Powell’s battle with inflation fuels an investor dilemma

September 30, 2022

Make no mistake, Jerome Powell is in full battle gear, ready to take on inflation even if it means squeezing the markets of liquidity and drying up investments for growth. The Fed Reserve Chair was unequivocal about a supply-demand mismatch in the US economy, especially the housing sector. He said so after announcing1 a 0.75 percentage point hike in base interest rates after the Fed’s September meeting, taking it between 3% and 3.25%, their highest levels since just before the rate cuts of 2008.

What’s more, Powell has no intention of relenting just yet, which makes market analysts believe that long term interest rates could hover around the 4.4% mark in 2023. This is definitely not good news for businesses and the economy in general and also leaves the investors seeking out-of-the-box solutions to generate profits. And the Fed’s projection of economic growth through 2022 and in 2023 is bleak and possibly some more. Overall economic growth is projected at an anemic 0.2% for 2022 and a modest 1.2% in 2023 while unemployment, which sits at 3.7%, is expected to rise to 3.8% by year-end and then canter its way to 4.4% over the 12 months of the next year.

Battling Inflation – the Fed Way

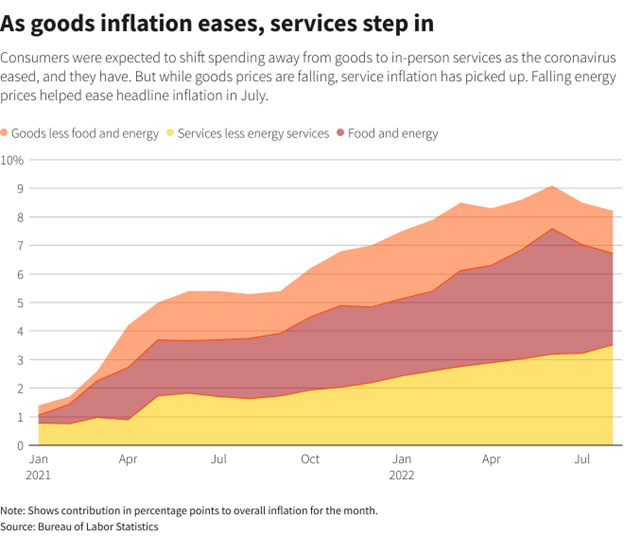

Powell also believes that inflation would drop significantly between 3.5% to 2.6% in 2023, though not everyone is convinced. Especially the likes of Jeremy Siegel, a longtime market guru and Wharton professor, who thinks2 Powell orchestrated the biggest blunder in the Fed’s 110-year history by not moving in to tighten monetary policy long before it got out of hand. “When commodity prices were going up at rapid rates, Chairman Powell and the Fed said they didn’t see any inflation and that there was no need to raise interest rates in 2022. Stubborn inflation requires the Fed to stay tight all the way through 2023,” he told CNBC on the day of the rate hike.

The Fed’s main target is to reduce consumer spending to bring about that balance that Chairman Powell spoke about, but it has several side effects too. Base rate increases make borrowings more expensive and this cost is borne by the customer in the form of rake hikes on debt across the board – from personal loans to credit cards and car loans to home mortgages. This leaves less money to spend and possibly even less to save, at least till such time that demand reductions and supply side spikes bring overall prices down to the level the Fed is hoping it would.

Investor Paradox

So, where does that leave the investors? These rate hikes could mean that investors park their cash with the banks who can afford to pay higher interest rates. However, what it also means is that more money could go out of other assets such as bonds or stocks, especially since the latter has seen high volatility in recent times. CNBC’s Jim Cramer wants investors to see the bigger picture3 and not take the short route, which he believes is taken by those that can’t handle pain or don’t believe in Powell’s prescription for settling down the demand-supply imbalance. He believes the Fed would ultimately win and when that happens, the short-termers would bottom out. He advised investors to believe in Powell’s vision if they wanted their portfolios to stay intact in the long term.

As for the hedge funds, this could just be the moment to ramp up their bets. Over the five weeks starting end-August, Hedge funds’ total gross trading flow (both long and short) rose and had the largest notional increase since 2017, according to Goldman Sachs’ brokerage data. Simply put, this means they’re putting money to work in a major way to capitalize on market volatility for their clients.

Market analysts4 believe that with the investor sentiment at a historical low, and further rate hikes by the Fed to tighten money supply seemingly round the corner, hedge fund managers seem to be in a happy spot, with strategies focusing around the macro, performing quite well. In fact, hedge funds gained 0.5% in August compared to the S&P 500’s 4.2% loss according to data from the HFR. Already some of the larger players such as Citadel’s flagship Wellington fund has rallied 3.74% since August, taking its 2022 performance to 22.75%. Looks like the best is yet to come.