm consumers. According to data from JustWatch, a platform that measures streaming engagement across US services, a combined Netflix–WBD would control roughly a third of US streaming activity.

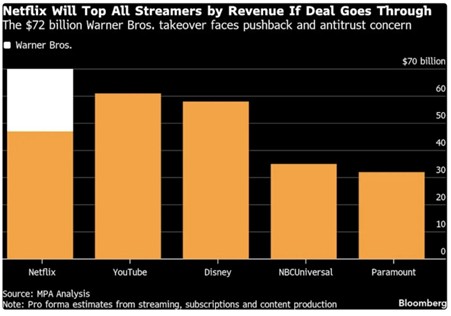

However, critics have missed a crucial point: the streaming business worldwide is no longer confined to the traditional players – Netflix, Amazon, Disney et al – but must be looked at in its entirety, which means that players such as YouTube and TikTok need to be considered. Once that is done, the picture seems less like a monopoly. While the combined entity will still be larger than any other player in the market, the difference is less pronounced. According to a Bloomberg report published on Yahoo, the market, post-merger, will look like this:

However, the deal may lose lustre if the regulatory process, especially in Europe, drags on and the expected annual cost savings of $2-3 billion don’t materialize. The deal effectively closes the door to smaller players and sharply raises concentration levels, something Big Tech has already demonstrated in Internet Search, GPU production, and related areas.

So while the naysayers to the deal may be vocal for the time being, there is a good chance that Netflix may, in fact, have the last laugh, worth all of the $ 72 B that it is forking out for Warner Bros.

End Notes