Oil is the New Yo-Yo

June 30, 2025

Barring a black swan event, global oil prices are heading south. This appears to be the consensus amongst the major fund managers and industry watchers. In fact, JP Morgan slashed its 2025 forecasted1 oil prices from $73/bbl to $66/bbl and has further forecasted that it will go further south to $58/bbl in 2026. Similarly, Goldman Sachs has pegged2 the 2025 prices at $66 and the 2026 prices at $58.

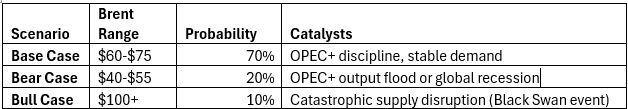

The broad consensus appears to be a range of $60-75 in 2025 for oil this year and moving down further in 2026.

So what really happened? An analysis of the first six months of June reveals that oil price movements have been primarily due to:

- US-Induced Tariff Issues: It is not that the tariffs pushed up the prices, it’s just that the frequent changes and the air of uncertainty around tariffs and their rollbacks roiled the global markets. This uncertainty spilled over into the entire business world, leading to an inability to predict which way the tariff dice will roll – if it will roll at all. Anticipated supply chain disruptions, which were predominant in the early days of the Tariff announcement (Feb/March), gave way to some relief when the US president gave a breather. Since then, the market appears to have read the tea leaves and factored in the unpredictability of the US administration and stabilised to a reasonable extent.

- Geopolitical Churn: This continues to be a major factor and, by all accounts, will be a major determinant for the rest of 2025. However, the major players in this churn have also probably realised that any economic fallout of their actions will have a domino effect on the oil prices, and hence most of the attrition has been marked by an absence of impact on oil production capabilities on all sides.

- Softer demand from major growth economies, which is now changing course. Primarily due to the tariff effect and the uncertainty around that, there was a softening of demand for oil from major growth economies such as China. The situation has since been resolved, and the demand for oil is returning to its robust levels. JP Morgan research indicates that demand may expand by 800,000 bpd in the rest of the year.

- A recalibration by OPEC+ to increase supplies in 2025: It is expected that the supply will be boosted by more than 4,00,000 bpd from June 2025, primarily by Iraq, UAE, and Kazakhstan.

- US Shale Flexibility: The U.S. shale industry has fundamentally reshaped global oil markets through its unique ability to rapidly respond to price signals3. This agility acts as a ceiling on oil prices, preventing sustained spikes above $70/barrel.

This explains the initial spike of oil in January when the initial announcement regarding the tariffs was made, and then the downward push as the FUD factor took over amidst constant flip-flops. (See chart below)

OIL PRICE MOVEMENTS LAST 12 MONTHS

Source: Macrotrends Daily4

Will There Be An Oil Shock?

Unlikely. However, like we said earlier, if there is a black swan event, then all deals will be off the table. Barring that, with diplomacy having won over attrition in the Middle East, most analysts believe that we are headed into relatively calmer markets for some time now. In any case, the speed of drilling in shale will ensure that the price does not exceed $ 70/bbl, preventing an oil shock in the US. Since the Fed is focusing on containing inflation, there will be sustained efforts to ensure that any kind of shock to the economy is prevented. Finally, given the increase in supplies by OPEC+ and over $ 10 B of investments already committed by oil companies, there are not likely to be any production mismatches at least for the next two years.

Further, analysts believe that the US administration will shift its rhetoric from tariffs to taxes and deregulation, and new trade deals arising out of the conversations will ensure that the $70/bbl is not breached.

The Bottom Line for Investors

The overarching message from asset managers and hedge funds is unequivocal: Oil is range-bound with a downward bias. Geopolitical flare-ups may indeed cause brief, localized spikes, but the confluence of structural surpluses and active policy interventions will act as anchors, preventing a dramatic and sustained surge.

For investors, this implies a need for nuanced strategies:

- Tactical Trading: The inherent volatility within the defined range will present tactical trading opportunities, especially around key data releases or geopolitical headlines. Utilizing options strategies around OPEC+ meetings or inventory reports can be a way to capture short-term gains.

- Long-Term Caution: Avoid strong directional bets on oil prices for long-term investments. Instead, focus on energy equities that possess low breakeven costs and a strong business transformation strategy to adapt to a lower-for-longer price environment.

- Monitor Triggers: Keep a close watch on potential catalysts that could deviate from the base case. Key triggers include a significant breakdown in OPEC+ cohesion leading to an uncontrolled output flood, or a deeper-than-expected global recession that would dramatically slash demand.